Square’s Stock Tanks after Lackluster Q1 Results

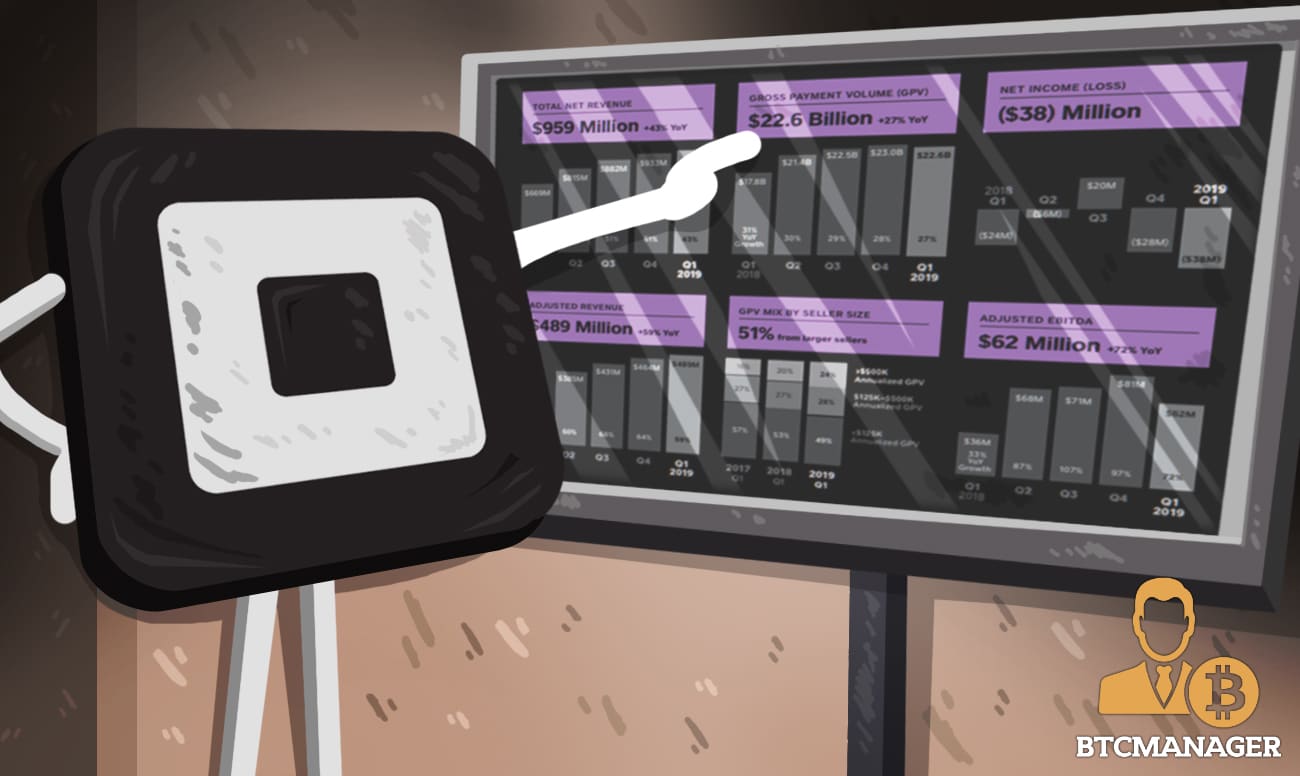

Despite a 43 percent year-on-year growth in net revenues, Square has declared a loss per share of 9 cents in a letter to shareholders. Wall Street was expecting the loss making company to finally declare an earnings call in the green, evidently, the market punished Square for hitting below expectations.

Earnings Call and Shareholder Letter

In their shareholder letter, Square Inc announced an increase in their revenues and positive EBITDA, the company sustained a $38 million net loss on account of mark-to-market valuation of their investment in Eventbrite.

Square has launched a plethora of new services to their product offerings. This quarter, they launched Square invoices; a tool for sellers who get paid remotely. 34 percent of their users are professionals/freelancers. Square is able to remotely collect these invoices in one day’s time; for comparison, the average small business in America is said to wait up to 21 days to receive a payment.

Only 20 percent of Japan’s transactions are done via cards. Square, seeing this as a huge opportunity, launched Square Stand and Square Reader to facilitate contactless digital payments. They tied up with Sumitomo Mitsui Bank, one of the largest commercial banks in Japan, to be promoted as the preferred choice for Point of Sale (PoS) machines.

Square’s focus on legitimate partnerships that expand their sales horizon is a positive for top line seeking investors. However, if this trend continues, it is unlikely they will declare a profit in 2019.

Good Losses and Bad Losses

Square’s loss can be considered a positive as it is expenditure that is necessary and allowing them to penetrate the market at a fast pace. Their Profit/Loss statement shows almost 70 percent of their operating expenses are product development and sales costs. Product development is essential, especially for a technology service provider. Companies that cheap out on product development usually regret doing so later on as it limit their initial market penetration and perception.

Only 6.6 percent of their expenses are transactional and loan losses. This shows a great amount of consistency in maintaining transactional efficiency. Additionally, Square announced $64 million worth of ‘Bitcoin costs’ and $65.5 million of ‘Bitcoin revenue’. Jack Dorsey, CEO of Square and Twitter, is a known proponent of Bitcoin and the Lightning Network. The revenue’s brought in through Bitcoin exchanges are a significant achievement considering investor reactions to their Bitcoin based revenue in the past.

The Square Cash App can be used to buy and sell Bitcoin. It doesn’t function as a regular wallet, but you can send Bitcoin to other wallets.

Square is the first American financial company to publicly embrace Bitcoin. This has improved its perception to crypto enthusiasts. But more importantly, it shows their ability to be dynamic and absorb new innovations to better serve their customers.