Spot Bitcoin ETFs record four-fold inflow spike, Ether ETFs recover from outflows

Spot Bitcoin exchange-traded funds in the U.S. saw a significant jump in net positive flows while spot Ether ETFs also logged net inflows ending their five-day outflow streak.

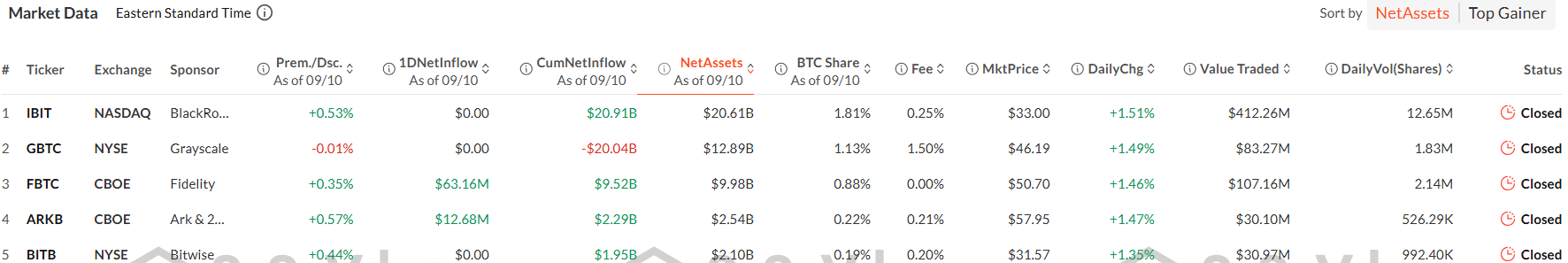

According to data from SoSoValue, the 12 spot Bitcoin ETFs logged inflows of $116.96 million on Sep. 10, a surge of over four times compared to the $37.29 million inflows recorded the previous day.

The positive inflows into these ETFs on these two days follow eight consecutive days of outflows, which reduced their total assets under management by more than $1.18 billion.

Fideliy’s FBTC led the lot for the second consecutive day with the fund witnessing inflows of $63.2 million on Sep. 10. Grayscale Bitcoin Mini Trust and ARK 21Shares’s ARKB followed with reported inflows of $41.1 million and $12.7 million respectively. The remaining nine Bitcoin ETFs remained neutral.

Interestingly, none of the BTC ETFs recorded any outflows on the day — a scenario not seen since July 16.

Total daily trading volume for the 12 spot Bitcoin ETFs dropped to $712.25 million on Sep. 10, down 56% from $1.61 billion the previous day. At the time of writing, Bitcoin (BTC) was down 1% over the past day, trading at $56,276 per data from crypto.news.

Meanwhile, the nine-spot Ethereum ETFs logged net inflows of $11.4 million on Sep. 10 marking an end to five consecutive days of net negative flows. Fidelity’s FETH led these inflows, which saw $7.1 million enter the fund. Additional inflows were recorded by BlackRock’s ETHA with the reported inflow of $4.3 million. The remaining seven ETH ETFs saw no flows on the day.

These investment vehicles have also seen their daily trading volume drop to $102.87 million on Sep. 10, a drop over the previous day. The spot Ether ETFs have experienced a cumulative net outflow of $562.06 million to date. At the time of publication, Ethereum (ETH) was also down 0.8%, exchanging hands at $2,326.

Despite the recent inflows into these ETFs, recent developments suggest a general waning of institutional interest in Ethereum-based products. VanEck recently announced closing its Ethereum Strategy ETF after less than a year while WisdomTree withdrew its application for a spot Ethereum ETF with the U.S. Securities and Exchange Commission.