SoFi’s сrypto business in jeopardy amid US regulatory concerns

Fintech firm SoFi declared it may be “forced to cease trading in certain types of assets” amid the US regulatory hurdle.

In a recent filing with the United States Securities and Exchange Commission (SEC), SoFi outlined several regulatory risks related to crypto trading in its latest quarterly filing with the SEC.

The company is waiting for changes to the regulator’s proposed crypto exchange classification rules. SoFi admits it could halt trading digital assets considered securities until it obtains additional regulatory permission.

“The time and cost of obtaining such permission could be significant, and is not guaranteed.”

SoFi’s filing to SEC

Among the cryptocurrencies supported by SoFi are Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE) and others. Solana (SOL) and Cardano (ADA) were removed from the platform in June as US regulators indicated they may be securities.

SoFi is trying to expand its presence in the crypto market while ensuring compliance with regulators. However, regulatory violations could negatively impact its other financial services divisions beyond crypto.

Last year, the company was hit with a violation by the Federal Reserve for “certain crypto-related activities” deemed impermissible for a bank holding company.

SoFi is currently under a two-year conditional approval to continue crypto activities, which it is trying to extend.

“There can be no assurance that such attempts will be successful. In the event regulatory approval is not obtained, we may ultimately be forced to wind down such activities in a short period of time.”

SoFi’s filing to SEC

The risks come as SoFi has grown its crypto business to $166 million in assets. But it lags behind crypto-native firms and faces pressure from incumbents expanding into digital assets.

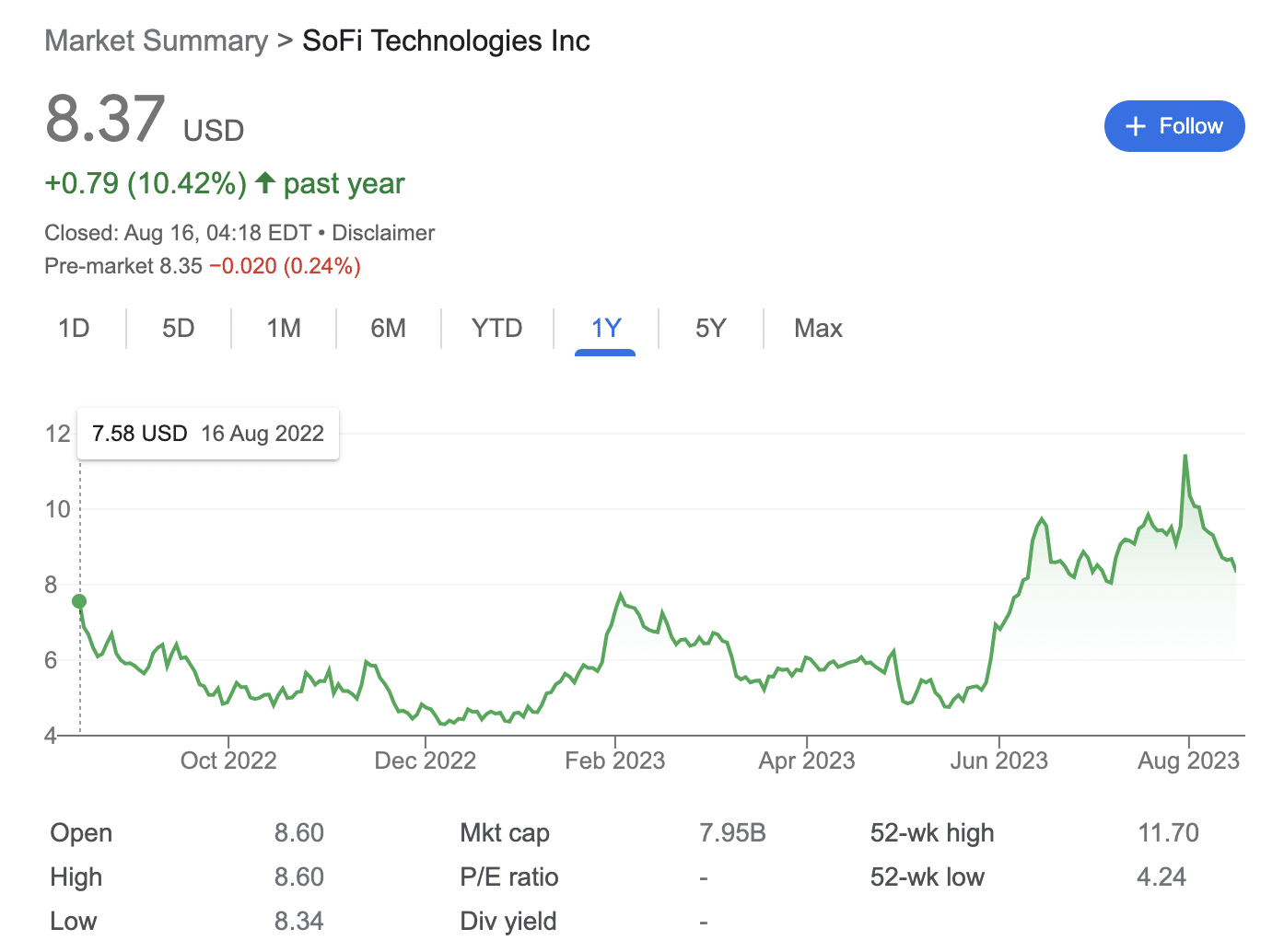

Originally a student loan provider, SoFi has expanded to offer stock trading and other financial services. Its stock rose on strong Q2 earnings. According to Google Finance, it’s up 10% over one year.

Regulatory scrutiny of crypto continues to intensify as authorities cite fraud, manipulation, and financial stability risks. The SEC is considering requiring in-house custody of crypto assets and reclassifying more tokens as securities.

While supportive of innovation, regulators aim to protect investors and ensure the banking system’s safety. Crypto companies are trying to comply while growing but admit it may force limits on business models.