UAE and Hong Kong central banks collab on bolstering crypto regulations

The UAE and Hong Kong central banks join forces to enhance regulatory frameworks through collaborative efforts on financial infrastructure and digital assets legislation.

As the global cryptocurrency industry gains prominence, various countries have been actively working towards regulating this emerging asset class.

While the US has adopted a stricter stance, characterized by increased scrutiny and unclear guidelines, Hong Kong, Japan, and the UAE have taken proactive steps to establish comprehensive rules and compliance measures for crypto businesses.

UAE and Hong Kong collaborate for crypto regulation

On May 30, the Central Bank of the UAE (CBUAE) and the Hong Kong Monetary Authority (HKMA) held a bilateral meeting in Abu Dhabi, focusing on collaborative initiatives related to financial infrastructure, financial market connectivity, and cryptocurrency regulations.

During the meeting, both central banks engaged in discussions on key areas of cooperation and agreed to prioritize joint fintech development initiatives and knowledge-sharing efforts within their respective jurisdictions.

To operationalize the agreed-upon initiatives, a joint working group led by the CBUAE and HKMA will be formed, with the support of relevant stakeholders from the banking sectors of both jurisdictions. This collaborative effort aims to effectively implement regulatory measures for businesses such as cryptocurrency exchanges, crypto mining facilities, and DeFi lending platforms.

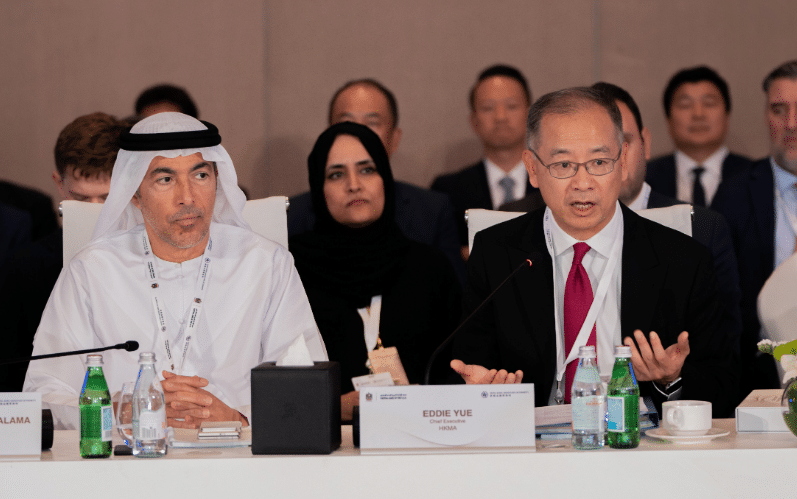

H.E. Khaled Mohamed Balama, Governor of the CBUAE, expressed optimism regarding the long-term nature of the relationship with the HKMA. Similarly, Eddie Yue, Chief Executive of the HKMA, highlighted the economic benefits of the partnership, citing complementary strengths and mutual interests between the two jurisdictions.

Exploring cross-border trade and investment opportunities

Following the bilateral meeting, the CBUAE and HKMA, along with senior executives from banks in the UAE and Hong Kong, conducted a seminar to explore key opportunities for collaboration.

The seminar focused on facilitating better cross-border trade settlement, enabling UAE corporates to leverage Hong Kong’s financial infrastructure platforms for enhanced access to Asian and Mainland markets, and exploring financial and investment solutions and crypto market opportunities in the Guangdong-Hong Kong-Macao Greater Bay Area.

Crypto exchanges eye Hong Kong’s growing market

The collaboration between the two central banks coincides with the Securities and Futures Commission (SFC) of Hong Kong allowing virtual asset service providers (VASPs) to cater to retail investors starting June 1.

Hong Kong’s treasury chief, Christopher Hui, emphasized the city’s acceptance of cryptocurrencies under its new regulatory regime, citing their inherent value and the need for regulated activities to harness their positive aspects.

The collaboration news has attracted interest from cryptocurrency exchanges, including CoinEx, Huobi, and OKX, which have submitted applications to offer dedicated crypto trading services in Hong Kong since the SFC announced the application process.

As the partnership between the UAE and Hong Kong central banks progresses, it is expected to lay the foundation for enhanced regulatory frameworks, fostering a conducive environment for the growth and development of digital assets and financial technology in both jurisdictions.