Unveiling trends and crypto investment opportunities in 2024

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Investing in the crypto space in 2024 requires a strategic approach due to the industry’s dynamic nature. We’ll explore the trends and investment options available and highlight CLS Global’s role in the market.

They offer a range of services beyond traditional investments.

Let’s look at the crypto landscape and CLS Global’s offerings.

1. DeFi is rising:

DeFi is revolutionizing the financial industry, and CLS Global invests in DeFi projects that promote financial inclusivity. They consider DeFi a fundamental shift in finance and collaborate with these projects to ensure their success.

Key areas of DeFi growth:

- Decentralized exchanges (DEXs): The rise of DEXs challenges centralized exchanges by giving users control over their funds and facilitating peer-to-peer trading.

- Liquidity protocols: Automated Market Makers (AMMs) and liquidity pools play a crucial role in enhancing liquidity within DeFi, enabling more efficient trading and lending.

- Decentralized lending and borrowing: DeFi platforms offer decentralized lending and borrowing services, allowing users to earn interest on their crypto assets or access capital without traditional intermediaries.

2. Integration of NFTs in various industries:

NFTs have transcended the realm of digital art, finding applications in gaming, real estate, and even the music industry. As this trend burgeons, CLS Global strategically explores investment opportunities within the NFT space, identifying projects demonstrating real-world utility and longevity.

3. Unlocking the future

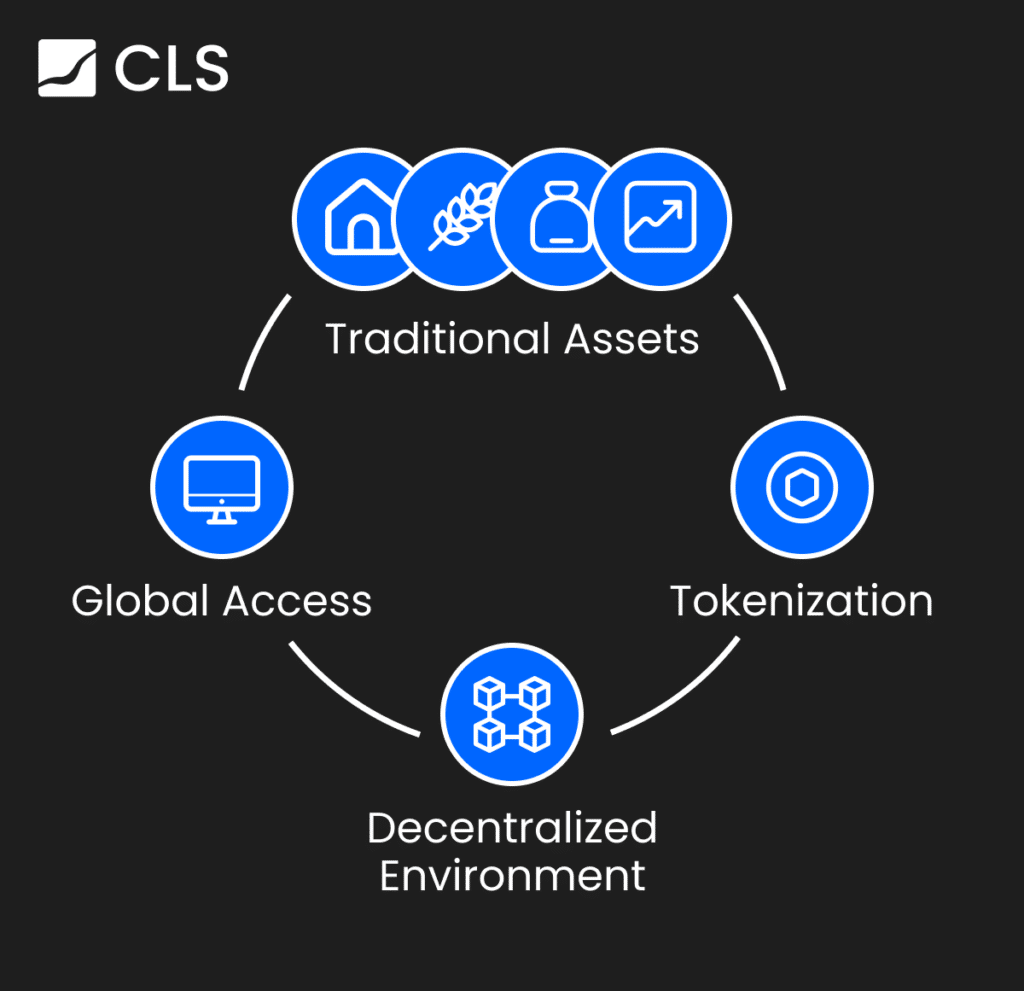

In a seismic shift within the digital investment landscape, a growing cohort of Web2 investors is redirecting their attention toward the untapped potential of Real World Assets (RWA) in the crypto realm. Traditionally rooted in the centralized world of web2 technologies, these investors recognize the transformative power of blockchain and decentralized finance (DeFi) in bringing real-world assets into the digital economy.

The appeal of real-world assets in crypto:

Real World Assets represent tangible assets with intrinsic value, such as real estate, commodities, or other physical properties. Incorporating these assets into the blockchain offers a bridge between the traditional financial markets and the decentralized, transparent nature of the crypto space. This convergence not only injects a new level of legitimacy into the crypto sphere but also opens avenues for broader adoption.

Web2 investors’ strategic pivot:

Web2 investors, traditionally associated with centralized technology ventures, recognize the profound impact decentralized technologies can have on traditional finance. The prospect of tokenizing real-world assets on blockchain networks presents an opportunity to enhance liquidity, accessibility, and efficiency in markets that were once predominantly confined to traditional financial ecosystems.

Key areas of interest:

- Tokenized real estate: Investors are exploring platforms that enable real estate tokenization, allowing for fractional ownership and easier transferability of property assets on blockchain networks.

- Commodities trading: Tokenizing commodities like precious metals, agricultural products, or energy resources is gaining traction. This facilitates seamless trading, reduces friction, and enhances market accessibility.

- Equity tokenization: Web2 investors are eyeing projects that aim to tokenize company equity, providing a decentralized and transparent way for individuals to invest in traditional businesses.

- Debt instruments: Platforms enabling the tokenization of debt instruments, such as bonds or loans, are attracting attention. This allows for more efficient debt trading and opens up new avenues for diversified investment portfolios.

CLS Global: A beacon in RWA integration:

CLS Global, a pioneering force in crypto investment, is leading the charge in this paradigm shift. Recognizing the potential of real-world assets, CLS Global actively engages in projects that aim to bridge the gap between the traditional and decentralized financial worlds. CLS Global acts as a catalyst for integrating RWAs into the crypto space by providing strategic investments and advisory services and leveraging its extensive network.

Challenges and opportunities:

Real-world assets (RWAs) can be integrated with blockchain technology to create new investment opportunities. Still, some challenges must be addressed, such as regulatory complexities, standardization, and interoperability. Web2 investors, such as CLS Global, are working to create an environment where RWAs can coexist with traditional financial systems.

Investors are increasingly focusing on the RWA sector of crypto, which marks a significant moment in the evolution of decentralized finance. This merger expands the range of investment opportunities. It propels the crypto space into a new legitimacy and mainstream acceptance era. With CLS Global leading the way, integrating RWAs can potentially redefine the future of digital finance.

4. Evolving regulatory landscape:

Regulatory clarity is becoming paramount for the mainstream adoption of cryptocurrencies. With its proactive approach, CLS Global collaborates with projects that navigate and comply with evolving regulatory frameworks, ensuring stability and longevity in an ever-changing landscape.

CLS Global’s holistic approach:

As we traverse the crypto trends of 2024, it’s noteworthy that CLS Global is an investor and a dynamic partner offering a spectrum of services. From strategic advisory and market analysis to tailored solutions for project development, CLS Global’s holistic approach can add immense value to potential projects seeking funding and guidance.

Conclusion

Navigating the crypto landscape in 2024 requires understanding emerging trends and strategic partnerships that can unlock the full potential of innovative projects. CLS Global is an active participant in shaping the future of crypto investments.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.