What happened to the Chinese authorities’ 190k Bitcoins?

Chinese journalist Colin Wu released an investigation into PlusToken, one of the largest cryptocurrency Ponzi schemes in history.

Table of Contents

According to the journalist, the Chinese authorities have confiscated a large number of digital assets. The PlusToken team, led by a middle school educated man from Changsha, raised 310,000 Bitcoin (BTC), 9.17 million Ethereum (ETH), and over 51 million EOS using a simple Ponzi scheme and pyramid scheme model. Chinese police confiscated 190,000 BTC, 830,000 ETH, and 27.24 million EOS.

“A man from Changsha, Hunan, with only a middle school education, raised 310,000 bitcoins; 9.17 million ethers; more than 51 million EOS, etc. Its model was a straightforward Ponzi scheme + pyramid scheme, raising funds and promising interest, with development of both upstream and downstream lines.”

Colin Wu, journalist

According to Wu, some confiscated cryptocurrency was sold through Beijing Zhifan Technology, similar to the American Chainalysis company. However, what happened to the remaining assets remains unclear.

Wu and another source, Jiang Zhuoer, claim that most confiscated BTC were sold between late 2019 and mid-2020 when BTC prices fluctuated between $7,000 and $12,000.

However, the fate of the rest of the assets remains unknown. Overseas analysts tracking PlusToken addresses believe that while most Bitcoins have been sold through the Huobi platform, about 15,000 BTC may still need to be sold. Additionally, they assume that the Ethereum addresses have stayed the same.

The journalist noted that there may be a discrepancy between the addresses identified by the police and the addresses recorded by foreign observers. He also notes that police are still tracing some addresses.

What is known about PlusToken

In 2019, users of the PlusToken cryptocurrency wallet lost $3 billion after the project leaders fled with their funds. The platform was launched in 2018 and promoted as a decentralized international project developed by a team from South Korea. PlusToken was aimed at Asian and European countries.

PlusToken investors were offered guaranteed monthly payments from 6% to 19% and bonuses for attracting new participants. The company planned to register 10 million users by the end of 2019, although the stated number of participants was 3 million people.

Investigation

In March 2019, police in the southern province of Hunan initiated an investigation into the PlusToken Ponzi scheme. Since then, the head of the Chinese division, Chen Bo, and five other Chinese citizens associated with the project have been on the run.

Several months after the platform was suspended, Primitive Ventures Managing Partner Dovey Wan reported that Chinese police were able to apprehend critical suspects in the PlusToken case.

At the same time, the auditing firm Peckshield reported that funds from wallets totaling about 1,000 BTC began flowing to the Bittrex and Huobi exchanges in early July.

Also, rumors among Chinese traders spread that someone allegedly associated with PlusToken was constantly leaking 100 BTC to the Binance exchange.

In July 2020, Chinese police detained 27 main suspects and 82 key participants in the PlusToken cryptocurrency pyramid scheme.

Dovey Wan confirmed information about the arrest of PlusToken organizers. She explained that they had been wanted for 12 months. Such a lengthy search can be explained by the fact that the key participants in the pyramid dispersed to different countries, complicating the search efforts.

First sales of confiscated assets

In November 2020, it became known that Chinese authorities had seized $4.2 billion worth of cryptocurrency from the PlusToken financial pyramid. The government will sell it and send the profits to the state treasury.

At that time, it was reported that the government seized the following coins: 195,000 BTC, 833,000 ETH, 1.4 million LTC, 27.6 million EOS, 74,000 DASH, 487 million XRP, 6 billion DOGE, 80,000 BCH, and 214,000 USDT.

Cryptocurrency landscape in China

China has long been the flagship and driving force of the cryptocurrency industry. In mining, it competed equally with the rest of the world, supplying a significant share of the total hashrate of the leading coin networks. Mass production of mining equipment was also established there. But everything changed in 2021 when the People’s Bank of China declared any cryptocurrency-related activity illegal.

The websites of crypto exchanges and many internet resources dedicated to cryptocurrencies were banned. Moreover, the regulator explicitly acknowledged, to avoid ambiguity, that stablecoins from Tether, Bitcoin, and Ethereum are not fiat currencies. A few years earlier, in 2017, Chinese officials successfully banned ICOs, explaining that companies conducting ICOs may violate financial regulations.

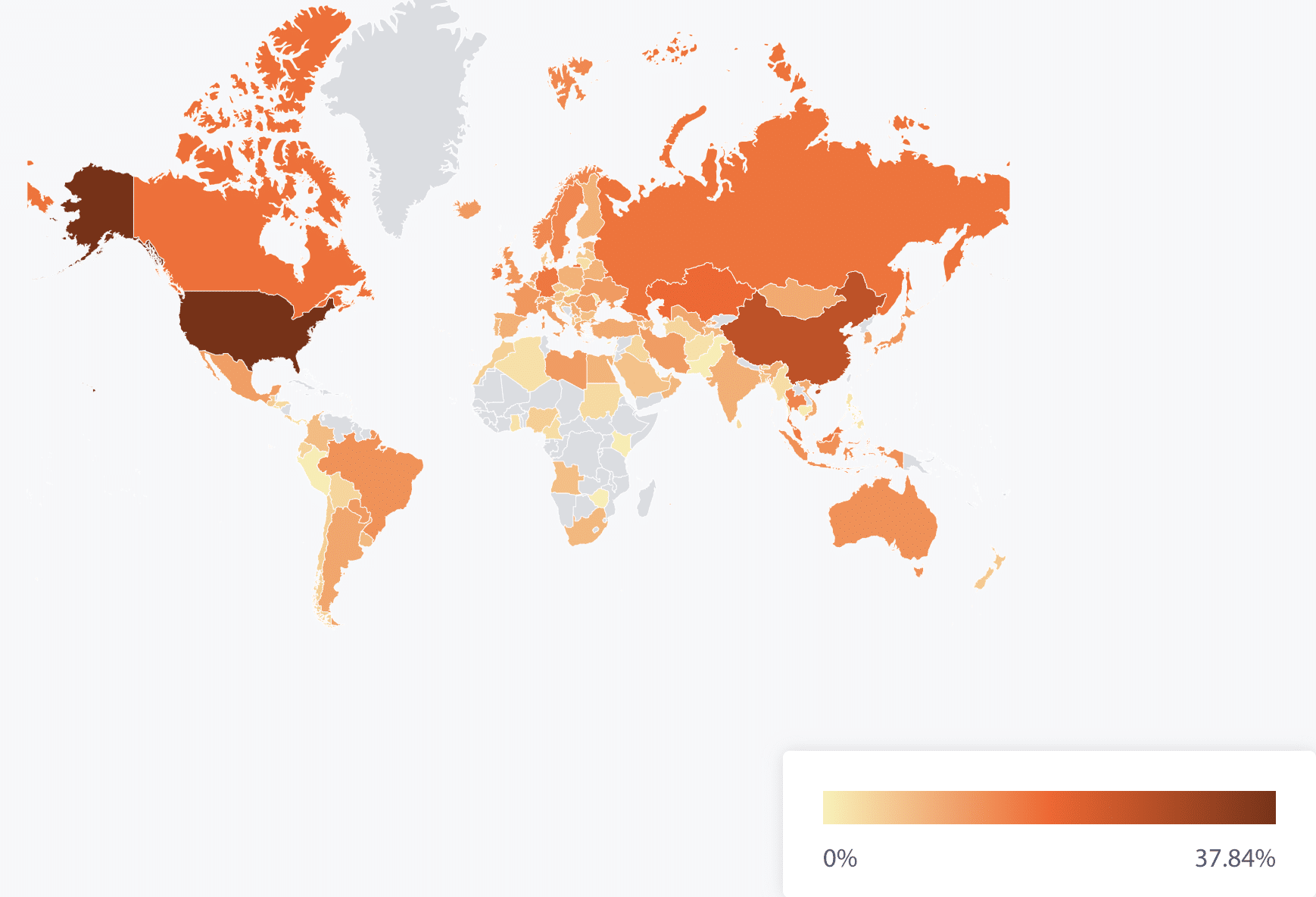

However, according to current data provided by CCAF experts, the share of mainland China in the world hashrate is 21.11%. That is, only 10% less than the June 2021 figures. And this is despite the complete ban of cryptocurrency mining.

The largest companies producing mining equipment are also located in China. First, these are Bitmain and the Antminer series devices, as well as MicroBT from WhatsMiner and miners from Innosilicon, AGM, Canaan, and Ebang.

Thus, despite all the current bans, China remains one of the most critical players in cryptocurrencies, albeit pretending to be an invisible shadow.