“If you Can’t Fight it, Adopt it,” Visa Wins Patent for Digital Currency Protocol

International payments processor Visa won a patent describing a digital currency protocol on May 14. The system works on a private blockchain and uses native tokens to facilitate transactions.

Good for Crypto?

As Forbes reported, the Visa blockchain would feature native “digital dollars” and other central bank-issued fiat currencies. The move seeks digitalization of all major forex pairs, such as the yen, pound, yuan, and euros, to ensure faster cross-border trade and secure inter-bank settlements.

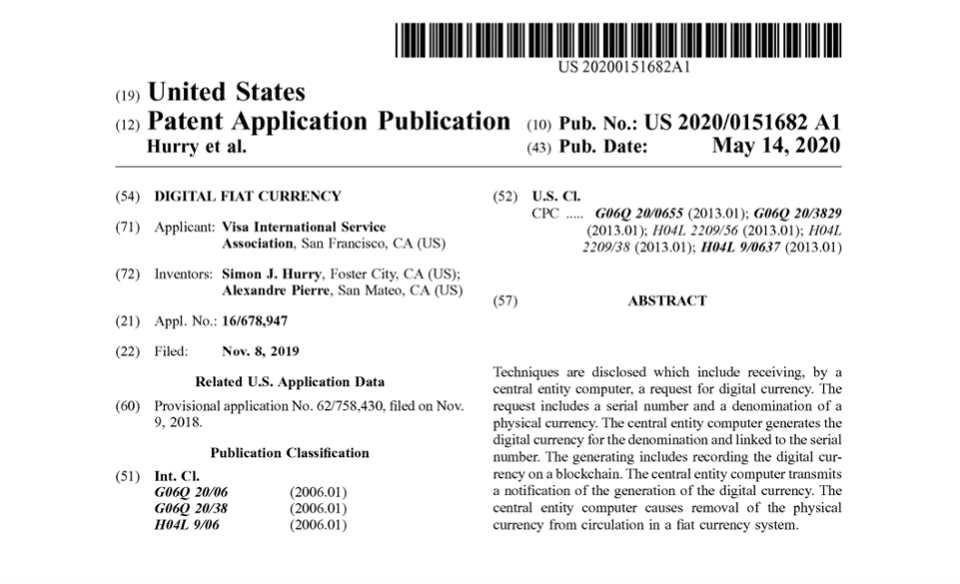

Filed as “Digital Fiat Currency,” the patent was first initiated in November 2019.

The U.S. Patent Office (USPTO) commented such issuances take “quite a while” to complete, considering the legal scrutiny and regulatory backlash over digital- and cryptocurrencies.

However, the patent does not necessarily mean a Visa-issued digital currency would be in the public’s hands soon. Forbes quoted a Visa spokesperson on this matter:

“While not all patents will result in new products or features, Visa respects intellectual property and we are actively working to protect our ecosystem, our innovations and the Visa brand.”

But J. Christopher Giancarlo differs. The former chairman of the U.S. Commodity Futures Trading Commission, compared the move to the pre-internet era, stating such partnerships between the private and public sector precede big developments.

“This patent filing is evidence the private sector is very much at work on the future of money,” noted Giancarlo.

Diving into Visa’s Patent

Visa’s patent describes the use of a central computer that received unique serial numbers and denominations of a particular currency. Upon verification, a “digital currency” is issued and the “removal of the underlying fiat” is recorded on a blockchain.

The central computer then transmits a notification of the successful issuance of digital currency to all parties, including the payee, the received, and the relevant bank.

(A snapshot of the patent. Source: Forbes)

The patent was filed under the “Visa International Service Association,” in San Francisco, CA, with engineers Simon J. Hurry and Alexander Pierre credited as “inventors.” The patent further describes the workings of a digital wallet and a blockchain.

Previously, Visa has announced several announcements related to the use of blockchain technology for payment processing. In 2019, the firm even joined Facebook’s enterprising Libra Association, but eventually withdrew in October that year after citing legal issues.

But its cryptocurrency ambitions remain. In February 2020, crypto-bourse Coinbase said it partnered with Visa to issue a debit card, which while not based on blockchain, allowed the former’s users to spend their cryptocurrencies and via an instant crypto-to-fiat conversion during payments.