SEC approves spot Bitcoin ETF on accelerated basis

The United States Securities and Exchange Commission (SEC) approved multiple spot Bitcoin ETFs on Jan. 10.

According to an official SEC filing, spot Bitcoin ETFs have been approved for listing on all registered national exchanges in the U.S., including the Nasdaq, NYSE, and CBOE, following a decade-long hunt for these products.

The approval means ETFs will go live in trading at the CBOE from 9 am on Jan. 11 when the U.S. stock market opens

11 issuers were mentioned in the SEC’s approval filing, issuing the green light to list Bitcoin (BTC) exchange-traded funds. The filing broke during the late hours of Jan. 10 before briefly disappearing, likely due to large traffic on the SEC’s website.

“As described in more detail in the Proposals’ respective amended filings, each Proposal seeks to list and trade shares of a Trust that would hold spot bitcoin, in whole or in part. This order approves the Proposals on an accelerated basis.”

SEC approval of spot BTC ETFs

Firms had indicated readiness to begin trading as early as Jan. 11. VanEck CEO Jan Van Eck confirmed this in an interview with CNBC. Other issuers have also signaled the ability to kickstart spot BTC ETF operations promptly.

Hours before approval arrived, BlackRock and ARK 21Shares filed amended applications disclosing even lower fees than previously mentioned. As it stands, Bitwise still offers the lowest fees at 0.2%, followed by ARK 21Shares, BlackRock, and Fidelity in that order.

As noted by Bloomberg’s Eric Balchunas, the so-called fee war may not impact how these ETFs ultimately perform. It’s also unlikely that firms will change their fees now that the SEC has issued green lights for spot BTC ETFs.

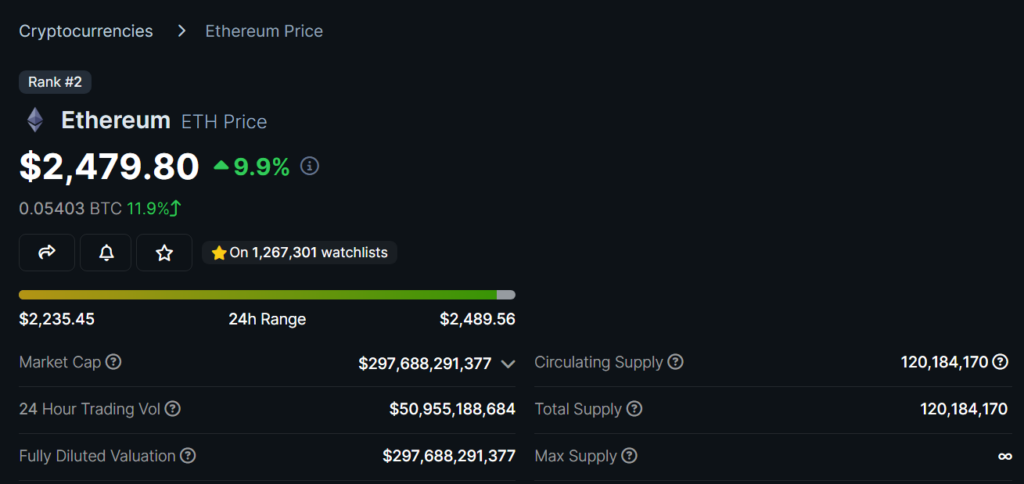

Upon the SEC’s declaration of acceptance for several bids, the underlying asset in BTC experienced volatility and price swings. BTC traded below $46,000, down over 2% at press time.

BTC also experienced fluctuating prices on Jan. 9 after the SEC’s X account tweeted a sham spot BTC ETF approval message. SEC chair Gary Gensler said unknown hackers compromised the page as the news triggered a 6% drop in BTC’s price, wiping out over $230 million in crypto positions. $90 million of that collectivecomprised leveraged Bitcoin positions per Coinglass data.

SEC lawyers confirmed a forthcoming internal communication to unearth the root cause behind what U.S. Senators have deemed a “colossal error”. The FBI is reportedly involved in investigations into the matter.

Now that spot Bitcoin ETFs have finally received approval, the next milestone may be logged at the BTC halving in April and the inflows into these BTC-related TradFi investment vehicles. While Wall Street stalwarts like JP Morgan foresee a staggered capital interest, crypto-native entities like Mike Novogratz’s Galaxy Digital expect massive price surges of up to 74%.

Responding to claims that BTC markets may see up to $100 billion in inflows in the first year, Bloomberg’s James Seyffart espoused expectations around the $10 billion to $15 billion range. The ETF expert noted that these flows could be split across new exposure to Bitcoin and capital rotation from other vehicles like Canadian ETFs, crypto mining operations, and futures-based products.

Matthew Sigel, head of VanEck’s digital asset research division, estimates $2 billion in inflows on week one and $40 billion in assets under management in the first year.

These numbers may increase or decline depending on several factors, including the upcoming 2024 U.S. presidential elections and shifts in government in some other 50 sovereign nations.

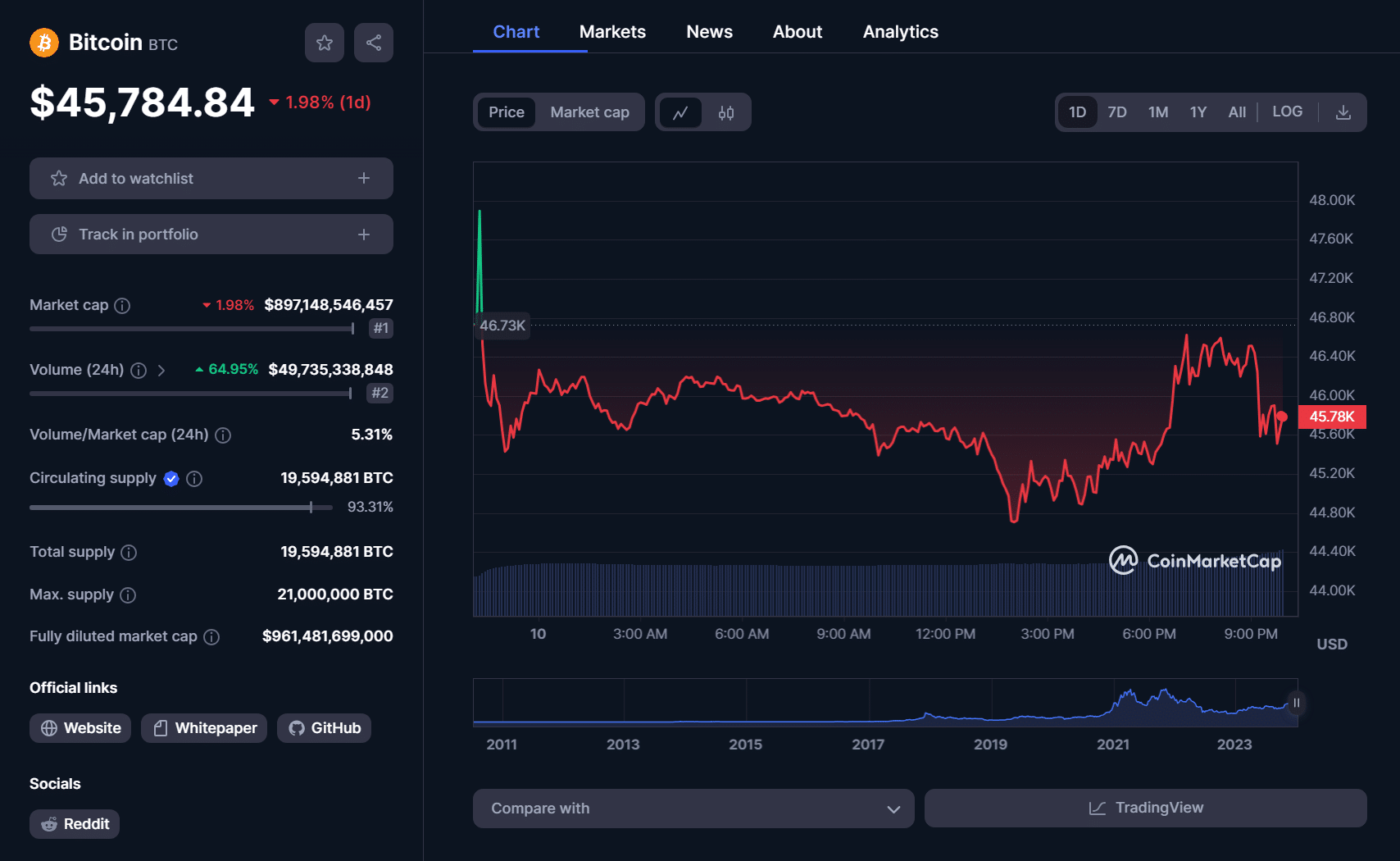

Attention may now shift to Ethereum (ETH), which boasts its own ETF frenzy and upcoming technological upgrades. ETH also showed resilience in the face of a fake Bitcoin ETF approval and has gained more than 9% in the past 24 hours.