The Ethereum Merge Will Transform the Entire Crypto Ecosystem: Chainalysis

Ethereum’s shift to a new consensus mechanism proof-of-stake implies that the entire crypto ecosystem will experience radical changes in terms of staking volumes, mining, and numerous on-chain indicators, a Chainalysis report shows.

The Merge: Key Changes

The largest altcoin moves in the direction of higher scalability, while the Merge’s impact on decentralization and sustainability is still debated by crypto analysts. The Merge will ensure that the main role in confirming transaction in Ethereum’s blockchain will shift from miners to validators. In order to become a validator, one has to reserve 32 ETH. At the same time, smaller holders can also participate in staking by allocating their crypto assets to staking pools.

The major benefits of the proof-of-stake consensus mechanism refer to the maximum environmental friendliness and openness to validators who cannot afford the expensive mining equipment. In addition, the Merge will contribute to reducing the average transaction fees in the Ethereum blockchain and increasing the transaction speed. However, in order to achieve the target goals in terms of speed and transaction volume, the layer-2 solutions (such as Arbitrum or Optimism) should be further developed.

Impact on Staking

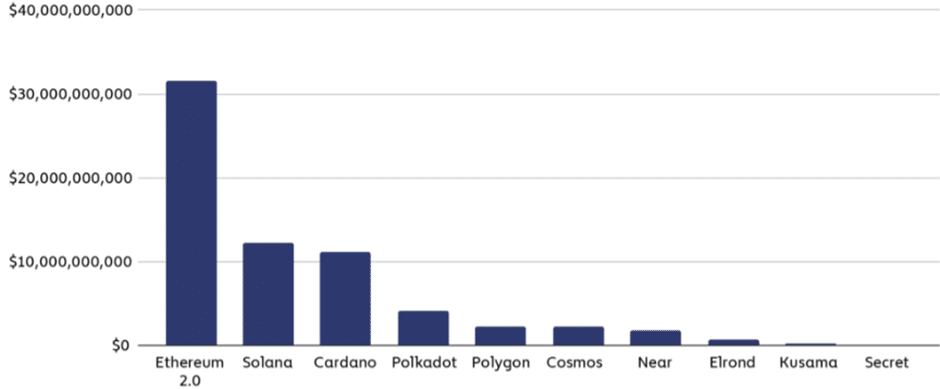

One of the major effects of the Merge that is already observed refers to the growing amount of funds directed to staking. Investors are motivated by the possibility to receive additional passive income. Moreover, most of them are overall bullish in terms of Ethereum’s capitalization in the following months. At the present moment, the total value staked in Ethereum 2.0 makes it the overall leader among all major blockchains, including Solana, Cardano, and Polkadot.

Figure 1. Total Value Staked by Blockchain. Data Source – Chainalysis

The total value staked in Ethereum 2.0 exceeds $30 billion, and the recent dynamics indicates that this volume may continue to increase in the following days. Institutional investors also demonstrate a considerable interest in the Merge and potential capitalization gains that may follow. The Merge may also indirectly contribute to addressing the problem of staked ETH by enabling holders to withdraw it at will, thus ensuring the higher liquidity availability in the system. Sharding should also maximize the rates of scalability improvements in the long term.

Institutional Support

Institutional investors are especially open to utilizing the emerging opportunities in terms of rewards maximization. In particular, Ethereum tends to be closely correlated with hi-tech stocks, implying that the higher yields can be generated, but they are also associated with higher risks. Following the Merge, ETH may become closer to a bond or commodity, thus offering the possibility to generate the decent returns at lower risks. Moreover, the combination of staking rewards and transaction fees allocated to validators may enable them to obtain about 10-15% of annual rewards that exceeds the vast majority of other market alternatives.

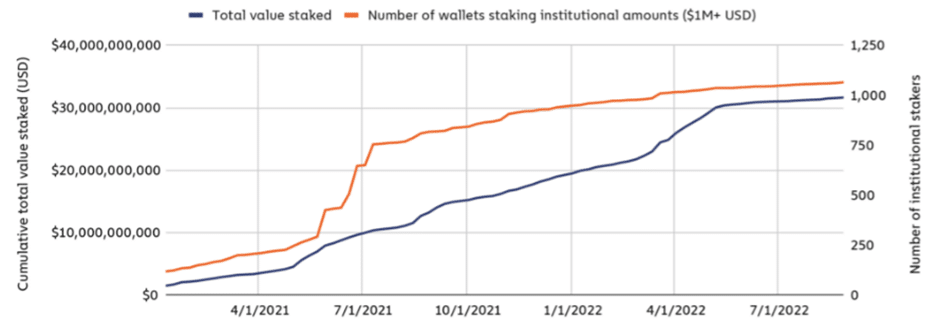

The cumulative ETH staking activity among institutional investors demonstrates an even higher dynamics as compared with the overall staking activity. The reason is that they are more sensitive to emerging profitability opportunities and possess more resources to direct to ETH staking. The number of wallets staking $1 million demonstrates the steady increase in the recent months. However, the main question refers to whether such rapid dynamics will persist in the weeks after the Merge. The ultimate outcomes will largely depend on Ethereum’s team ability to meet all technical challenges and ensure the smooth transition to the proof-of-stake consensus mechanism.

Figure 2. The Cumulative Staking Activity: Institutional Investors and Overall. Data Source – Chainalysis

Impact on Mining

The most negatively affected group by the Merge refers to the Ethereum miners. At the moment, miners effectively distribute hashrate among Ethereum and other blockchains. Although Bitcoin and Ethereum constitute the two most popular blockchains among miners, the Merge will not result in the shift toward the higher intensity of BTC mining. The reason is that the equipment used in Ethereum’s mining (GPUs) is unsuitable for Bitcoin mining (that is mostly based on more powerful solutions known as ASICs). The major problem is that 97% of GPU mining activity is observed in the Ethereum blockchain, and the Ethereum miners may lack decent alternatives for maintaining the target level of activity and profitability.

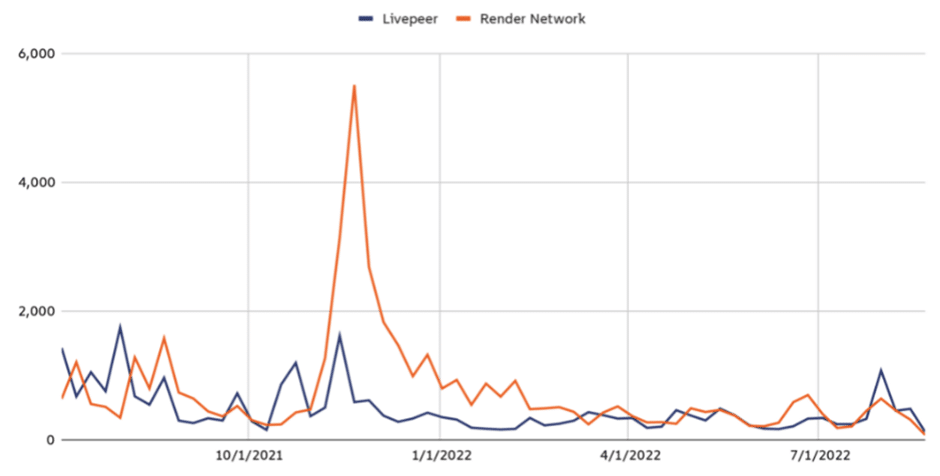

Figure 3. Transfers to the LivePeer and Render Smart Contracts. Data Source – Chainalysis

The transactions from the LivePeer and Render smart contracts imply that rewards to GPU owners continue to decline rapidly, and the current scheme appears to be unable to maintain the Ethereum miners’ profitability anymore.