Unpacking “The Convergence Stack” with Outlier Ventures’ CEO Jamie Burke

Since 2014, Outlier Ventures (OV) has been honing in on some of the most important technologies of our time. After speaking with nearly 1,000 different startups, the venture capital firm has been examining the ins and outs of what a future-proof investment thesis might look like. The Convergence Stack, as CEO Jamie Burke likes to call it, is ultimately a big bet on bots, blockchains, and tokenized networks.

The Convergence Stack

When blockchain technologies burst onto the scene shortly after the arrival of Bitcoin, Burke and his team were quickly onboard.

“At that time,” he told BTCManager, “we were mostly looking at use cases for the technology rather than anything to do with tokenized networks.”

Commodities, real estate, data, and secure supply chain management, but all on a blockchain, was the primary focus three and a half years ago.

After 1,000 interviews with different startups peddling some good, but mostly poor ideas, Burke’s firm began developing a much different idea of what the future of technology would look like. Primarily, which technologies are merging to support one another?

A quick survey of OV’s portfolio points to a continued focus on blockchain technologies, but there is now a serious appreciation for the combination of artificial intelligence and the Internet of Things (IoT). Ocean Protocol, a blockchain-based data exchange protocol, Fetch.AI, an AI platform that automates tokenized “agents,” and IOTA are a few examples of this.

“Crypto is not based on the adoption of currencies, but instead enabling bots to conduct economic activity,” explained Burke. And, rightfully so.

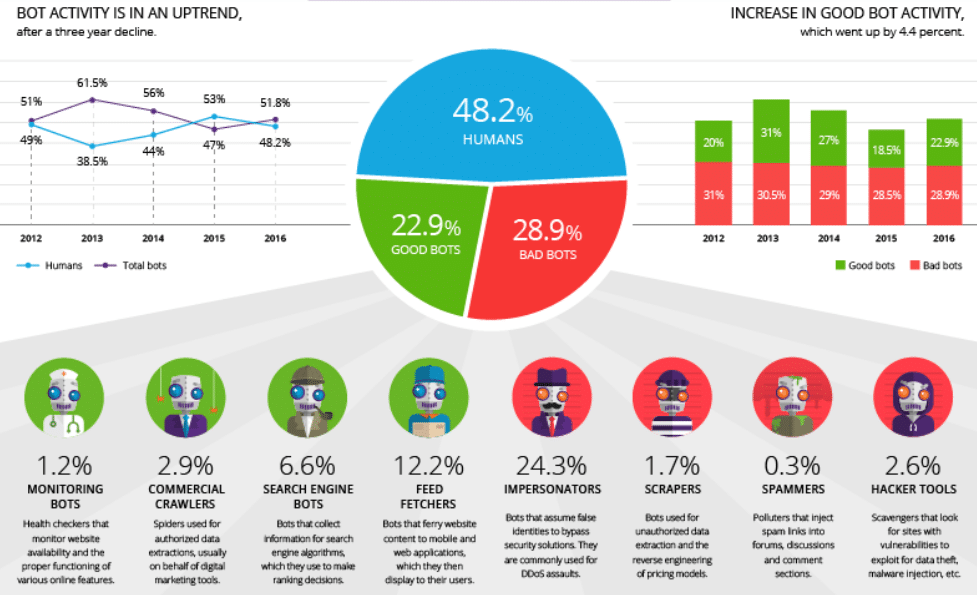

As much as the cryptoverse prides itself on the myriad talented minds that populate Twitter and Telegram accounts, the vast majority of Internet activity is, in general, completed by bots.

The annual bot report from security firm Imperva reported that more than 50 percent of Internet activity was made up of bots in 2016. Though the data may be a bit dated for the technology sector, reports from 2017 indicate only slightly different figures.

(Source: Imperva)

This also means that the vision of a Web 3.0 is also one in which people are mixing with robots almost as frequently as they are with other humans. At least this is how Burke and OV are hedging their bets. “The Internet will be less about finance and more about enabling a machine to machine economy,” he said.

Supporting businesses like Fetch.AI, for instance, maintains this theory, too.

The London-based blockchain and AI startup wants to empower the soon to be ten billion IoT devices in the world with autonomy of action. In other words, they want to allow a Tesla to be able to freely interact, perhaps even create a data marketplace with a British citizen’s smart home. Tokenization is also a critical part of that, according to Burke.

By adding, hopefully, perfectly rational participants and securing a mesh of such participants with a blockchain, a network could finally achieve perfect coordination.

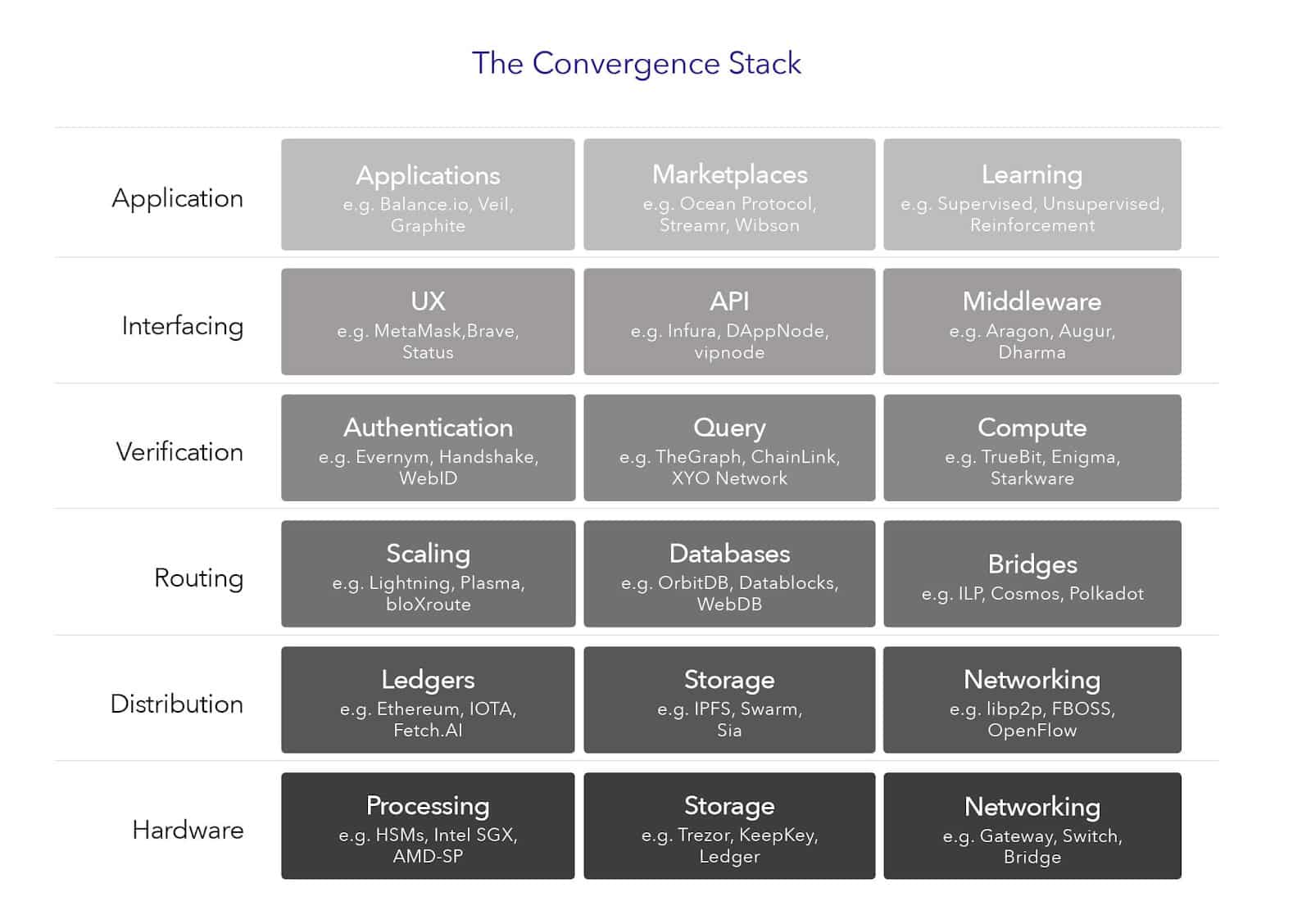

This melding of technologies is defined by OV as The Convergence Stack, and is made up of “a set of interlinked and open-source technologies spanning hardware, software, networking and applications that support a more secure, private, accessible and ultimately what we hope to be equitable digital infrastructure.”

(Source: Outlier Ventures)

Correcting Original Sin

If an even greater philosophical consideration could bind OV’s stack, it would be to right the wrongs of the Internet.

“The existential threat of the Internet is very real,” said Burke. “Surveillance capitalism is real as well as the rise of platform economies and closed wall gardens.” The Facebooks, Googles, and Amazons of the modern era have been taking a serious beating in the press, but the attacks appear to be more than justified.

If one throws Apple and Netflix into the mix, the FANG group indeed seems vampiric. All of these companies have been harvesting users’ data, whether known or unknown and selling it for massive profits. The collection of this data has been so widespread and so categorically monolithic, that these companies, above all else, are morphing into AI companies.

For the uninitiated, all artificial intelligences rely on vast swaths of data to provide the best course of action. A small startup that’s looking to learn more about its potential customer base and market share, for example, will inevitably concede to paying Google or Facebook some fee for access to their global database of information.

Fortunately, some regulators, especially in the EU, are stepping in to end the rampant monopolies.

The reality, however, is that regulations likely won’t be enough to change this. “Ending the reign of many of these companies comes from a top-down approach, like regulation, but also the availability of an alternative technology,” said Burke. The space is far from overtaking Google or otherwise, especially as these companies begin picking apart the most interesting features for themselves.

Still, OV and Burke are convinced that such a toppling is inevitable.

Investment Strategy

Despite the recent pump in the price of bitcoin, OV is relatively indifferent. Albeit a bull market is slightly more interesting as more companies take on marginally more risk, a ten-year horizon keeps Burke patient over the long-term. More to the point, he was one of the first in 2017 to call for a much-needed “crypto winter.”

“The 2017 bubble had very little to do with the utility of the market. It was all speculation,” he said. “And as we saw this winter approaching, we built our investment model on this expectation.”

OV, therefore, operates markedly different than other venture firms, in that the latter are typically structured like hedge funds. A VC traditionally works at the intersection of multiple partners who have ultimately pooled their resources and handed over the reins (within reason) to a dedicated fund for investment. This fund is then responsible for the safeguarding and ultimate increase of these resources.

Conversely, OV is a limited liability partnership (LLP), meaning that the firm can invest their own money as aggressively as they wish. All the responsibility rests in their own hands.

With the above mentioned $30 million, and the LLP moniker, OV will launch a diffusion program to help their “portfolio engage with industry partners, academia, smart cities, developer communities and one another to increase interoperability, usability, and adoption.”

Concluding, regardless of market conditions, the OV team is bullish on the end of tech conglomerates, the rise of economically autonomous robots, and building out a better Internet.