Whales respond to Ripple’s $285m buy-back plan: XRP price rally imminent?

XRP price is consolidating at $0.60 as of Jan. 12, up 12% within the daily timeframe, but whale investors’ reaction to Ripple Lab’s recent buy-back signals more upside.

XRP reclaimed the $0.62 territory in the late hours of Jan. 10. The price rally came after the Ripple team unveiled plans to buy back $285 million worth of the parent company’s shares at a valuation of $11 billion.

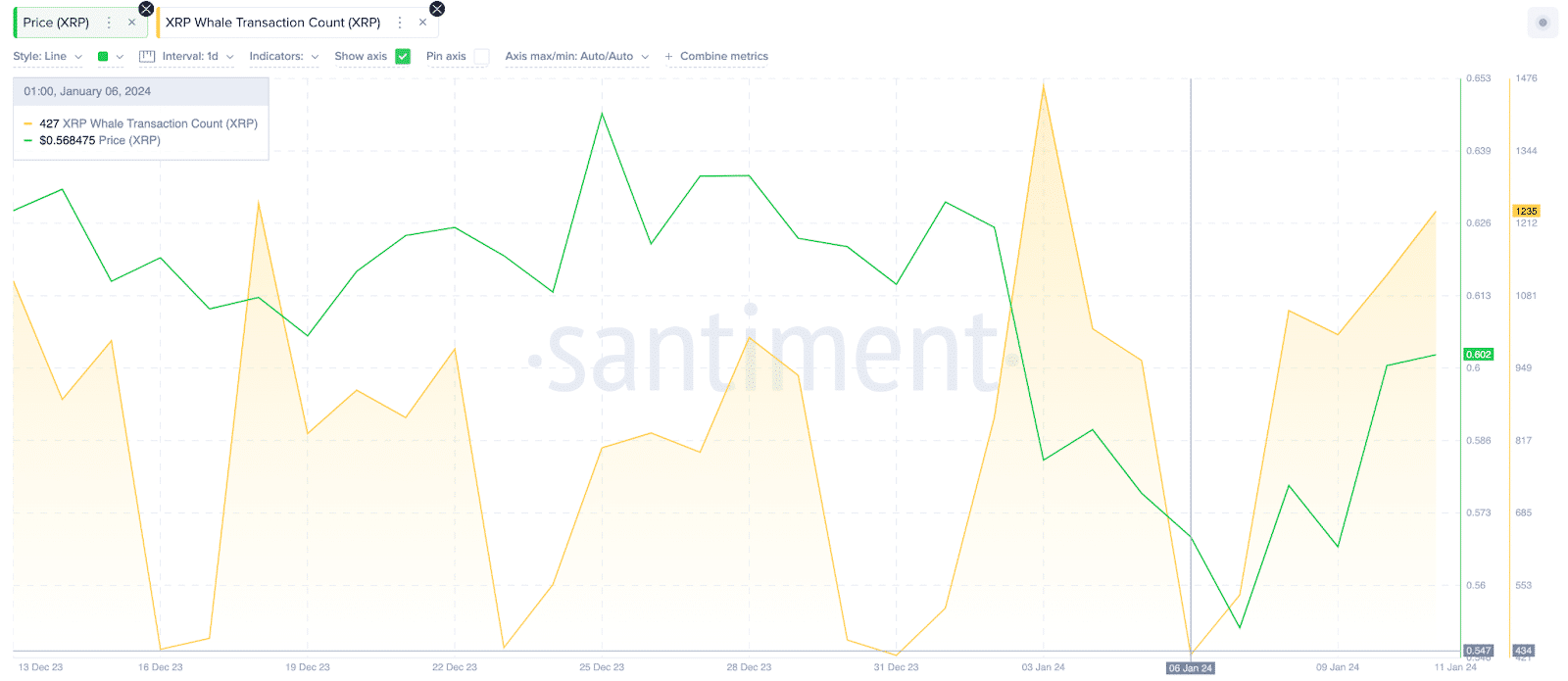

On-chain data reveals a steady growth in the spate of whale transactions on the XRP ledger network since the buy-back was announced on Jan. 10.

XRP whales hit 2024 second-highest transactions

XRP price has delivered a substantial growth performance this week, scoring a 10% growth performance between Jan. 7 and Jan. 12. The rally has been partly attributed to the significant buy-back plans revealed by the sixth largest cryptocurrency’s parent company, Ripple Labs.

Initial market reaction to the news of Ripple’s buy-back plans saw XRP price reclaim the $0.61 mark for the first time since the widespread liquidations that rocked the crypto markets on Jan. 3.

Looking beyond the price charts, on-chain movements from whale investors in response to the buy-back news signals that more upside could follow.

Santiment’s whale transaction count metric tracks real-time changes in whale investors’ trading activity by aggregating the number of confirmed transactions that exceed $100,000 daily.

The latest reading shows that the XRP ledger network recorded 1,235 Whale transactions on Jan. 11, up 190% from the 427 recorded on Jan. 6. Notably, the Jan. 11 figure represents the second-highest whale transaction count for 2024, behind the 1,462 recorded on Jan. 3.

By tracking transactions exceeding $100,000, the whale transaction count metric effectively serves as a proxy for measuring the dominant sentiment among institutional and high-net-worth investors on a blockchain network.

When there’s a sharp increase in the Whale Transaction count, strategic investors often interpret it as a bullish signal.

Firstly, it affirms a positive sentiment and high demand for XRP among whale investors in the aftermath of the buy-back news.

If the whales sustain the buying pressure, it’s only a matter of time before strategic retail traders begin to mirror their trades. This scenario could propel the XRP price toward the $0.70 milestone.

XRP Price Prediction: the $0.70 target in firm focus

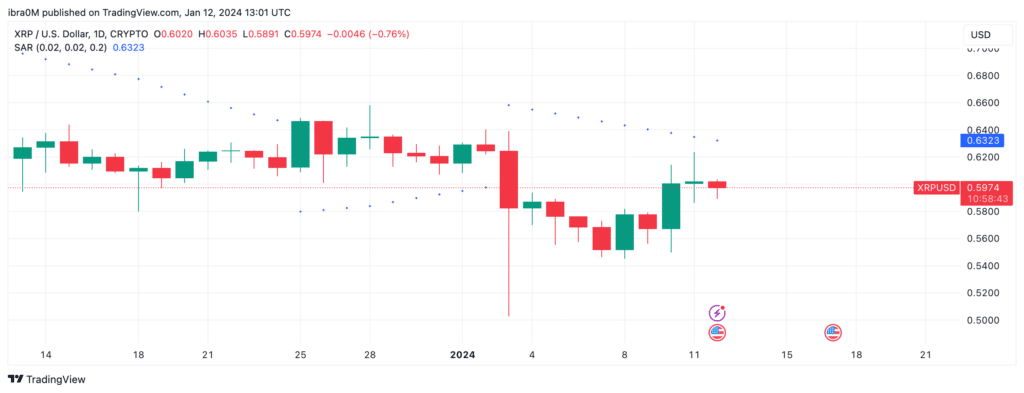

Considering that XRP price recently breached the $0.62 territory on Jan. 11, the bulls could set their sights higher on an ambitious $0.70 retest on the next rally.

The parabolic stop and reverse (SAR), a technical indicator to identify potential reversal points, also validates this bullish XRP price prediction. When an asset is trading below the parabolic SAR indicator, it typically suggests a bullish trend in the market.

At the time of writing on Jan. 12, XRP is trading at $0.59, which is well below the Parabolic SAR dots, pointing toward $0.63. A decisive breakout from that short-term resistance could trigger a major price breakout

Hence, if traders capitalized on these signals to buy more, XRP could soar towards $0.70, as predicted.

Conversely, the bears could invalidate that prediction if they successfully force a downswing below $0.50. However, the bulls will likely mount a major buy wall around the psychological support zone at $0.55. If that support territory holds firm, it could trigger an early rebound.