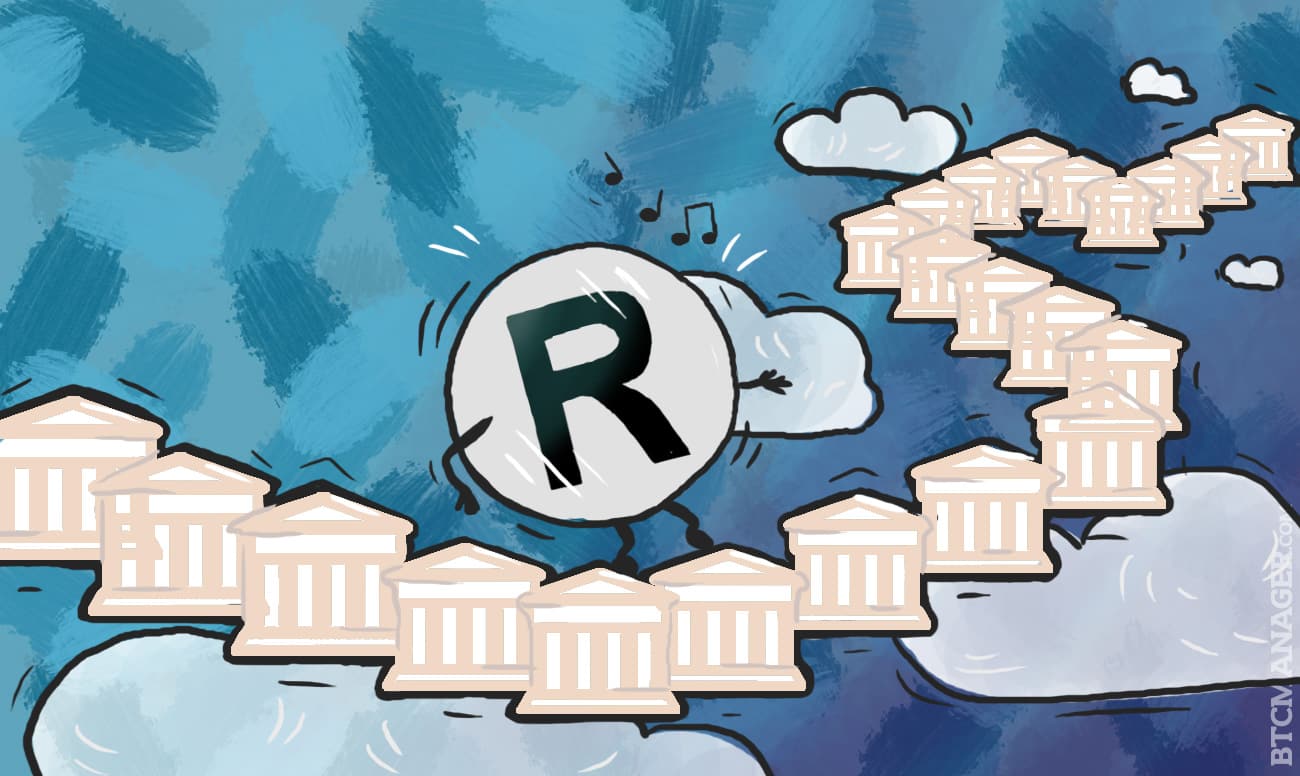

R3 Ledger Project Grows to Include Twenty-Two Banks

R3 purports to be an “innovation firm focused on building and empowering the next generation of global financial services technology.” The company’s latest bid to fulfill that mission includes the launch of their distributed ledger project designed for global financial markets.

The project started earlier this year with nine banks initially supporting it: Barclays, BBVA, Commonwealth Bank of Australia, Credit Suisse, Goldman Sachs, J.P. Morgan, Royal Bank of Scotland, State Street and UBS.

In a recent press release, however, R3 announced that an additional 13 banks have pledged their support for the distributed ledger project bringing the total to an impressive 22 institutions.

The 13 banks that join the 9 banks are of the same global caliber, with some banks having already dabbled in Bitcoin before, as Goldman Sachs did with its investment in Circle. The list of new supporters includes Bank of America, Bank of New York Mellon, Mitsubishi UFJ Financial Group, Citi, Commerzbank, Deutsche Bank, HSBC, Morgan Stanley, National Australia Bank, Royal Bank of Canada, SEB, Societe Generale and Toronto-Dominion Bank.

The group will work collectively to establish industry-wide standards and regulations for the technology; this will accelerate further adoption by making it progressively easier as more and more businesses adopt the ledger.

Each bank brings specific expertise to the table ranging from sales and trading, all the way to custodial services. Each is expected to pull its weight in contributing toward the goal of creating a lower-cost banking experience.

“The addition of this new group of banks demonstrates widespread support for innovative distributed ledger solutions across the global financial services community, and we’re delighted to have them on board,” says David Rutter, CEO of R3. “We have placed an emphasis on working with the market from day one, and our partners recognise that a collaborative model is the best way to quickly, efficiently and cost-effectively deliver these new technologies to global financial markets.”

While the banks will be working for a ledger solution, R3 will not be sitting idle. R3 will also be working with their bank partners to form coalitions that will lead these efforts, using R3 as a mediator.

All ledger-related prototypes and protocols will be tested thoroughly for their effectiveness in real world situations. It’ll be exciting to see what the first projects that come to fruition from this initiative are, and the impact they’ll have on the financial sector.