Santiment: Litecoin’s small traders’ exit could signal bullish rebound

Litecoin has been struggling with a significant price drop and reduced social interest, but a recent sell-off by small traders could hint at a market turnaround.

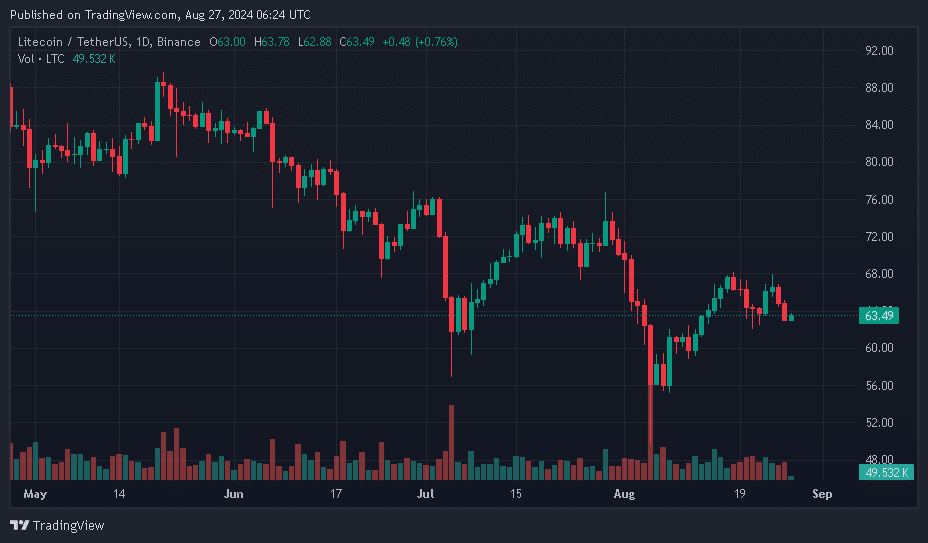

Litecoin (LTC), ranked 25 in terms of market capitalization, has had a poor run recently, with data from crypto behavior analysis platform Santiment showing it lost more than 36% of its value in the last three months.

Further compounding that, the coin has been getting very little attention on social media and online crypto forums, reflecting reduced interest from the community. This has culminated with more than 45,000 wallets holding between 0.1 and 1 LTC reportedly exiting their positions in the last 24 hours.

According to Santiment, that number is the highest drop in LTC small holders in a 24 hour period since October 2022. While this means that many small investors have decided to give up on Litecoin, Santiment analysts have suggested that it could be an indication of an upcoming bullish phase for the coin.

Analysts on the platform suggest that when weaker hands sell off their cryptocurrency, the remaining investors tend to be more confident, which can lead to price recovery.

A recent analysis by TradingView user Jasminex1x2 seems to give credence to Santiment’s assertions. The trader suggested that prevailing market trends could potentially create a favorable environment that could push the price of LTC to new highs in the near future.

Data from crypto.news shows that at the time of this writing LTC was priced at $63.49, a 1% drop from its Aug. 26 position. Furthermore, the price represented a 5.2% loss across seven days, and a more severe 9.6% plunge over one month.

Interestingly, since the Aug. 5 crypto crash triggered by a less than ideal U.S. jobs report, LTC was one of the few cryptocurrencies that held a steady uptrend with no major price drops.

At the time, market watchers suggested that the price action could have been as a result of consistent buying pressure around the coin. Furthermore, Litecoin’s on-chain activity has doubled in the last year per data from IntoTheBlock. It grew from 196 million LTC moved on-chain, to more than 412 million LTC in the first two weeks of August.