Probability of Bitcoin Unlimited Hard Fork Execution: Where It Is Now

The majority of the Bitcoin community believes a hard fork execution will not occur anytime soon. Experts and developers including Andreas Antonopoulos, BitGo engineer Jameson Lopp and Charlie Shrem have noted that Bitcoin Unlimited is not ready for production and its policies toward closed development are not being supported by the market.

Over the past few weeks, the Bitcoin Unlimited team has struggled to deal with internal bugs that have led to downtime for miners and forced its developers to run a closed-source code update. One of the changes to the protocol made by the Bitcoin Unlimited development team which Core developer Greg Maxwell criticized was the elimination of runtime state corruption protection. Maxwell explained that the absence of this feature can lead to potential consensus splits and remote code execution.

Maxwell wrote:

“BU [Bitcoin Unlimited] now apparently has a bugfix release out– though it is closed source, binary only, and they haven’t updated their source code for six days. Considering reports on Reddit that their website was hacked, my initial thought was that their github was hacked and the binaries were malicious. Among other things, they’ve removed all the runtime state corruption protection. So cases where nodes would cleanly and safely shut down in the event of things going wrong, turn into potential consensus splits or even remote code execution.”

Considering the inability of Bitcoin Unlimited developers in dealing with bugs and prioritizing security measures, security experts such as Antonopoulos stated that there is less than a 10 percent probability of Bitcoin Unlimited being forked. Even if the miners in China plan a 51 percent attack on Bitcoin to fork the network, there are some in the community proposing an alteration in Bitcoin’s Proof of Work protocol to combat the 51 percent attack.

“I think there’s less than 10 percent chance of a hard fork anytime soon. I might be wrong of course, but I’m not worried. Honey badger will survive,” said Antonopoulos.

More importantly, Antonopoulos emphasized that the debate between Core and Unlimited developers and supporters have turned into a conflict of ego and emotions, completely unrelated to technical knowledge and the best interests of the Bitcoin community.

In the span of two weeks, the Bitcoin Unlimited codebase was exploited by external developers in two separate events. Even worse, the bugs or the errors in the code were not discovered by the Bitcoin Unlimited team.

The second bug exploitation was heavily criticized by Core developers including Peter Todd, who particularly pointed out the Bitcoin Unlimited team’s decision to release a closed-source, non-cryptographically-signed binary, which is damaging to the Bitcoin protocol.

Most businesses including BitGo, which supports some of the largest bitcoin exchanges in the industry including Bitfinex and Kraken, stated that Bitcoin Unlimited fails to meet all of the three criteria that are referred to when evaluating a hard fork.

For businesses like Bitgo, Blockchain, and Coinbase to support a hard fork solution, it needs to have a clear on-chain activation mechanism, provide strong two-way replay protection and wipe-out protection. Ben Davenport, Co-Founder and CTO at BitGo, noted that Bitcoin Unlimited failed to meet all of three criteria and is thus a contentious and technically dangerous solution to run, which is the reason why the three businesses are in support for Bitcoin Core and Segregated Witness. In fact, Blockchain is already Segwit-ready.

“Bitcoin Unlimited does not meet the above tests for being a supportable fork today. In fact, it fails all three criteria. Additionally, there are serious problems with “emergent consensus,” which can result in ongoing network splits and chain reorganizations of arbitrary length, depending on how different groups of miners set their consensus parameters. Finally, there are serious concerns about the general code quality and peer review process of the Bitcoin Unlimited code base itself. As such, we will not be able to provide support for a hard fork caused by Bitcoin Unlimited in its current form,” said Ben Davenport.

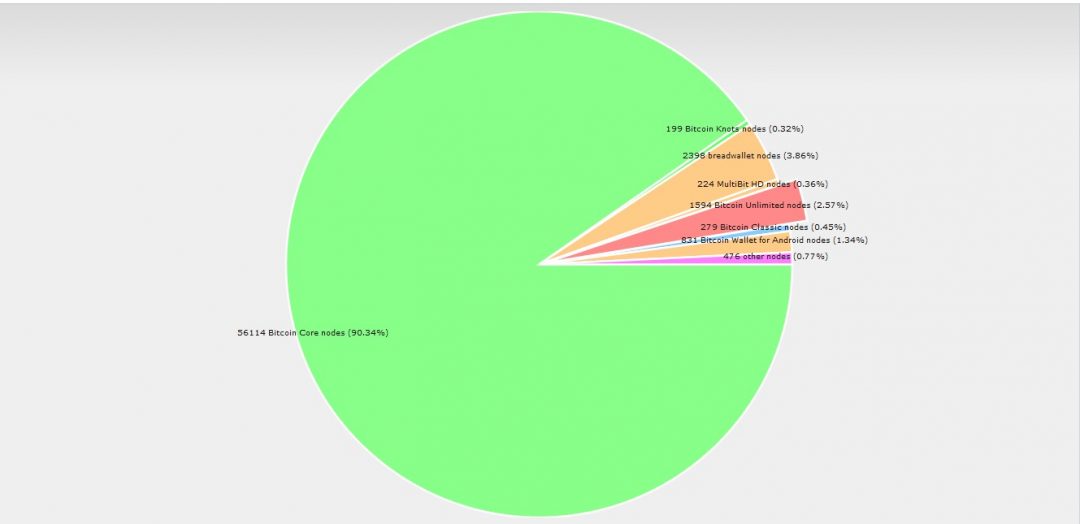

While miners support Bitcoin Unlimited, the largest businesses in the bitcoin industry, the vast majority of developers and most users are against Bitcoin Unlimited purely due to technical reasons. The chart below shows that just over 2.5 percent of nodes support Bitcoin Unlimited, while SegWit signaling reached its highest ever level on March 26, around 29 percent. Therefore, as Antonopoulos noted, the probability of a hard fork is very low at this point.

Source: http://luke.dashjr.org/programs/bitcoin/files/charts/software.html