Tether’s USDT is dominant, but for how long?

With the rise of the Markets in Crypto-Assets Regulation in Europe, questions have risen whether Tether’s USDT stablecoin could maintain its dominance for the long term.

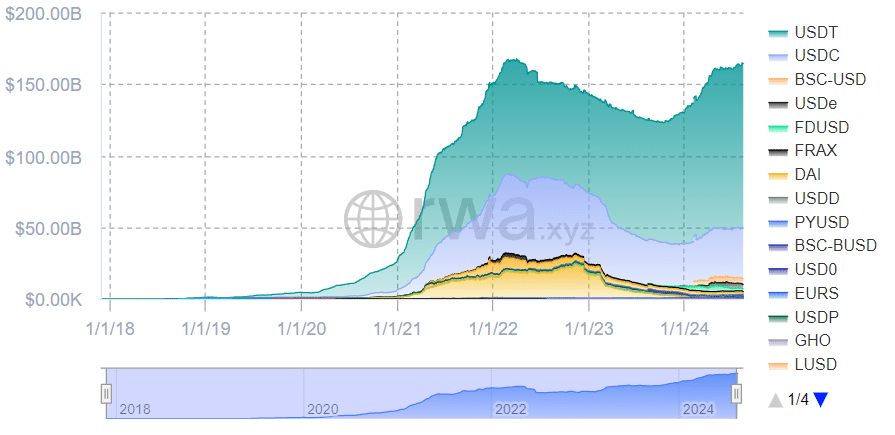

Data from rwa.xyz shows that Tether (USDT) is currently dominating the stablecoin market with a 70% share and has a market cap of $115.67 billion. However, Tether CEO Paolo Ardoino has shared concerns regarding the latest MiCA regulation which came into force on June 30.

Under the new law, stablecoin issuers like Tether and Circle would have to keep 60% of their assets in EU-based banks. While Ardoino believes this puts the stablecoin market at risk, his competitor has already become an early adopter.

Circle, the issuer of USD Coin (USDC) already launched the euro-pegged stablecoin, EURC, on Coinbase’s layer-2 blockchain, Base. Per the report, EURC is completely compliant with the MiCA regulation and already has a market cap of $36.8 million.

Luca Prosperi, the co-founder and CEO of M^0 Labs, told crypto.news that USDT’s dominance would depend on its use cases, for example settling retail trades. He added that “no mature market could expect one issuer to dominate 70%” of a market.

“While we do not know, ex-ante, what will be the landscape going forward, we expect Tether to decrease its market share to 10-30%.”

Luca Prosperi, the co-founder and CEO of M^0 Labs, told crypto.news.

Maruf Yusupov, the co-founder of Deenar, told crypto.news that the adoption rate of stablecoins is still meager and at its very early stages. “Once the asset hits mainstream adoption, regulatory-compliant stables might outperform Tether in the long term,” he added.

Are stablecoins winning?

One of the main reasons behind the growth of stablecoins is the high market volatility as users turn to them as a safe haven. Per data from rwa.xyz, the number of total stablecoin holders increased by 8.3% over the past 30 days, reaching 114.15 million addresses.

Ethena USDe (USDe) reached a market cap of $3 billion in less than four months after its launch. Ripple started privately testing its RLUSD stablecoin on XRP Ledger and Ethereum. Ripple CEO Brad Garlinghouse claimed that the stablecoin would likely launch before 2025.

“The winning point for stablecoins remains their flexibility, ease of adoption, and convenience compared to fiat.”

Maruf Yusupov, the co-founder of Deenar, told crypto.news.

However, M^0 Labs’ Prosperi believes that stablecoins have “no clear standard, no transparency metrics, appropriate regulation, and no liquidity unification layer.”

“This exposes users and holders to significant risk and provides an unfair economic advantage to currently dominating issuers.”

Luca Prosperi, the co-founder and CEO of M^0 Labs, told crypto.news.