The US to fine for social media boosting: How crypto bloggers may suffer

The U.S. Federal Trade Commission has banned fake reviews and recommendations. What does it mean for crypto?

Table of Contents

According to the latest news, the decision introduces financial and administrative restrictions on individuals who “sell or buy fake social media influencer indicators.”

The FTC leadership unanimously supported the introduction of the new rules. They will take effect 60 days after publication in the Federal Register:

Fake reviews not only waste people’s time and money, but pollute the marketplace and divert business away from honest competitors.

Lina M. Khan, FTC chair

The new policy also applies to crypto influencers. With the release of the latest ban, unfair methods to boost a channel or page on a social network will lead to fines and sanctions from the authorities. The FTC will also prohibit using tools that use artificial intelligence technologies for such purposes.

At the same time, the ban only applies to cases where the account owner specifically ordered or otherwise facilitated such a service. The rules also mention that fines will be imposed if the mentioned methods are used to obtain benefits for commercial purposes.

Social media investment scams continue to grow

Recently, the FTC has noted a sharp increase in social media investment scams, especially in cryptocurrency. These include fake messages promising guaranteed high returns with little or no risk.

FTC consumer education specialist Andrew Raio noted that scammers are increasingly targeting social media users on major platforms with fraudulent investment opportunities, especially crypto:

If you reply, the scammer will say they’ve made lots of money investing in Bitcoin or another cryptocurrency. And they can get you a unique opportunity that guarantees significant returns with little or no risk. But these are all lies designed to convince you and get your money.

The victim is redirected to a fake investment site or app where their investment account looks profitable. However, once the scammer has squeezed out as much money as possible, they disappear, leaving the victim with nothing.

Crypto romance scams

The FTC has also warned about cryptocurrency scammers offering investment advice under the guise of romantic partners.

The regulator noted that scammers build an emotional connection with you, making you more likely to believe they are experts in investing in cryptocurrency.

The scam usually begins with an unsolicited social media contact. The scammer carefully studies the victim’s profile to establish trust and a connection. Once a relationship is established, the conversation turns to investments, with the scammer claiming their top priority is the victim’s financial security.

More restrictions for the crypto sphere are coming

In addition to crypto influencers, betting platforms have previously come under the scrutiny of the U.S. authorities.

Earlier in August, the U.S. Congress called on the Commodity Futures Trading Commission to ban political bets. Authorities noted that they could influence the outcome of the U.S. presidential election.

Five senators and three members of the House of Representatives sent an open letter to CFTC Chairman Rostin Benham. They stated that such mechanisms could undermine public confidence in the electoral system.

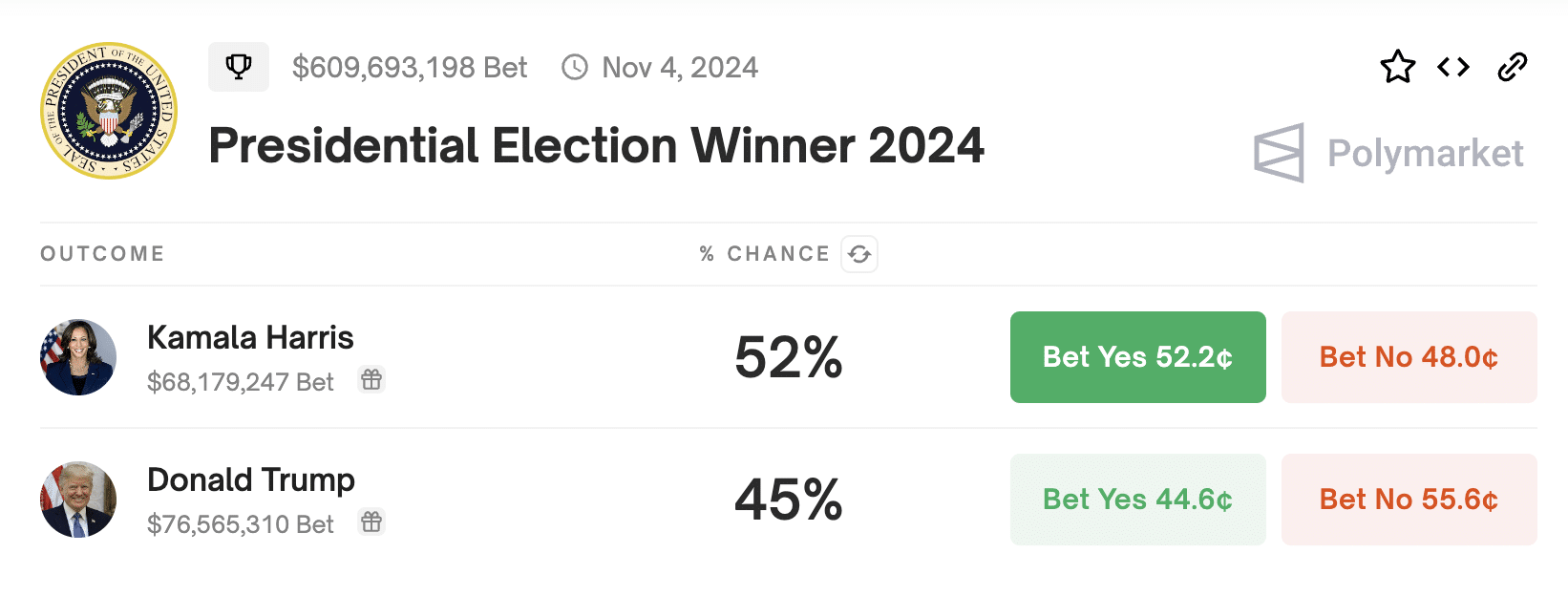

The initiative is also aimed at the Polymarket betting platform, where crypto community members guess the presidential election’s outcome. According to the latest data, the bet volume has exceeded $606 million. Vice President Kamala Harris is in the lead — users estimate her chances of winning at 53%, and 44% of people who placed a bet believe in former President Donald Trump’s triumph.

At the same time, the total political section on the platform in terms of funds exceeds $1 billion. Polymarket participants bet on hundreds of events.

U.S. politicians have suddenly fallen in love with cryptocurrencies

Despite the statements of individual regulators and government officials, politicians have also increased their interest in cryptocurrencies in the run-up to the presidential elections. In particular, Trump, who in 2018 instructed the U.S. Treasury to end Bitcoin (BTC), and in 2021, called it a fraud and asked for regulating the industry.

Although the Democrats have not explicitly stated their support for digital assets, they have not recently called for increased regulation or a ban. In addition, with the approval from above, the Securities and Exchange Commission would have approved even one of the documents required to list the Ethereum ETF.

Therefore, it is evident that American politicians have taken a course on a loyal attitude towards cryptocurrency.