Reef price rebounds as futures open interest hits 2-year high

Reef token rose for five consecutive days as demand in the spot and futures market rose after it was delisted by Binance.

Reef (REEF) rose to a high of $0.0012 on Sept. 3, marking its highest point in a month and 106% above its lowest point last month. This recovery brings its market cap to over $25 million.

Reef’s recovery followed the launch of a new community developer fund by its developers, aimed at supporting projects related to lending protocols, hardware wallets, DAO infrastructure, and bridge integrations.

Reef’s rally led to a sharp increase in investor demand. Data from CoinGecko shows that the 24-hour trading volume jumped to $45 million on Tuesday, up from $23 million on Sept. 1, marking its highest point in nearly a month.

Additionally, Reef’s open interest in the futures market soared to $60 million, its highest level in two years, significantly higher than August’s low of $3 million.

Notably, Reef’s rebound occurred after the token was delisted by Binance, the most popular crypto exchange. Typically, cryptocurrencies tend to retreat after being delisted by tier-1 exchanges.

Data indicates that most of the trading is happening on Gate.io, followed by HTX, KuCoin, and Bitget.

Reef price crosses key resistance

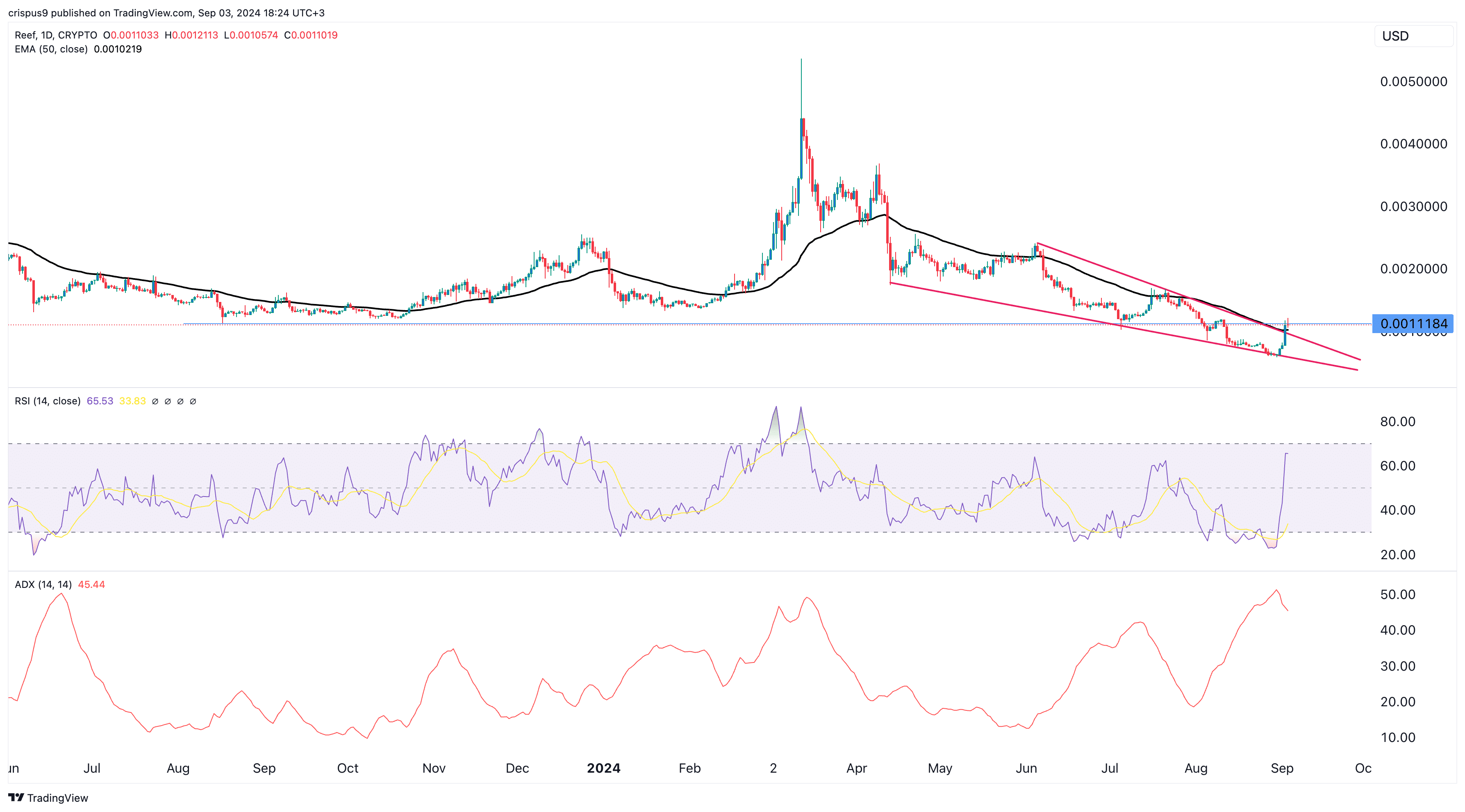

Reef rose to a high of $0.0013, crossing the important resistance point at $0.0011, its lowest swing in August last year.

Before its rebound, Reef formed a falling wedge pattern, a popular bullish reversal indicator. The token has now rallied above the 50-day moving average, while the Relative Strength Index is nearing the overbought level of 70. The RSI is a momentum indicator that measures an asset’s rate of change.

The Average Directional Index, which measures the strength of a trend, was at 50 and pointing downwards. Therefore, the token will likely retreat briefly as traders take profits before potentially resuming the bullish trend.