Pepe price forecast: here’s why the $PEPE token is rebounding

Pepe (PEPE) price bounced back on Wednesday following the release of encouraging US Consumer Price Index (CPI) data. Pepe jumped to a high of $0.00014 in a high-volume environment. It has soared by over 23% from its lowest point this week.

Buying the dip after the CPI data

The Bureau of Labor Statistics (BLS) published encouraging inflation data. The headline Consumer Price Index (CPI) dropped from 0.3% to 0.0%, missing the expected 0.1%. The CPI dropped for the second straight month on an annualised basis. It dropped to 3.3% from the previous 3.4%. Excluding the volatile food and energy prices, inflation dropped to 0.2% MoM and 3.4% YoY.

These numbers came ahead of the Federal Reserve interest rate decision. Analysts expect the Fed’s officials will welcome the current inflation numbers and look to cut rates in the coming months. Rate cuts in general represent a positive catalyst as lower cost of borrowing increases the attractiveness of speculative investements, especially meme coins.

The rebound in Pepe’s price was also supported by a broader uptrend in the cryptocurrency market as investors waiting patiently on the sidelines were given a reason to start buying. Bitcoin jumped to $69,600 while Ethereum jumped to $3,645. Other meme coins like Bonk, Dogwifhat, and Book of Meme also bounced back. These tokens could see a harsh reversal if the Fed delivers a hawkish decision.

Last, Pepe’s momentum can be due to a classic case of buying the dip. Notably, the coin was down by around 35% from its highest level this week. This rebound happened in a high-volume environment. According to CoinGecko, the daily volume of Pepe jumped to over $1.28 billion, up from Tuesday’s $714 million.

Pepe price prediction

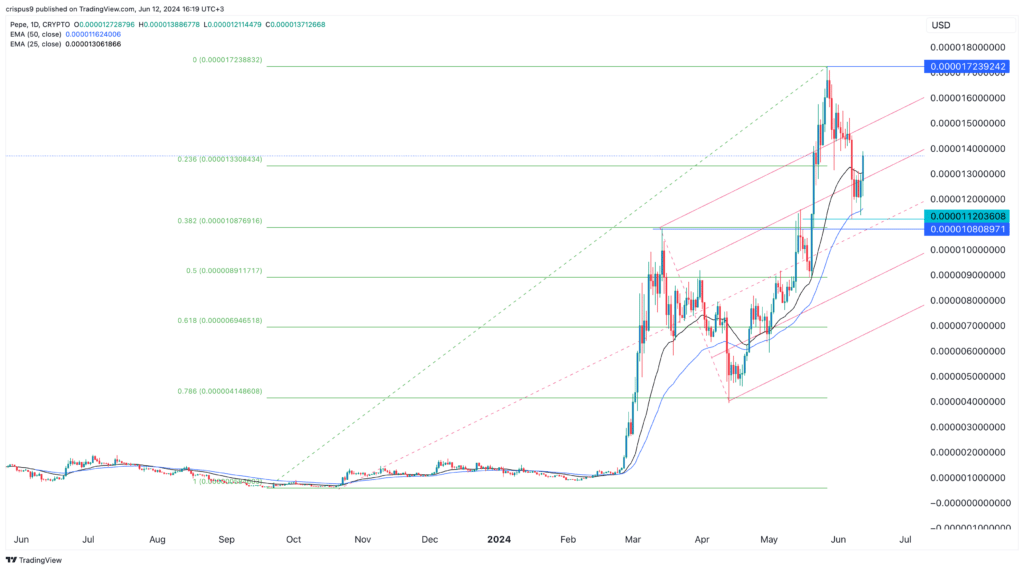

The daily chart shows that the price of Pepe bounced back after the weak US inflation data. It rebounded after bottoming at $0.00001120, its lowest point this week. This price was a few points above the crucial support at $0.00001080, its highest swing on March 14th.

Pepe has now moved above the 23.6% Fibonacci Retracement level, which is a positive sign. Also, it has jumped above the 50-day and 25-day moving averages and the first resistance of the Andrew’s pitchfork tool.

Therefore, the token will likely continue rising as buyers target the next psychological level at $0.00015, 10% above the current level. A break above this level will see it soar to the year-to-date high of $0.0000172.