Sui and Polkadot ETFs from 21Shares listed on DTCC website

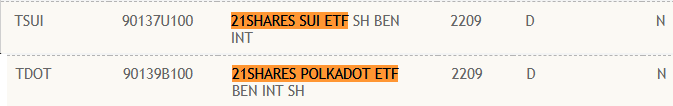

Spot Sui and Polkadot exchange-traded funds from 21Shares have been listed on the Depository Trust & Clearing Corporation’s National Securities Clearing Corporation list as they await regulatory approval.

- 21Shares’ SUI and Polkadot ETFs have been listed on the DTCC’s clearing list under tickers TSUI and TDOT.

- SUI and DOT prices slipped despite initial gains.

- Analysts believe the chances of SEC approval are high, especially following recent regulatory developments.

According to the DTCC’s updated list, 21Shares SUI ETF was added under the ticker TSUI, while the DOT ETF was listed under the ticker TDOT, which clears them for listing and settlement.

A DTCC listing is a routine step that precedes an ETF’s potential launch and doesn’t confirm regulatory approval from the U.S. Securities and Exchange Commission. Over the past weeks, the DTCC has added a number of crypto ETFs to its list, including funds tied to Solana, XRP, Hedera, and Dogecoin.

As of Oct. 1, neither of the ETFs has been approved by the agency, but these listings can be considered a sign that issuers are laying the operational groundwork as they likely expect an SEC approval soon.

SUI and Polkadot ETFs has high odds of approval

Bloomberg analysts James Seyffart and Eric Balchunas have previously placed the odds of approval for the Polkadot and Sui ETFs at around 90 percent and 60 percent, respectively.

However, following some recent regulatory developments, these odds have likely improved as the SEC appears to be moving toward a more streamlined review process for crypto-linked funds.

On Sep. 29, the agency withdrew its delay notices for at least 16 applications for exchange-traded fund products based on Solana, XRP, and other tokens, just days after it approved new generic listing standards for crypto-based ETFs.

In a recent X post, Balchunas said these developments are a sign that the long wait for crypto ETF approvals may finally be over. According to him, the SEC’s decision to adopt generic listing standards has removed many of the procedural bottlenecks that once slowed down the review process.

Essentially, issuers now only need to secure approval for their S-1 registration statements from the SEC’s Division of Corporation Finance, instead of waiting through the lengthy 19b-4 review process that previously governed ETF applications.

Balchunas sees Solana as the first among the upcoming crypto ETFs to be approved; however, with many of the other application deadlines clustered throughout October, other funds are expected to follow suit in quick succession.

SUI and DOT prices fail to react

Even with ETF approval chances now higher than ever, both SUI and DOT failed to pull off noteworthy rallies supported by the DTCC listing news.

SUI initially rallied by over 3 percent while DOT recorded gains of nearly 2 percent following the DTCC listing; however, as of press time, both tokens were in the red as sentiment across the broader market remained cautious, especially with the U.S. government shutdown in effect, which has dampened risk sentiment.