Web3 gaming: a 2023 industry overview

A new report from the Blockchain Gaming Alliance reveals an optimistic future for the web3 gaming industry and a concerning gender imbalance among players.

On Dec. 13, 2023, the Blockchain Gaming Alliance (BGA) shared its annual State of the Industry Report with crypto.news. It is an online survey designed to put a finger on the pulse of the fledgling blockchain gaming sector.

While the report delved into many areas, key takeaways included nearly 80% of respondents sharing their belief that they will continue in the industry over the next year. It also revealed a worrying statistic: females made up only 16.9% of participants in the sector.

The BGA report also showed that over 76% of blockchain gamers recognized asset ownership as a top benefit of web3 games. In comparison, nearly 38% predicted that traditional web2 game studios would drive the industry forward. A further 52.1% said they expected at least 20% of the gaming industry to adopt blockchain in some form.

In terms of challenges, more than half of the respondents in the BGA survey mentioned onboarding as the main issue affecting the industry. 70% pointed to the pervasive misconception of blockchain gaming as a scam, while about 35% indicated user acquisition as a pressing challenge.

Even amid the crypto market downturn of the last two years, web3 games recorded nearly 800,000 unique active wallets. However, those games still do not get as much attention from the broader gaming community as more mainstream titles such as GTA VI do, given the latter was announced roughly two weeks ago.

That said, web3 games are slowly gaining a foothold in the mainstream market, with companies like Square Enix and Ubisoft working on new blockchain games.

So, what does the sector have to offer? Let’s take a closer look at how it is evolving.

Web3 gaming investments overview: story so far

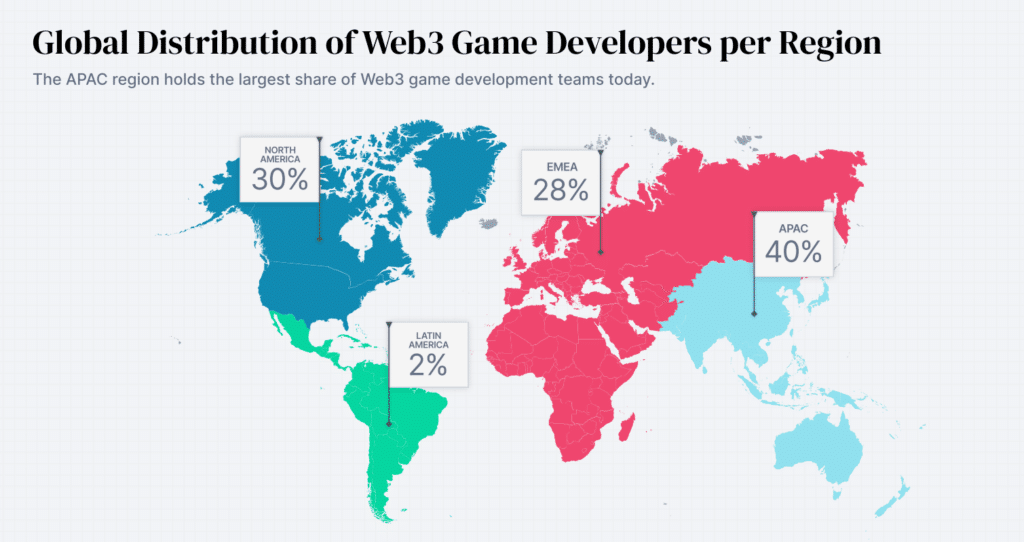

Based on another survey by Game7, web3 gaming projects have received over $19 billion in investments, with the Asia-Pacific region (APAC) at the forefront of blockchain gaming activities.

Game7’s research revealed in the first half of 2023, blockchain gaming projects got investments of about $1.5 billion, with $800 million going directly to web3 games. Investment in such gaming content surpassed the amount dedicated to infrastructure by $375 million during the said period.

However, the amount has dropped significantly compared to 2022’s $3.3 billion investment valuation.

Analysts consider the blockchain gaming market’s performance to be encouraging, but just like the global crypto market slump, it has taken a few hits.

2023 showcases market upturn

Game7 stated that web3 gaming funding in 2023 has remained stable, comparable to the levels in 2021, before the bull market. Over the past few years, investors have focused on developing gaming content rather than infrastructure.

In 2022, the blockchain gaming industry reached a valuation of $4.6 billion. The first quarter of 2023 witnessed a significant upward trend in this industry, with a remarkable growth rate of 45.60%. It indicates that blockchain games continuously advanced and captivated users and investors despite the broader market enduring a prolonged crypto winter.

Data from DappRadar, quoted in BGA’s State of the Industry Report, shows that web3 gaming projects in Q2 2023 saw approximately $973 million in investments, a 31% increase from Q1.

In Q3 2023, blockchain gaming projects collected $600 million, a 60% drop from the previous quarter. By the end of August, the total investments made in web3 gaming reached $2.3 billion, equating to just 30% of the totals reached last year, according to DappRadar.

Further, DappRadar data shared in the BGA report also indicated a slight decline in people playing web3 games. According to the numbers, there were about 2.2 million monthly active blockchain game users in 2023, down from an average of 2.6 million in 2022.

However, the report suggested that many companies in the space were using the downtime to create game-enhancing solutions they hoped would improve onboarding and overall playing experiences.

Geographical distribution of web3 gaming investments and developers

Game7’s report highlighted the amounts of investments received per region, with the USA dominating the funding activities with about $4.2 billion, followed by France with $0.9 billion, Canada ($0.68 billion), Singapore ($0.67 billion), Hong Kong ($0.66 billion), Australia ( $0.36 billion), with others like UK and Germany following suit.

Funding trends have been notably influenced by the rise of sports and metaverse-related massive multiplayer online (MMO) titles. Since 2018, sports web3 gaming projects received about $1 billion, MMOs $989 million, role-playing games $728 million, and action $341 million.

In 2023, approximately 30% of newly formed web3 gaming teams originated from the United States. However, South Korea also saw a significant increase, accounting for 27%, nearly doubling its contribution compared to the previous year.

In the BGA survey, the most significant respondents hailed from Europe (38.8%) and Asia (29.1%), placing the regions as the largest hot zones for web3 gaming activities.

However, the survey also revealed that movement away from web2 and into web3 is significantly echoed in Asia, where gaming companies are capitalizing on their established IPs and market influence to delve into the possibilities offered by blockchain and NFTs.

Asia looks to improve web3 gaming with new titles

Per the BGA report, in Asia, Vietnam, home to Axie Infinity’s developers Sky Mavis, leads the way in web3 game developments. At the same time, the Philippines holds the topmost position among countries spearheading the adoption of blockchain games.

The report also indicated that India’s 500 million-strong gaming community is warming up to blockchain gaming.

Elsewhere, Japan has pushed itself into the forefront of web3 game developments, triggered by its Prime Minister Fumio Kishida’s recent comments that web3 is the “new form of capitalism.”

Square Enix, a Japanese-based game startup renowned for smash hits like “Final Fantasy” and “Sleeping Dogs,” has openly expressed its interest in blockchain games as a growth strategy for the mid-to-long term. The company is developing “Symbiogenesis,” a unique NFT game built upon 10,000 NFTs and slated to be released on the Polygon blockchain.

Oasys, a rising Japanese-based blockchain gaming company established in 2021, has swiftly gained a loyal fanbase and secured funding of over $5 million from investors, including prominent blockchain venture capital firms and seasoned game industry veterans.

The startup has launched a Closed Alpha version of the game dubbed “Defend the Kingdoms,” a highly anticipated play-to-earn strategy game on the Immutable network. This immersive game, which garnered over 50K pre-registration, aims to give players a unique and engaging experience where their decisions shape the outcome.

Another interesting tidbit from the BGA report is the emergence of the Middle East and North Africa (MENA) region as a destination for blockchain game developers. Per the report, the region, which represented 5% of respondents, has come into its own following improved regulatory clarity regarding crypto in places such as the United Arab Emirates (UAE) and more investment being channeled into web3.

In 2022, Dubai, one of the cities making up the UAE, pledged $4 billion to metaverse development over five years. Through its special economic zone in Neom, Saudi Arabia also put $50 million into Hong Kong-based blockchain games developer Animoca Brands to create a web3 services hub in the Middle Eastern country.

Which is the most popular blockchain gaming network?

Per Game7’s research, 2023 saw the highest numbers in terms of game migrations between networks since the dawn of web3 games. The tally reached 65, a 35% increase from 2022, showcasing a significant growth in interoperability among gaming blockchains.

Polygon (MATIC), Immutable (IMX), and Arbitrum (ARB) received the most web3 games from other blockchains, while Oasys and Ethereum received the lowest. Also, according to the research, 57% of games that left layer-1 (L1 )blockchains migrated to layer-2 (L2) solutions, 41% chose another L1, and 2% moved to L3 networks.

Moreover, most web3 games have migrated to blockchain networks with Ethereum Virtual Machine (EVM) services, with 68% choosing to move from non-EVM to EVM networks.

Polygon remains the most popular web3 games host in 2023, with over 250 titles leveraging the sidechain, closely followed by Binance Chain (BNB) and Ethereum (ETH).

According to the BGA, several blockchains, including BNB, Solana (SOL), Hive, Ronin (RON), WAX, Avalanche (AVAX), Immutable, and Tezos (XTZ), all saw reduced game activity.

The most affected among the blockchains was Hive, which registered a 75% drop in gaming activity in the last year. Solana was just as badly affected, shedding off more than 69% of blockchain gaming activity, while BNB and Ronin each saw reductions by 47.6% and 40.9%, respectively.

The report pointed out that the drop in gaming activity on the networks was a “sign of innovation,” with wallet activity and transactions shifting to networks such as ZkSync, which users felt had better utility, ease of use, and newer gaming projects.

More than 76% of respondents to BGA’s 2023 survey also consider asset ownership, which includes digital assets like NFTs, as their most significant source of income.

“Blockchain gaming is not merely an evolution of entertainment but a revolution in digital asset ownership and value creation. Beyond the interactive experiences, blockchain gaming positions itself at the confluence of creativity, economy, and technology. It grants players true ownership of their in-game assets, fosters decentralized communities, and can even pave the way for novel economic models that empower and reward both developers and players.”

Tim Dierckxsens, Venly CEO

After asset ownership follows new revenue models, which was third in the list back in 2022, alternating positions with player reward models; however, the two in the list varied by region, as respondents from Asia and Latin America valued player rewards more than new revenue models.

Web3 game developers’ preferred blockchain frameworks

The general definition of a blockchain framework is a set of tools used to create a fundamental structure that enables the development of software applications in a structured and efficient manner.

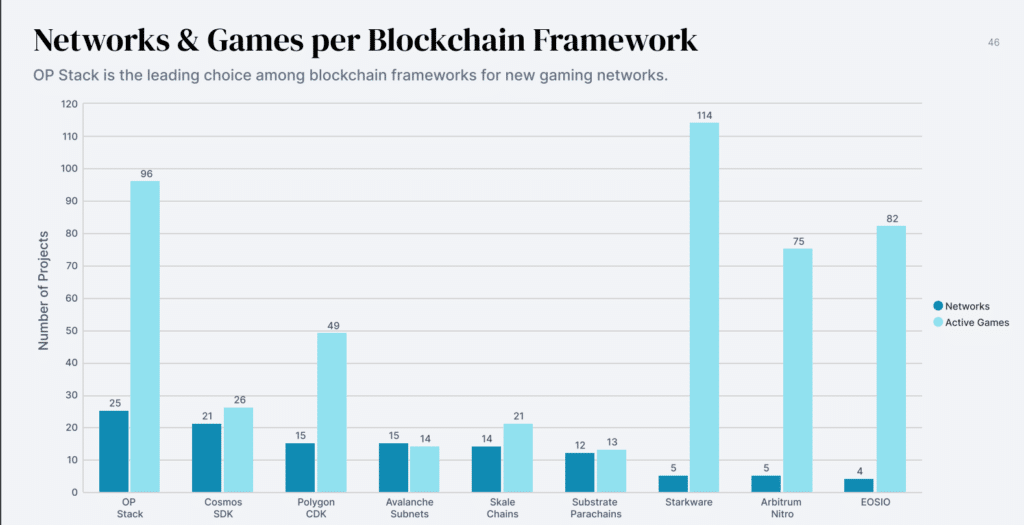

Regarding game development, most creators lean towards open-source networks, like Unreal Engine, to help them create games of different genres across several networks. It is evident in the study Game7 conducted, where new games used blockchain networks with Optimism’s OP Stack framework the most.

The OP Stack is an open-source development framework for the Ethereum and Optimism ecosystems. Developed and maintained by the Optimism project, this standardized stack powers Optimism by providing comprehensive software components.

The vision behind the OP Stack is to foster innovation within the Ethereum community, offering a user-friendly platform that empowers developers to focus on cutting-edge advancements and simplifies the process of creating their blockchains.

However, regarding the number of projects developed in a blockchain framework, StarkWare carried the year. the company’s dominance, according to Game7, was primarily driven by the number of projects leveraging two networks using its framework model, Immutable X and WAX.

Major hurdles in web3 gaming adoption

As major web2 entities look to make the transition to web3, the migration process has been everything but smooth. BGA’s report noted the most significant problem these entities face is the perception most people have of cryptocurrencies.

According to the survey, crypto is highly affiliated with the dark web and illegal activities, scaring away big players in the gaming industry.

“Despite highly publicized legal actions against crypto companies over the last year and relentless negative press in mainstream media (mostly oblivious to the fact that the fraud has taken place almost entirely in traditional intermediary structures), blockchain game developers continue to build, and the core user group continues to grow. User ownership is the future, and blockchain games are not going away.”

David Hoppe, Gamma Law Founder and Managing Partner

The second largest hurdle from the report is poor gameplay, which is rather harsh, given how young the blockchain gaming niche is. 37% of respondents believe web3 games could be better developed.

Most gamers are comparing the gameplay of web2 titles, which have decades of development experience and consistently good results, to the slowly growing web3 gaming industry.

The BGA believes the industry will grow exponentially if web2 game developers embrace blockchain technology in games while adding staff composed of individuals adept in web3 technology.

Looking ahead

According to a Coingecko study, out of 2,817 web3 games launched in the past five years, a staggering 2,127 games, accounting for 75.5%, have fallen out of favor with the market. This alarming statistic becomes even more pertinent considering the average annual failure rate of 80.8% from 2018 to 2023, highlighting the significant instability the web3 gaming industry faces.

About 70% of blockchain games released this year have failed, which is surprising given the amount of investments poured into the industry. Whether 2024 will become a better year for these gaming ventures remains to be seen, but if the likes of Sony, Sega, and Square Enix launch web3 games, the community might turn its critical eyes toward the niche.

The BGA predicts a likely shift to web3 by traditional web2 gaming publishers, especially in the realm of mobile and multiplayer games. The Alliance expects that an influx of web2 studios into blockchain gaming will likely help improve web3 games’ UI and UX, areas that have been major sticking points for blockchain gamers.

In its report, the Alliance also predicted artificial intelligence will play a more prominent role in blockchain gaming in 2024. Furthermore, it expects a blockchain game will finally be good enough to create a domino effect that will shift public opinion regarding web3 games.