Pepe price on the rebound as traders identify bullish patterns

Pepe price rose for the second straight day as the crypto industry stabilized and as traders identified some bullish formations. The token rose to $0.000012, ~25% above its lowest point this month. This recovery has risen has pushed its market cap to almost $5 billion.

Pepe’s price action coincided with the rebound of other meme coins. Popcat, a Solana meme coin, jumped by over 65% while Tooker Kurlson, Jeo Boden, and Mog Coin jumped by more than 30%.

A likely reason for this rebound is that Bitcoin has struggled to extend its losses below the crucial support at $60,000. It was trading at $61,125 on Tuesday as investors buy the token’s dip.

The token has also steadied as data reveals that the proportion of whale holdings has remained steady this month. Data by CoinMarketCap shows that whales held over 203 trillion PEPE tokens on Tuesday, the highest point since May 31st. More whale holdings is often seen as a positive sign for a coin. The number of Pepe holders has jumped to over 247k, according to Etherscan.

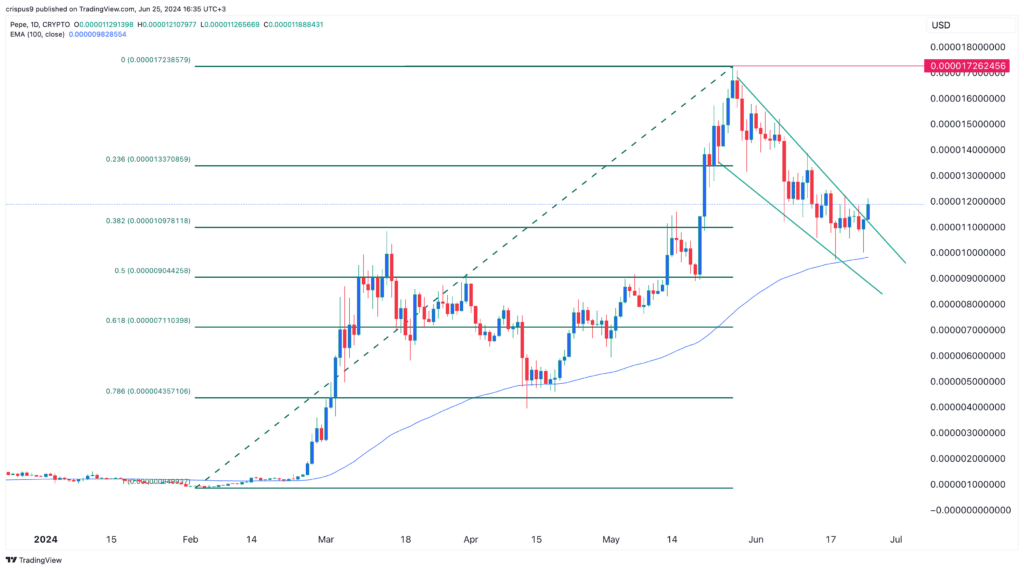

Pepe price chart

Meanwhile, traders have pointed to some bullish patterns Pepe has formed recently. First, as shown above, the token has constantly remained above the 100-day Exponential Moving Average (EMA), signaling that bulls were in control.

Further, Pepe has recently formed a falling wedge chart pattern, which is a popular bullish sign. On Tuesday, the token moved above the upper side of this pattern.

Pepe’s hammer pattern and rising open interest

Additionally, it also formed a hammer candlestick pattern, which is characterized by a small head and a long lower shadow. In most cases, this pattern leads to a rebound, especially when volume is rising. Data by CoinGecko shows that the daily volume of Pepe traded in all exchanges rose to over $865 million, higher than Monday’s $454 million.

The same is happening in the futures market where open interest has risen to over $134 million, its highest level since June 17th. Open interest is an important metric that looks at the number of contracts held by traders in active positions.

Pepe’s open interest has risen

Meanwhile, Pepe has also bounced above the 38.2% Fibonacci Retracement level, pointing to more upside. However, the main risk is that this rebound is part of a dead cat bounce, where an asset in a freefall rebounds briefly and resumes the downward trend.