Solana sheds $7b in 7 days: Is the crypto bull run over?

Memecoins powerhouse and major L1 blockchain network Solana lost billions in market cap on Monday, as the whole crypto market slid down over 4%.

Solana (SOL) lost roughly $3 billion in value and retraced to around $128, down 10% in the past seven days and around 50% away from its all-time high (ATH) set during the previous 2021 peak.

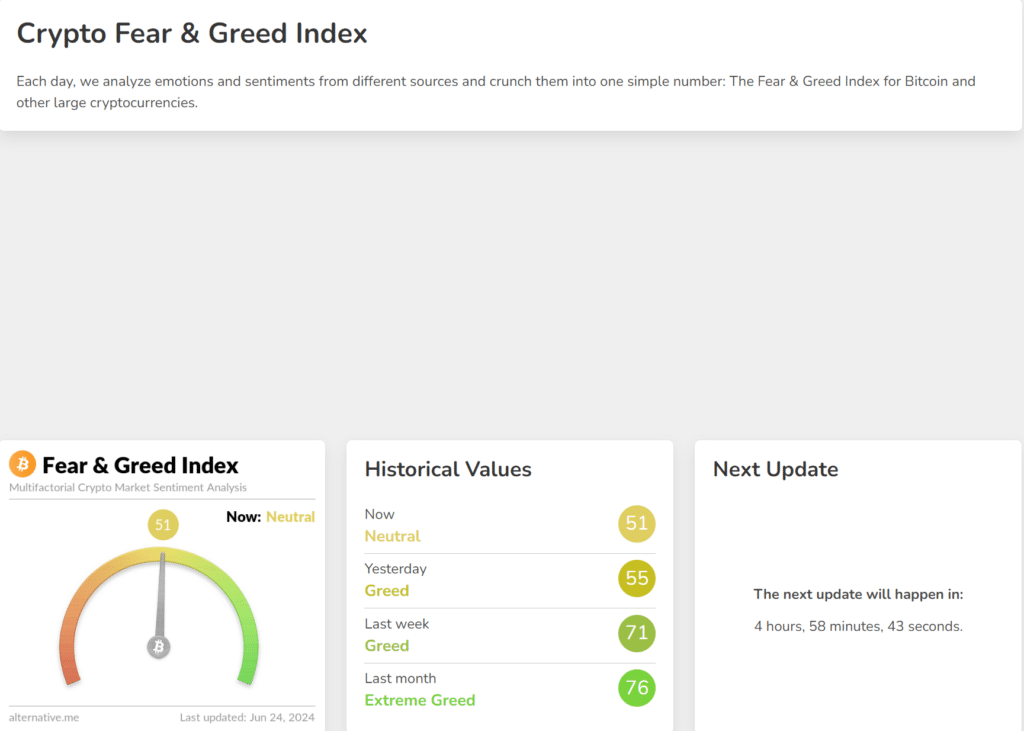

Other major cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), BNB, XRP, Toncoin (TON), and Dogecoin (DOGE), also declined as much as 10% in the last week amid a broad market downturn. The crypto fear and greed index notched a neutral level at around 51 for the first time in over a month. In other words, general crypto sentiment is uncertain about the market’s trajectory, whether bullish or bearish.

Where is the market heading?

Observing previous cycles, 30%-40% drops in the market are common, especially following Bitcoin halvings. Therefore, the ongoing market downswings is not surprising.

Furthermore, according to TradingView, the total cryptocurrency market cap has grown over 35% year-to-date (YTD). In comparison, the S&P500 index is up just 15% over the same time period.

As crypto.news reported, altcoin products also recorded inflows last week. This could indicate an appetite to “buy the dip” from investors and traders interested in risk assets.

Another factor to consider in the economic control measures deployed by the Federal Reserve geared toward. Despite the recent hawkish Federal Open Market Committee (FOMC) meetings, a rate cut in September remains the expectation.

Experts expect the forthcoming Securities and Commission (SEC) approval for spot Ethereum ETF to catalyze more growth. However, decentralized finance (defi) proponents remain unconvinced about how ETF ETFs tracking spot prices will positively impact the on-chain ecosystem.

Additionally, the dynamics introduced by the Bitcoin halving are set to deliver a supply shock. Since block rewards have been halved, and spot Bitcoin ETFs exist with growing demand, there isn’t enough Bitcoin to meet eventual buying pressure. Analysts surmise this phenomenon will drive prices higher.