Polymarket: Ethereum price will not hit all-time high in 2024

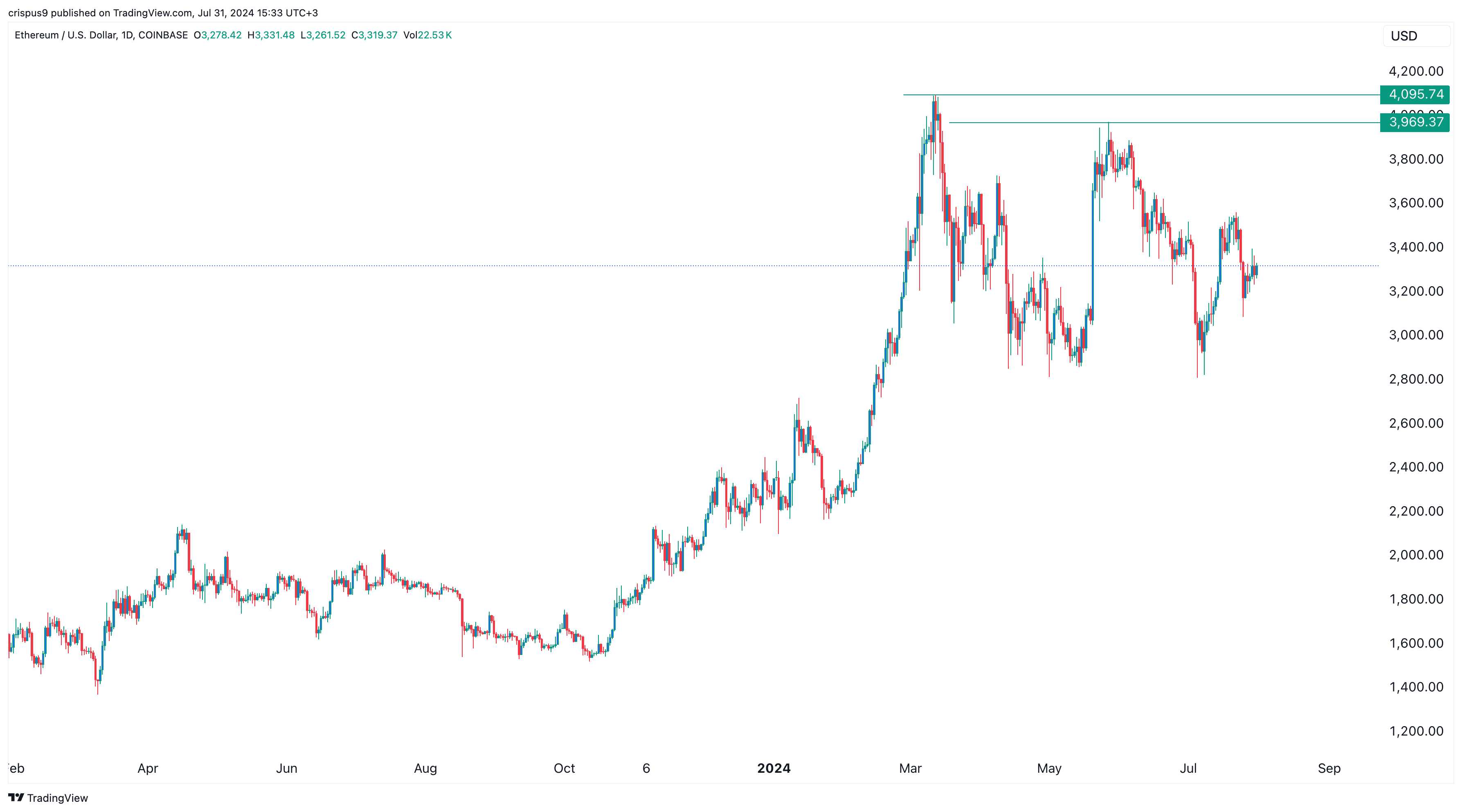

Ethereum price has performed well this year, rising by 41% in the first seven months, but is unlikely to reach its all-time high.

ETH will not hit all-time high in 2024

According to a Polymarket poll, the odds of Ethereum (ETH) returning back to its all-time high of $4,857 this year have dropped from 75% in June to 49%. The poll has attracted over $623,000 in funds.

ETH needs to rise by 46.17% from Wednesday’s $3,318 to get to its all-time high. While this is possible, participants believe that the token lacks a clear catalyst.

In another Polymarket poll with $334,000 in funds, the odds of Ether rising to $10,000 in 2024 are just 13%.

Ethereum has outperformed some of its top peers in the crypto industry like Avalanche (AVAX), Cardano (ADA), and Near Protocol (NEAR). However, it has lagged behind Bitcoin (BTC) and Solana (SOL), which have risen by 50% and 65%, respectively.

The network has also generated the most revenue in fees as transaction numbers have risen. Data by TokenTerminal shows that its fees rose to $1.75 billion, higher than Tron, Bitcoin, and Lido Finance.

However, Ethereum faces robust competition from other chains. Justin Sun’s Tron has become a significant competitor in the payment industry, becoming a favorite among Tether users.

Ethereum has also benefited from the recently approved spot ETFs, which are seeing robust inflows. Blackrock’s ETHA fund has attracted over $442 million in inflows and is followed by Bitwise, Fidelity, and Grayscale Mini.

Ethereum’s underperformance after the ETF approval mirrors Bitcoin’s performance after its approvals in January. The decline could be due to ongoing liquidation from the Grayscale Ethereum Trust, which has an expense ratio of 2.50%.

Conditions for Ethereum price to hit ATH

Two things need to happen for Ether to hit its all-time high this year. First, Bitcoin needs to have a strong bullish breakout above its record high of over $73,300. This performance is likely since Bitcoin has formed numerous bullish patterns including a falling broadening wedge, an inverse head and shoulders pattern, and a cup and handle on the weekly chart.

Second, ETH will need to invalidate its double-top chart pattern that exists between $3,970 and $4,095. If this happens in a high-volume environment, it will indicate robust demand for the coin.

Another potential catalyst for Ethereum is the Federal Reserve, which could signal that it will start cutting interest rates in September. A dovish Fed makes riskier assets like cryptocurrencies more attractive to investors.