Staking has become top use case for crypto in Singapore, Coinbase says

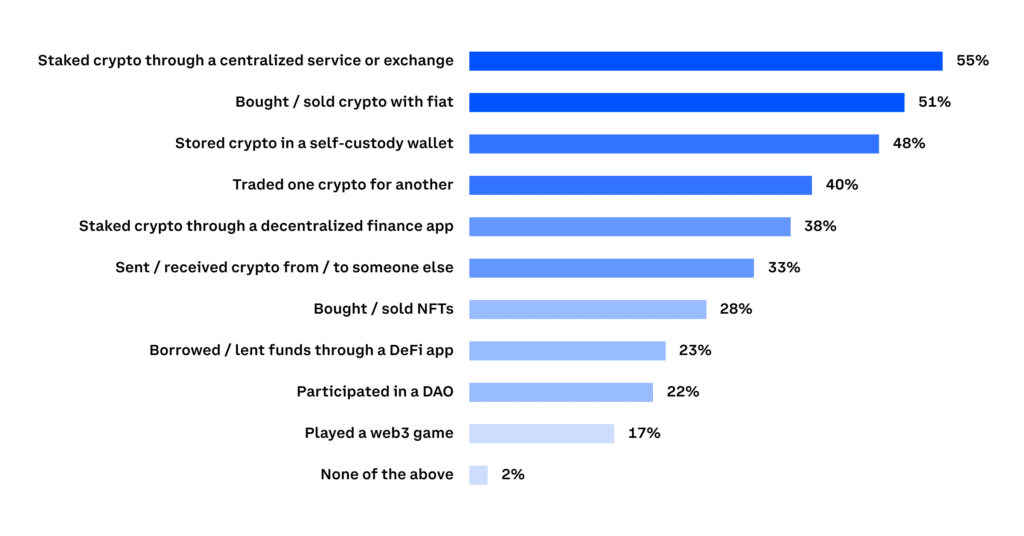

Crypto exchange Coinbase has found that around 55% of crypto investors in Singapore had staked crypto through a centralized exchange.

A recent research jointly conducted by Seedly and Coinbase has unveiled that a significant majority of crypto investors in Singapore are actively engaged in staking services.

The survey, which gathered insights from over 2,000 adults during Q4 of 2023, indicates that approximately 55% of respondents reported engaging in staking through centralized exchanges, while 38% utilized decentralized finance (defi) applications.

Despite fluctuations in the market, Singaporeans continue to express optimism about the long-term potential of crypto, Coinbase says, adding that 56% of respondents believe that crypto “is the future of finance, and 46% expect prices to rise over the next 12 months.”

Furthermore, the survey reveals that 54% of respondents use stablecoins, while 35% use other crypto for remittances. The U.S.-headquartered crypto exchange says the optimism “demonstrates the vibrant crypto ecosystem developing in Singapore.” When selecting platforms for buying, selling, and managing crypto, over 70% of respondents emphasized the importance of fund protection.

In late 2023, crypto.news reported that over 11% of global venture capital funding in blockchain and crypto was funneled towards ventures based in Hong Kong and Singapore throughout 2023. That’s according to analysts at PitchBook who attributed this change to several factors, including the collapse of Sam Bankman-Fried’s FTX crypto exchange and the subsequent bankruptcy domino effect it created that compelled many U.S.-based crypto companies to reassess their strategies.