Terra (LUNA): A New DeFi Leader

LUNA is a native token of Terra, a blockchain developed in 2018 and introduced to the market in 2019. LUNA performs the functions of collateral in regards to stablecoins issued by Terra. All Terra’s stablecoins are freely convertible to LUNA, and the growing demand for stablecoins and Terra’s ecosystem contributes to the proportional appreciation of LUNA.

The demand for LUNA is also maintained via its functionality in terms of paying the fees and participating in collective decision-making regarding network’s functioning. Terra relies on a proof-of-stake mechanism, enabling its holders to stake their tokens and receive additional passive income. There are some minimal requirements for validators in regards to the number of tokens held for at least three weeks. At the same time, one can also collaborate with other validators to overcome such restrictions.

At the present moment, Terra has reached a market capitalization of $20.78 billion, making it the 9th most popular cryptocurrency in the market. Its circulation supply equals $400.85 million. The maximum supply of LUNA is 1 billion, and its users receive adequate guarantees in terms of inflation prevention. Terra’s major advantages for potential investors include:

- the instant access to the decentralized stablecoin UST;

- an innovative smart contracts platform;

- a comprehensive cross-chain DeFi environment;

- reliance on the Cosmos SDK consensus.

The current market dynamics confirm considerable market value generated by Terra to investors with the possibility of effectively adjusting their strategies according to their risk preferences and investment priorities.

Reasonability of Investing in LUNA

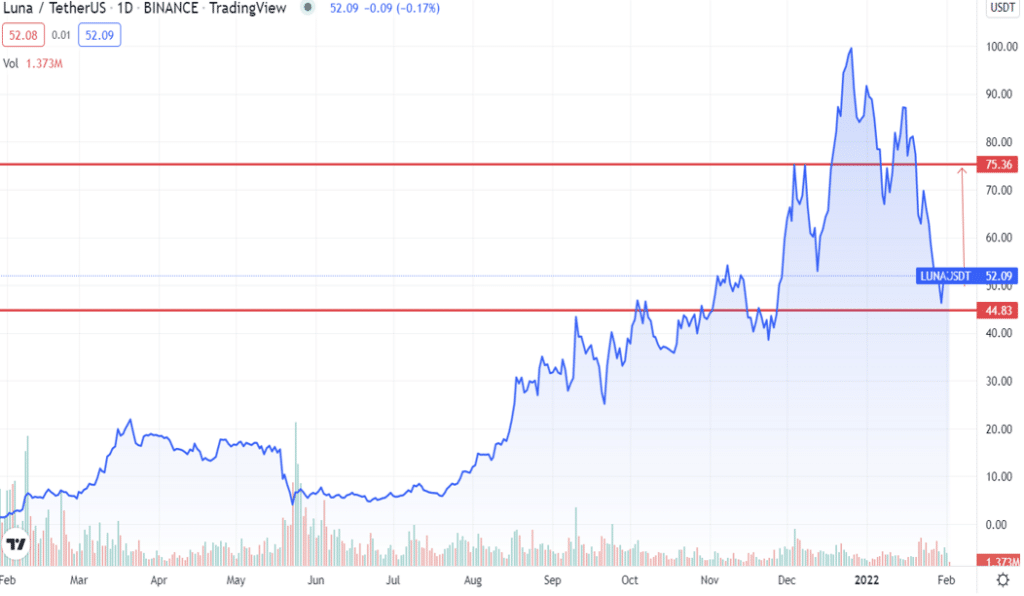

LUNA performs the unique functions of integrating stablecoins with the dynamic DeFI segment. The growing demand for smart contracts and the active integration of stablecoins into the traditional cryptocurrency system may create additional demand for LUNA in the following years. In the short run, the expected price changes may be within the broad range of $45-$75. The strong support level at $45 indicates the high likelihood of the gradual LUNA’s appreciation within the following weeks. At the same time, the existing instability in the crypto market can make it more difficult to exceed the resistance level of $75.

However, long-term investors may still be optimistic of Terra’s market perspectives, considering its effective utilization of the proof-of-stake algorithm and integration with various blockchain platforms.

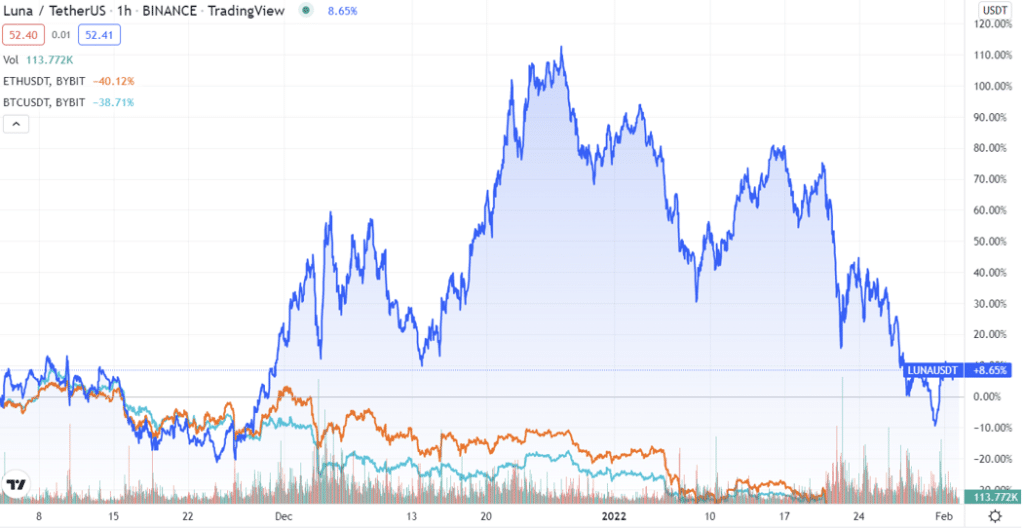

LUNA’s market price demonstrates a positive dynamic within the past 3 months despite the fact that both BTC and ETH demonstrate a negative trend within the same period. Thus, the high likelihood of LUNA’s variability within the following months can also be expected.

Therefore, it may be included in the portfolio with other cryptocurrencies to maintain the proper balance of expected risks and returns.

Considering Terra’s close association with stablecoins and the demand for them, LUNA’s price should remain within the positive percentage range in the short run as the growing number of investors may shift to stablecoins in an attempt to protect their investments and minimize potential risks incurred.

Overall, Terra has a significant potential for sustainable growth in the long run consistent with the development of the DeFi segment.