PEPE lost 15% in one week despite surge in exchange inflows and whale activity

Pepe’s (PEPE) price has struggled over the past month after allegations of insider trading and rug pull emerged.

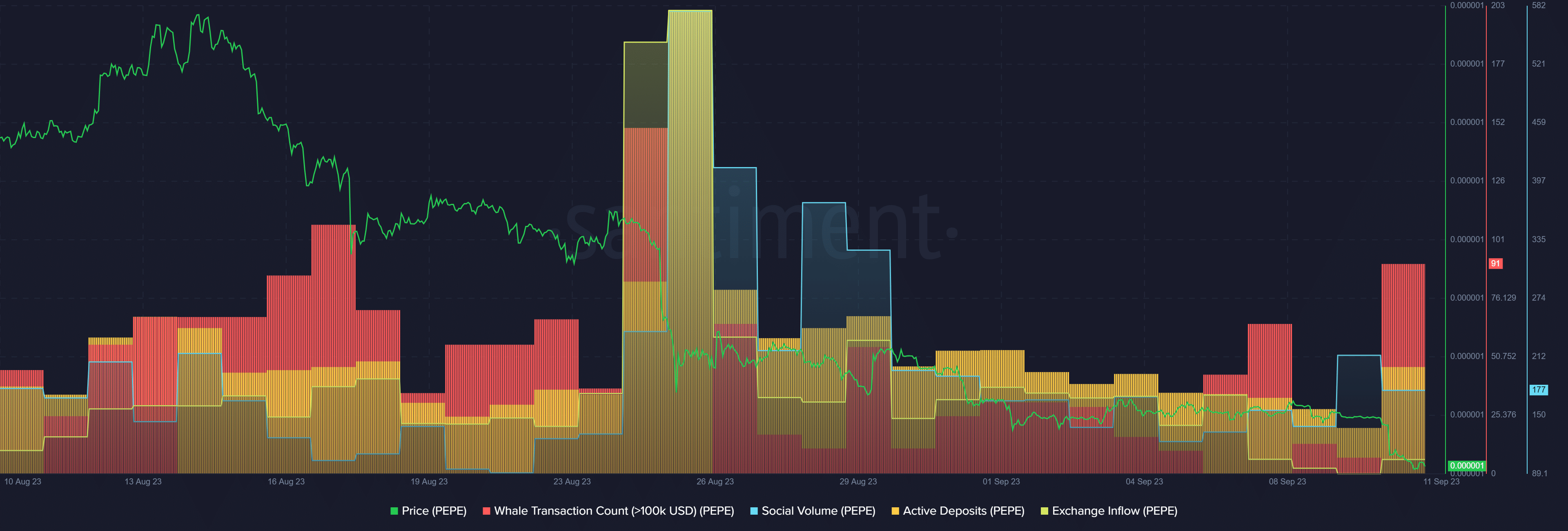

According to data from Santiment, the meme coin registered an almost 50% decline since Aug. 13. Its price plunged by 15% over the past week, making it the top loser among the top 100 cryptocurrencies in both timeframes.

As the drop goes even further, Santiment data shows that the amount of PEPE inflow to exchanges has risen from 116 billion coins to 950 billion tokens since Sept. 9. Per the market intelligence platform, Pepe’s active deposits also surged from 73 on Sept. 9 to 170 transactions at the time of writing.

Historically, when the amount of deposits to exchanges rises, there is a high expectation of significant selling pressure, which could take the price even lower.

Moreover, data provided by Santiment shows that Pepe’s social volume has been constantly declining since Aug. 25. Per the data, the asset’s social volume dropped by 17% over the past two days.

On the other hand, PEPE whales have become more active despite the price dip. According to Santiment’s data, whale transactions consisting of at least $100,000 worth of Pepe tokens surged from 7 on Sept. 9 to 91 unique trades over the past day.

It’s important to note that high volatility is expected when whales make big moves in the market.

Pepe is down by 4.8% in the past 24 hours and is trading at $0.00000069 at the time of writing. The asset’s 24-hour trading volume surged by 31%, reaching $55 million, as whales make notable moves.