Stocks down, gold and crypto up as market correlations shift

The correlation between Bitcoin, gold, and major stock indices like NASDAQ and S&P500 changed in October. Here is what it means.

In early October, the financial landscape saw an unexpected twist. The trigger was the attack by Hamas on Israel, an event that led to noticeable shifts in global markets.

Stocks, especially big players from the U.S. like the S&P 500 and Nasdaq, started facing downward pressure. Their values dipped, reflecting concerns from the ongoing geopolitical tensions. Several months prior, Bitcoin demonstrated a strong positive relationship with these key stock markets. However, by October, this parallel movement noticeably weakened as correlation figures with Bitcoin decreased.

Gold and cryptocurrencies, typically seen as safe havens during uncertain times, began their ascent, seemingly moving together. In October, their correlation increased.

Let’s dive into the connections between these assets, explore the reasons behind their movement, and discuss the broader implications for the financial markets.

How did the equities fare in October?

Throughout October, U.S. stocks, notably the S&P 500 and Nasdaq, experienced notable fluctuations due to a combination of geopolitical events and key economic data releases.

In the beginning, on Oct. 3, there was a considerable dip: the S&P 500 lost 1.4% while the Nasdaq went down by 1.9% after a concerning job openings report.

Mid-month wasn’t any better. On Oct. 18, a rise in Treasury yields and earnings assessments pushed both indices down even further, making bonds more lucrative.

Moreover, as tensions between Israel and Palestine escalated, NASDAQ’s value dramatically decreased to 12,595 by Oct. 26 – a drop of around 8%.

Shifting the focus to specific stocks, the “S&P 7” – the seven major tech stocks – lost a staggering $500 billion in value since July.

These stocks had previously driven the stock market consistently upwards. However, now there seems to be a change in the wind as these tech giants face increased pressure, leading the S&P 500 into a correction zone, down 10% since July.

The month also sparked curiosity about the Federal Reserve’s next move. Currently, expectations lean towards rate cuts starting in June 2024. Yet, there’s still speculation for a potential hike in January 2024, especially with a crucial Fed meeting on the horizon.

What happened with gold?

Gold’s performance in October 2023 seemed to ride the waves of global events and economic indicators.

The month began with gold prices at a seven-month low on Oct. 3. Gold, which doesn’t yield returns like interest-bearing assets, tends to lose its luster when interest rates rise. Confirming these fears, the Federal Reserve’s hawkish signals contributed to gold touching its seven-month low again.

But as geopolitical tensions in the Middle East flared, gold found its shine again. By Oct.13, prices rose alongside U.S. Treasuries and oil, a classic sign of investors flocking to safer assets amidst uncertainty.

Moreover, the most telling sign of change, however, was the price jump from $1848 to $2000 over October, marking a roughly 8% increase.

This significant uptick, in large part due to the Middle East tensions, spotlighted gold’s appeal amidst the evolving asset landscape.

To sum it up, October reiterated gold’s age-old narrative: it remains a sought-after refuge during turbulent times, but its charm is invariably linked to global events and economic policies.

What’s happening in crypto?

Firstly, BTC’s surge to a 16-month high at $35,150 on Oct. 26 was a standout moment. Amidst a backdrop of a shaky macroeconomy, this rally wasn’t entirely unexpected. However, the potential for a BTC ETF turned as a bullish catalyst.

Post its peak, Bitcoin has exhibited stability, consolidating its gains and hovering in the $34,000-$34,500 range. Such consolidation after a surge can be seen as a healthy sign, reflecting confidence and reducing fears of immediate sell-offs.

But Bitcoin wasn’t the only star. The global crypto market also stole some limelight by touching $1.28 trillion.

This milestone, the highest over a year, bolstered the bullish thesis for cryptocurrencies, suggesting a broad-based confidence and optimism across various digital assets, not just BTC.

Changing correlation and market dynamics

S&P, NASDAQ, and BTC: A shift in correlation

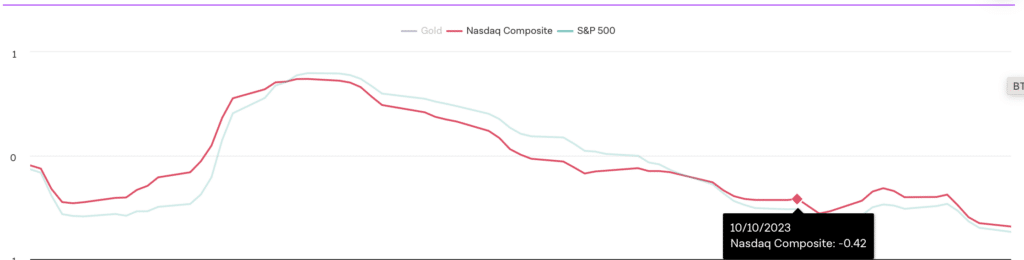

A few months ago, Bitcoin positively correlated with major stock indices like the NASDAQ and S&P. Specifically, in August, the correlations stood at 0.72 and 0.71, meaning when these stock indices moved in a particular direction, Bitcoin typically moved in a similar manner.

However, by October, this trend shifted notably. The correlation values for NASDAQ and S&P with Bitcoin dropped to -0.69 and -0.74, respectively.

This negative correlation implies that when the stock indices moved up, Bitcoin tended to move down, and vice versa.

Such a divergence can be attributed to various external factors like geopolitical tensions and differing investor sentiments in traditional stocks versus the crypto market.

BTC and gold: converging paths

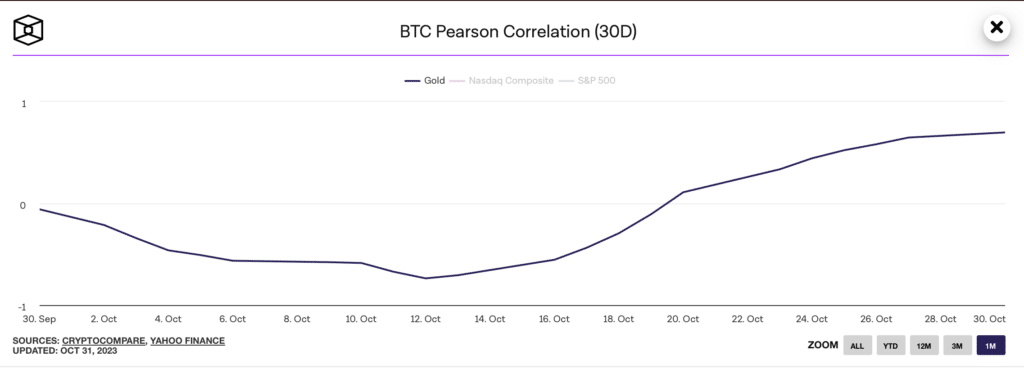

On the other hand, Bitcoin’s relationship with gold displayed a contrasting trend. Starting from a negative correlation of -0.74 in early October, it increased to a positive 0.7 by the end of the month.

This shift suggests that as October progressed, the price movements of Bitcoin and gold became more aligned. This can be seen as a reflection of both assets being perceived as alternatives or hedges against the uncertainties in mainstream markets.

What it means for the market

Looking ahead, the changing relationships between assets like stocks, gold, and Bitcoin remind us that the financial landscape is always evolving. Recent events have shown us that traditional stocks and cryptocurrencies might react differently to global events.

While Bitcoin and gold seem to be moving more closely together lately, traditional stock indices and Bitcoin are showing opposite trends. This could suggest that investors are viewing them differently, possibly seeing Bitcoin and gold as safe spots during uncertain times.

However, it’s worth noting that markets can be unpredictable. What we see today might shift in the coming weeks or months, especially as global situations and policies change.

For investors, it’s a good time to keep an eye on the market, stay informed, and be careful with decisions. It might be beneficial to have a mix of different assets in a portfolio and to be ready for unexpected market moves. Always proceed with caution and consider seeking advice when making major financial decisions.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.