Tether CTO claims USDT price being manipulated, some suggest Binance involvement

Tether and Bitfinex chief technology officer Paolo Ardoino voiced concerns over what, according to him, are signs that the USDT (USDT) stablecoin is being manipulated.

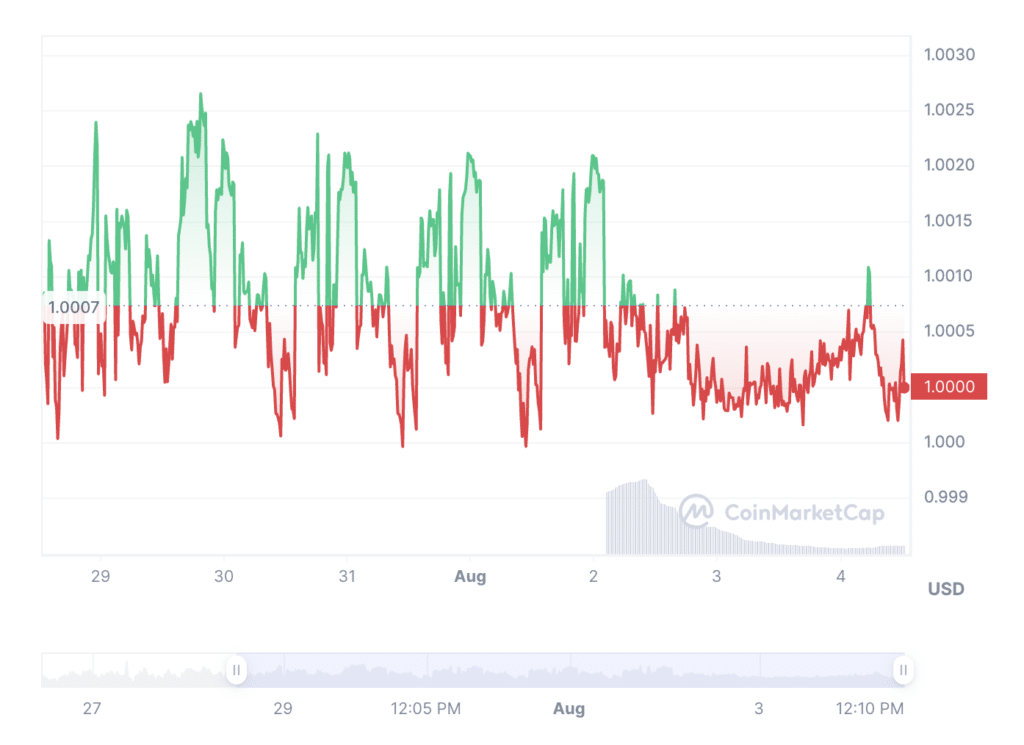

In an Aug. 3 tweet, Ardoino explained that USDT is being pressured down by about 10 basis points (equivalent to 0.1%, or a price of about $0.99). Still, while one would expect USDC — arguably USDT’s main competitor — to gain from this situation, it is instead redeemed heavily while a very new competitor “is getting it all.”

“Exactly! It feels definitely organic and not manipulative at all,” Ardoino concluded with a sarcastic remark.

Stablecoin data suggests that Ardoino was most likely referring to a new stablecoin named First Digital USD (FDUSD) in his tweet. CoinMarketCap data for this stablecoin goes back until July 26 and shows a market cap of just $20.25 million on Aug. 2, just before a sudden explosion to its current market cap of $256.55 million.

Furthermore, the new stablecoin is now the sixth stablecoin by trading volume. FDUSD went from just about $620,000 of volume at the start of Aug. 2 to nearly $245 million later that day.

Financial analyst Adam Cochran also provided more context in a Twitter thread. According to him, many on-chain addresses are swapping USDT for DAI, with them being funded by an address with thousands of Ethereum (ETH) coming from Binance.

He also went on to explain that all of those addresses only had USDT coming in and out — further suggesting that the purpose of those activities is likely to be the exertion of artificial market forces on USDT. The swapping of USDT for DAI started about 100 days ago, and Cochran said that “it seems like it might be the exchange itself, as its constantly under attack from spoof phishing attacks that target exchanges (sic).”