Sylo rallies to 19-month high despite market-wide turbulence

Sylo (SYLO), the native token of the blockchain-based data exchange, is bucking the broader market trend having recently rallied to a 19-month high above $0.0043.

Before the recent uptrend Sylo had largely underperformed this year plummeting to a low of $0.001108 in October. While the rest of the market witnessed year-to-date (YTD), gains at the time represented a 42% decline in Sylo’s price YTD.

However, the token made a late and unexpected comeback against bear market sentiment at the start of November. The token surged 50.7% from the $0.001108 low on Oct. 20 to $0.001670 on Nov. 13. Despite the resurgence, Sylo was still in bearish territories on the YTD timeframe.

The asset eventually collapsed from the $0.001670 threshold dropping below $0.0015 as November progressed. It later leveraged a market-wide uptrend to rally to $0.002644.

Despite intermittent declines, Sylo’s uptrend seems to be persisting as the crypto token continues to record higher highs. Sylo is sustaining an uptrend amid the ongoing market correction hitting a 19-month high of $0.004318 on Dec. 18. The last time Sylo saw this price was before the Terra implosion of last May.

The asset has corrected some of the latest price gains, but holds up well above $0.003. Sylo currently trades for $0.003638, with a 24.58% increase over the past week. Sylo is also up 152% in the last one month, and 25% over the last 24 hours.

Sylo sees drop in social volume amid RSI spike

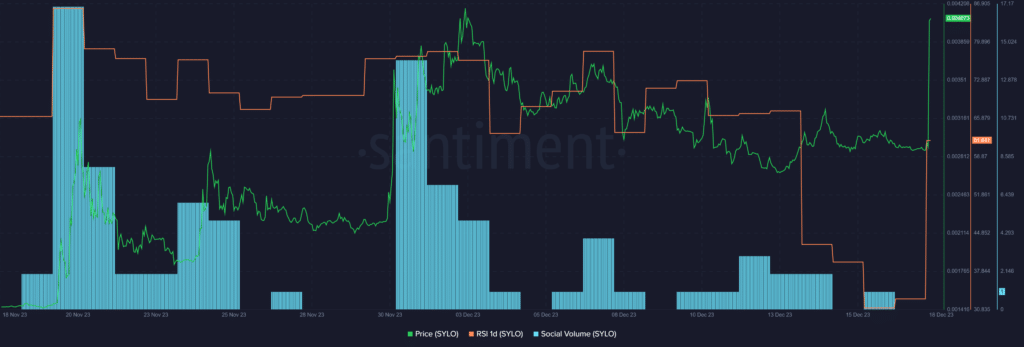

The token’s 24-hour trade volume has also skyrocketed by a mind-blowing 421% to $5.19 million as of Dec. 18. Despite this increased volume, data from market intelligence resource Santiment suggests the asset’s social volume has dropped to 1 in recent times. This suggests low social mentions.

Meanwhile, Santiment data confirms that the recent spike in price has impacted Sylo’s Relative Strength Index (RSI), which has surged from 32.8 to 61.8. This rapid increase indicates a substantial strengthening of Sylo’s momentum, as the recent price spike leads to substantial buying pressure.

While Sylo’s RSI could suggest a price downturn, staying below the 65 mark would still suggest further bullish momentum.

The notion of increased buying pressure is further bolstered by the massive 421% surge in trade volume. With no significant updates surrounding the project in recent times, market watchers attribute the recent campaign to speculation.

As a result, a correction could be on the horizon as the asset enter overbought regions with no support from the broader market. The global crypto market cap is down 1.91% as of Dec. 18.