SEC postpones decision on BlackRock and Fidelity’s Ethereum spot ETF

The U.S. Securities and Exchange Commission (SEC) has again postponed the deadline for a decision on BlackRock and Fidelity‘s applications to launch Ethereum (ETH) spot ETFs.

Information about the application appeared on the regulator’s website. The SEC once again postponed the deadline for consideration of the application and requested comments from market participants.

“The Commission has reached any conclusions concerning any of the issues involved. Rather, as described below, the Commission seeks and encourages interested persons to comment on the proposed rule change.”

SEC statement

The first postponement of the decision on applications was recorded in January 2024. The March postponement was the second. The SEC may change the decision date on applications three times in total.

According to Bloomberg analyst James Seyffarth, the instrument could hit the market on May 23, 2024. This day marks the deadline for the SEC to issue a decision on VanEck’s application to launch a spot Ethereum-ETF.

In February, the American investment fund Franklin Templeton, which manages $1.5 trillion in assets, joined the list of applications to launch an Ethereum-ETF. The company plans to entrust the storage of ETH to the Coinbase exchange as a custodian. Units of the Franklin Ethereum ETF will trade on the Chicago Board Options Exchange (CBOE).

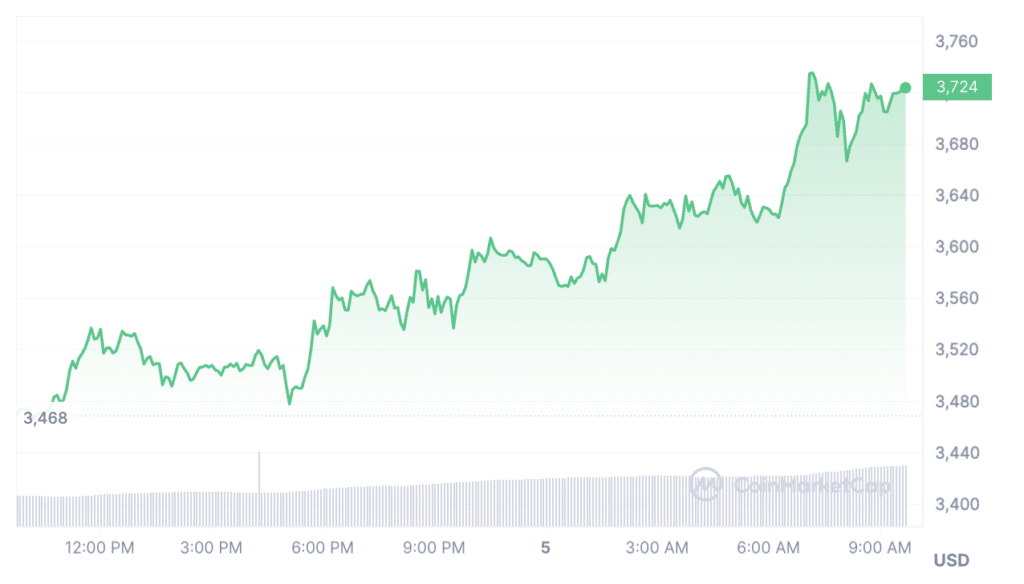

Meanwhile, the SEC’s decision did not affect the price of Ethereum in any way. The second-largest cryptocurrency by market cap is up more than 7% over the past 24 hours, trading above $3,700 at the time of writing, according to data from CoinMarketCap.

The growth of ETH followed the rapid rally of Bitcoin (BTC) – on March 4, BTC came as close as possible to its all-time high, reaching $68,770.