Solana ETF may be launched soon: Here is the possible deadline

The new wave of prosperity in the crypto market could be a significant benefit for Solana: now, the chances of creating a spot SOL ETF may be even higher.

Matt Sigel, head of digital asset research at VanEck, believes that a spot ETF based on Solana (SOL) could be on the market by the end of 2025.

In an interview with Financial Times, Sigel noted that under the leadership of current U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler, the agency has moved away from the traditional approach of interacting with businesses.

Sigel also pointed to the need to return to a system focused on disclosure, which will create new opportunities for the crypto industry to grow.

VanEck filed for a Solana ETF in June 2024, calling this decision “a bet on Donald Trump to win.” Sigel believes that the new administration will support the crypto industry and promote the development of investments in digital assets. In addition, he indicated that the crypto industry expects other spot ETFs to appear, and the VanEck team is already analyzing the chances of launching different asset classes.

However, the SEC representatives recalled that the previous chairman, Jay Clayton, appointed by Trump, initiated about 80 lawsuits against crypto companies and rejected all applications for spot Bitcoin ETFs.

“It was Gary Gensler’s SEC that broke with long-standing tradition with the rules-guided process and regulated through enforcement. Going back to the usual disclosure-based system would create scope for more innovation in this space.”

Matt Sigel, head of digital asset research at VanEck

The launch of a spot ETF on Solana may happen even earlier

Syncracy Capital hedge fund co-founder Daniel Cheung predicted that the crypto industry might see spot ETFs on Solana even earlier than Siegel expects.

Thus, Cheung believes that the first spot of Solana ETFs will likely hit the market as early as Q1 2025. This will allow Solana to surpass Ethereum (ETH) in growth rate and reach the $1000 mark.

At the same time, he called the Trump presidency with a “four-year call option on the Bitcoin market” the main driver of the fund’s approval. He recalled that the president-elect promised to make the first cryptocurrency a reserve asset and pointed to his statement about Gensler’s likely resignation.

The Solana ecosystem is experiencing a new boom

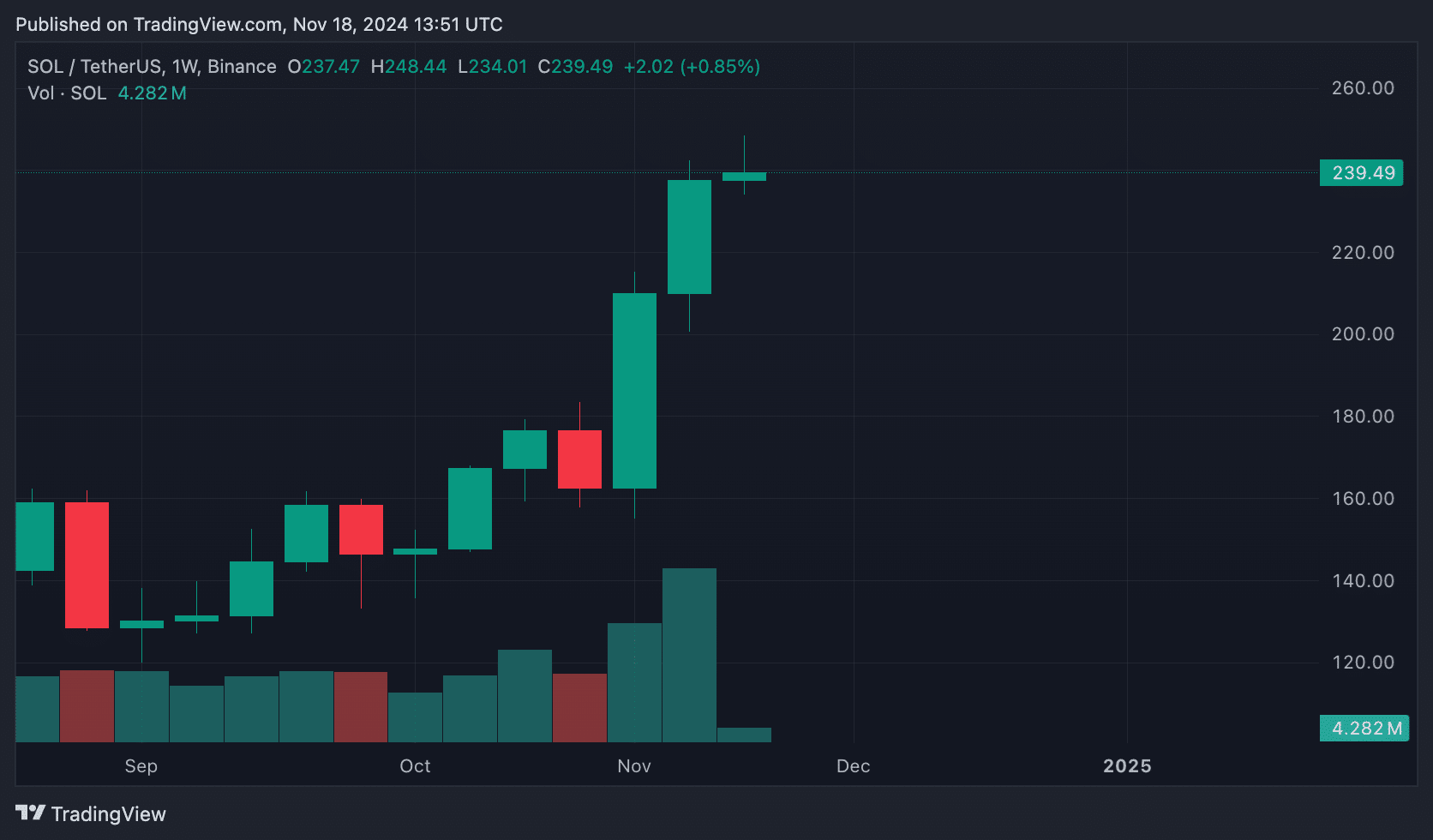

Over the past week, Solana has significantly strengthened the cryptocurrency market, approaching its historical maximum. At the time of writing, the token is trading at $240, up by 10% over the past week.

Solana has also reached a market capitalization of $112 billion, up 44% from the $77 billion recorded at its previous all-time high on Nov. 6, 2021.

The increase in market cap is due to the growing supply of Solana tokens, issued on an inflationary schedule, rewarding stakes with new SOL tokens. Solana-based applications have also seen record fees and revenues in the past 24 hours, driven by a resurgence in meme coin interest.

According to data published by analyst Patrick Scott on Platform X, five of the top ten protocols by fee collection over the past 24 hours were on Solana. Automated market maker Raydium set a record by collecting $11.31 million in fees on Nov. 17, while liquid staking protocol Jito posted the third-largest daily fee of $9.87 million on the same day.

Additionally, meme coin startup platform pump.fun recorded its seventh-largest revenue, collecting $1.65 million in fees. Solana meme coin trading bot Photon was the seventh-largest revenue earner, recording the fifth-largest daily fee dump at $2.36 million.

What’s driving Solana’s growth?

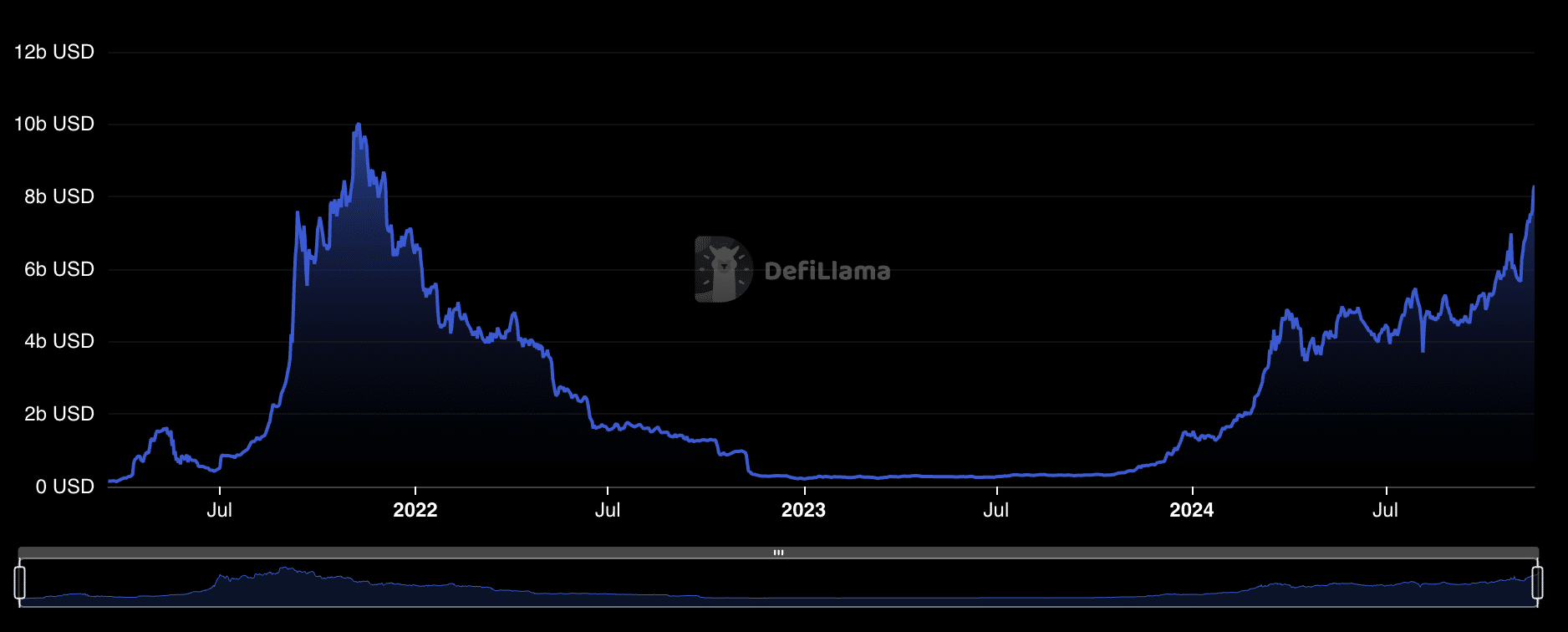

Solana’s performance has been fueled by increased user activity in meme coins. According to DeFiLlama, the blockchain‘s total value locked (TVL) has risen to its highest since 2021, surpassing $8.3 billion.

The exchange’s research division said in a report that rapid growth and speculation make meme coins an investment vehicle with the potential for huge profits.

Analysts say one of the reasons for the increased interest in such risky assets is the “financial nihilism” of investors. Following the inflation caused by “helicopter” money during the COVID-19 pandemic, the study says traditional investments such as real estate have ceased to serve as a good haven for capital, as they have become susceptible to inflation.