USDC frenzy, over $4.4b minted, over $4.2b burned on Feb. 10

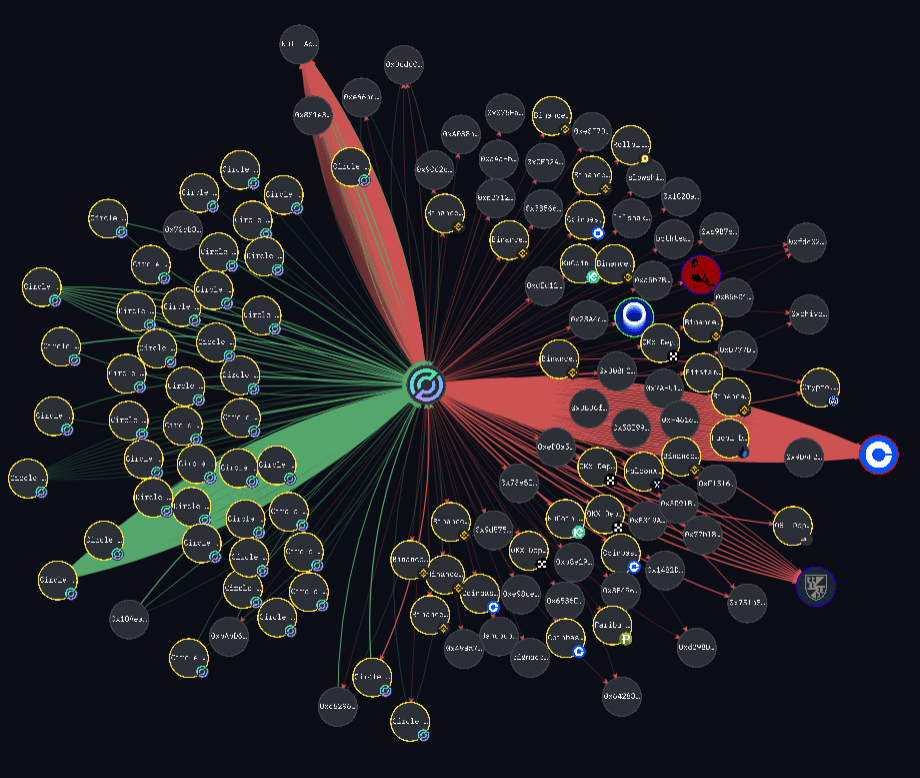

The USD Coin (USDC) stablecoin has seen a frenzy of activity on Feb. 10, 2023, with many billions worth of the stablecoin burned and minted on the Ethereum (ETH) blockchain for an increase in USDC supply on the blockchain of $148 million.

Blockchain data shows that the value of USDC tokens on the Ethereum blockchain was altered significantly by Circle with the burning of $4,286 billion and the minting of $4.434 billion — for an increase in supply of $148 million on Feb. 10, 2023.

Please keep in mind that some of those tokens may have been transferred to other blockchains or from other blockchains since only ethereum data is considered.

Despite the partial data, it is possible to conclude that the overall supply likely did not fluctuate more than usual based on data from top crypto data provider CoinMarketCap.

The firm’s data shows that USDC’s market cap increased from a mid-day low of $41.44 billion to a high of $41.57 billion before falling to its current value of $41.48 billion. At least some of this change can be attributed to fluctuations of in value of the stablecoin currently priced at $0.9999.

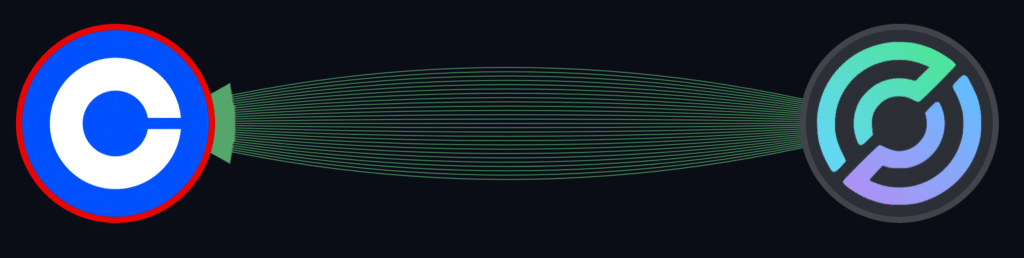

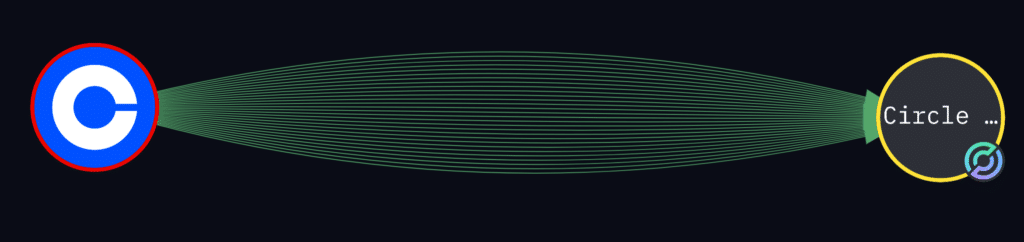

Coinbase — a major United States-based publicly-traded cryptocurrency exchange — has seemingly played a key role in the inexplicable activity burning and minting billions of tokens again within hours.

This one institution alone received a total of $4.731 billion worth of USDC — more than was minted on the ethereum blockchain on that day.

Furthermore, Coinbase also deposited to its Circle deposit address $4.675 billion — more than was burnt on that day — in 29 transactions on Feb. 10, 2023. Overall, Coinbase withdrew $56 million more from Circle than it deposited today.

The report follows Coinbase launching a campaign to encourage users to switch from Tether (USDT) to USDC by waiving all conversion fees. In its campaign announcement, Coinbase described USDC as the “most reputable” stablecoin in the market.

The institution explained that trust and stability were critical in attracting and retaining customers. However, certain quarters of the crypto community didn’t take Coinbase’s call to sell Tether (USDT) for USDC at face value.

Several crypto twitter personalities have made allegations regarding USDC, with some going as far as calling it a “scheme on the brink of collapse.” While USDT is widely seen as controversial, USDC also has its own share of controversy.

Particularly notable is the scandal that resurfaced in August 2021, when it was uncovered that USD Coin was not fully backed by the U.S. dollar, while a sizeable portion of its backing was indeed backed by more speculative assets.