Silvergate terminates crypto payments network as shares plunge to record low

Crypto bank Silvergate has discontinued its digital assets’ payment network because it is a “risk-based decision.”

The announcement comes after the bank’s stock fell over 59% last week due to fears of a potential bankruptcy.

Silvergate terminates exchange network

Silvergate announced on its website on Mar. 4 that it had closed the Silvergate Exchange Network (SEN). All other deposit-related services remain operational.

SEN allows the bank’s institutional investors and digital currency clients to transfer U.S. dollars between their accounts 24/7.

Silvergate also provides a stablecoin infrastructure platform, digital asset custody management, and collateralized lending services.

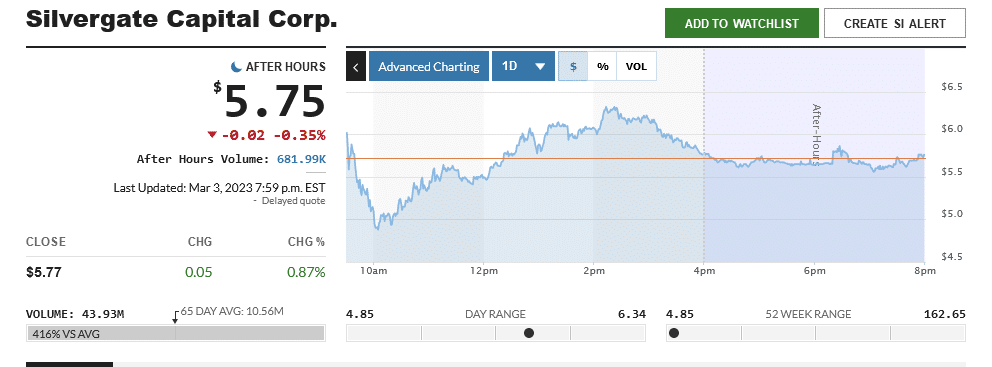

The bank’s shares, SI, listed on the New York Stock Exchange (NYSE), hit an all-time low on Thursday, plunging over 97% from their peak in November 2021. On Friday, the shares closed up 0.9% at $5.75 in regular trade.

United States Judge Michael B. Kaplan ordered the bank to return $9,850,000 deposited by BlockFi.

BlockFi, just like Silvergate, is one of the firms affected by the fall of FTX in November 2022. After the fall, Silvergate reported a $1b loss last quarter and cut 40% of its staff.

Federal Prosecutors are investigating Silvergate’s role in the FTX collapse. The probe is on the bank’s hosting of accounts linked to former FTX CEO Sam Bankman-Fried’s business.

Crypto firms ditch Silvergate amid solvency concerns

On Mar. 1, the bank announced that it would postpone filing its annual 10-K financial report, which had many fearing that it was about to file for bankruptcy.

A day after the announcement, crypto firms Coinbase, Paxos, Circle, Galaxy Digital, and Bitstamp said they would scale back their partnerships with the bank in some capacity.

“Coinbase will be facilitating institutional client cash transactions with our other banking partners and have taken proactive action to help ensure that the clients experience no impact from this change,”

said Coinbase

Moreover, MicroStrategy and Tether publicly denied that they had any meaningful exposure to Silvergate Bank.

A 10-K report is a document required by the Securities and Exchange Commission (SEC) that provides a comprehensive overview of a company’s business and financial condition.

Silvergate requested an additional two weeks to complete the report for the 2022 fiscal year.

The bank also revealed that it had sold additional debt securities this year at a loss. Further losses mean the bank could be “less than well capitalized.”