Users accumulating stablecoins as bitcoin and crypto prices rally

Data from Glassnode, a crypto intelligence provider, shows that there is a noticeable accumulation of BUSD, USDC, and USDT across top centralized exchanges like Binance and Coinbase.

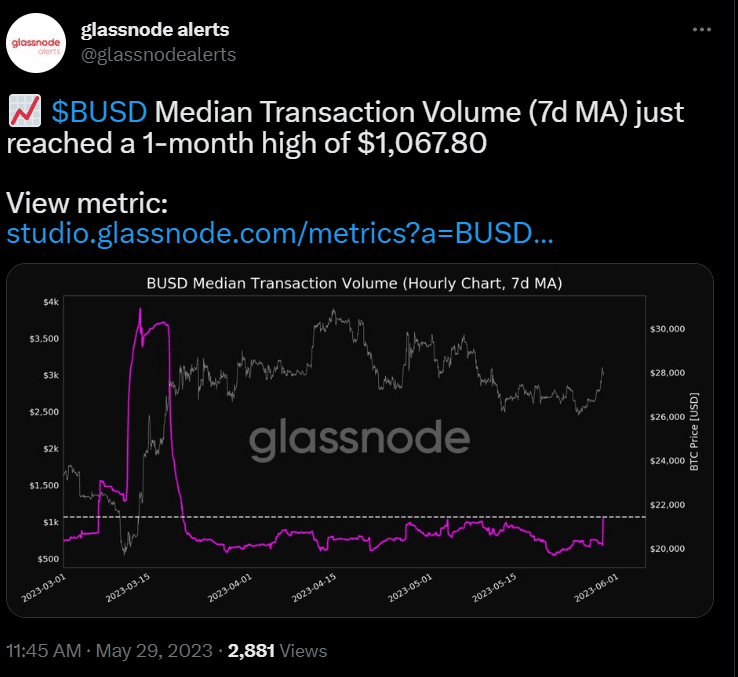

On May 29, the provider reveals that BUSD’s transaction volume recently hit a 1-month high of $1,067.80, suggesting that more users are using the token..

This spike in activity is despite the uncertainty pertaining to BUSD’s future. Paxos, the firm responsible for the minting of BUSD, stopped minting new tokens in Q1 2023 after receiving an order from the New York Department of Financial Services (NYDFS).

Responding to the disclosure, the CEO of Binance, Changpeng Zhao assured users that token redemption will be “fully covered” from reserves held by Paxos.

Afterward, Binance shifted its focus to TrueUSD (TUSD), a stablecoin.

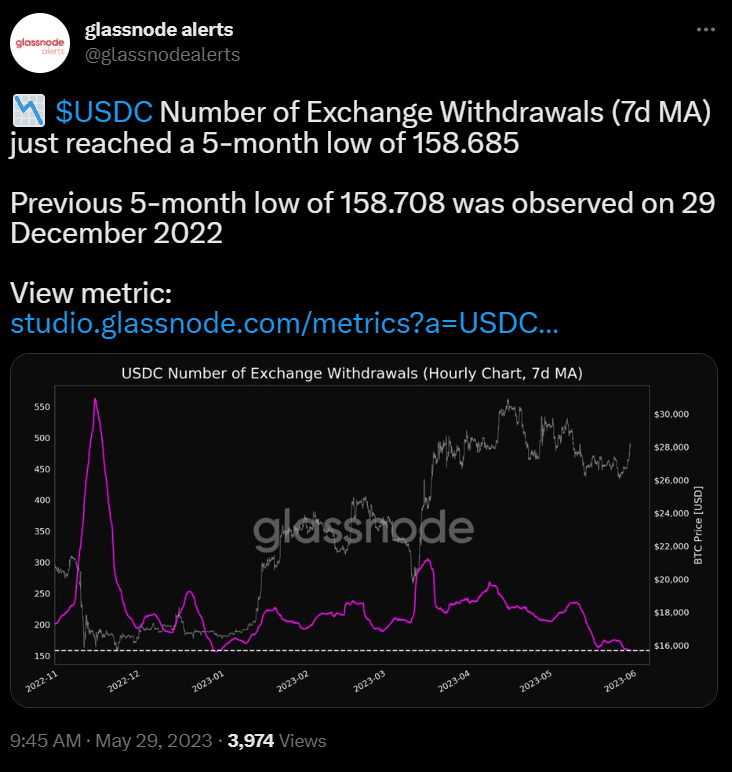

Meanwhile, Glassnode data shows that the number of USDC exchange withdrawals on a 7-day moving average have dropped to 158.685. This marks the lowest value seen this year, and the lowest in the past five months.

This may indicate that more holders, mostly traders, are opting to custody their stablecoins in exchanges, leveraging them for trading and other CeFi-related activities.

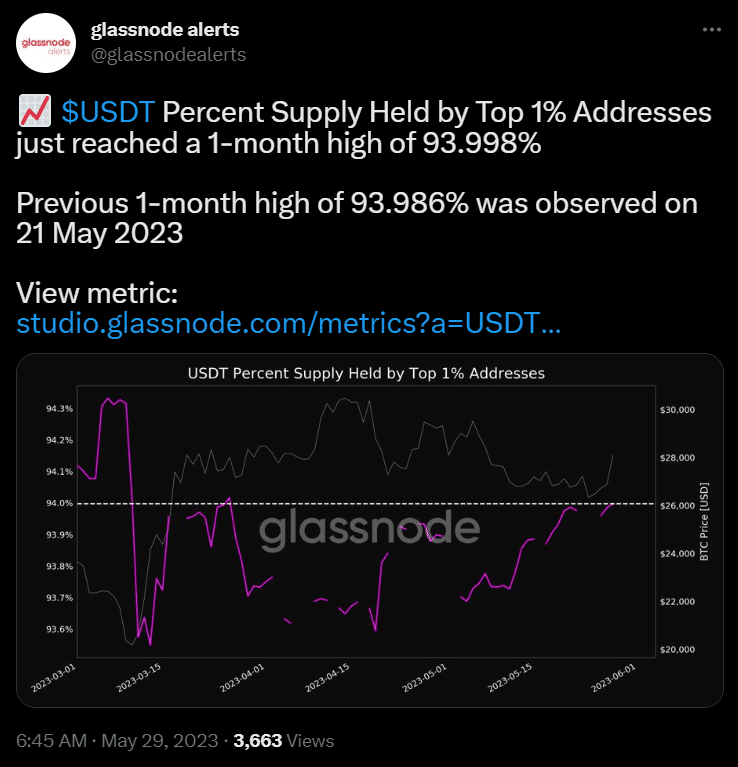

The USDT is also on an upward trend. According to Glassnode, the top 1% of USDT holders own 93.998% of the stablecoin’s total supply. USDT is the largest and liquid stablecoin by market cap. As of May 29, it had a market cap of $83.1 billion and was more valuable than the Binance ecosystem.

The shift in stablecoins’ trend in centralized exchanges coincides with price expansions of top coins, mostly bitcoin (BTC).

As of May 29, BTC is trading at $27,895, up roughly 3% in the past week.