‘Profitable’ BTC volume hits two-year high

The share of potential profit-generating Bitcoins (BTC) reached 83.7% of the total supply.

As follows from a report by Bitfinex analysts, this is the highest figure since Nov. 2021. Experts noted that the owners of these 16.3 million BTC “are reluctant to sell, and buyers are not actively seeking supply” of the coins.

According to analysts, 60% of coins have remained motionless for two years.

Bitfinex specialists say the indicators mean that the market is “in a relatively strong position” as coin owners see a positive return on their investments and are in no rush to liquidate assets.

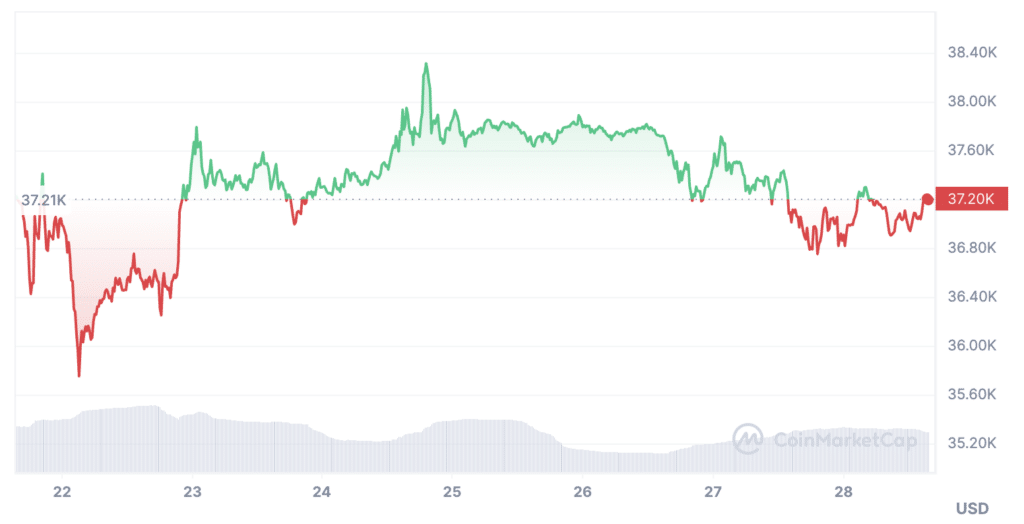

Experts also pointed out that Bitcoin did not move out of its current price range last week, despite the negative news background around Binance.

On Nov. 24, the price of the first cryptocurrency exceeded $38,000, inching ever closer to the key pyschological support level of $40,000.

Another analyst predicts Bitcoin’s imminent surge to $40,000 citing potential ETF approvals and the upcoming halving event as key drivers.

Meanwhile, the fate of the spot Bitcoin ETF remains uncertain. The US Securities and Exchange Commission (SEC) has repeatedly delayed the review of applications for the creation of funds. The regulator is now expected to make a decision on ETFs in January 2024.