What is proof-of-stake (PoS)?

Proof-of-stake works through the concept of staking, which means locking up your tokens into a smart contract on the blockchain. In return, you become a validator to verify transactions and earn rewards. Here is everything you need to know about how PoS works and how it differs from other consensus mechanisms like proof-of-work.

Proof-of-stake consensus mechanism explained

In September 2022, the Ethereum blockchain shifted from a proof-of-work to a proof-of-stake consensus. The transition, popularly called “The Merge,” has elicited interest in the proof-of-stake (PoS) consensus mechanism.

Proof-of-stake (PoS) systems change how blockchain nodes achieve consensus, contributing to network security. In a PoS blockchain network, nodes stake a certain number of tokens to gain the chance to create the next block of transactions. The chosen node, also known as a validator, receives block rewards paid in the network’s native token, for example, ether for Ethereum.

A distinguishing characteristic of blockchain networks and cryptocurrencies is their decentralization. This means there are no financial institutions or entities in charge of maintaining a blockchain’s transaction and data records. Instead, the network uses a consensus mechanism, which is a set of rules that allows nodes, or network participants, to agree on the validity of transactions. These transactions are then added to the blockchain as new blocks.

The consensus mechanism is essential in determining which transactions are valid or invalid. The two most common consensus mechanisms used by blockchain networks are proof-of-work and proof-of-stake.

In the PoS consensus mechanism, token holders lock a set number of crypto tokens in a smart contract on the blockchain as collateral. This process is known as staking. In return, they are given the opportunity to validate new transactions and earn rewards, which are typically paid in the network’s native token.

Those who stake a certain amount of tokens become validators. Validators are then randomly chosen by the network to validate blocks and earn rewards. Unlike the proof-of-work mechanism, where participants compete, the proof-of-stake mechanism selects validators randomly. Still, the selection is influenced by the amount of stake, the length of time the tokens have been staked, and other factors. This process reduces energy consumption and increases efficiency, making it a popular choice for many newer blockchains.

How does proof-of-stake work?

Proof-of-stake works through the concept of staking, where token holders can lock up a set number of tokens in the network’s smart contract and become validator nodes. Staking is essentially locking up a particular amount of your tokens into a smart contract held on the blockchain. In return, you become a validator to verify transactions and earn rewards.

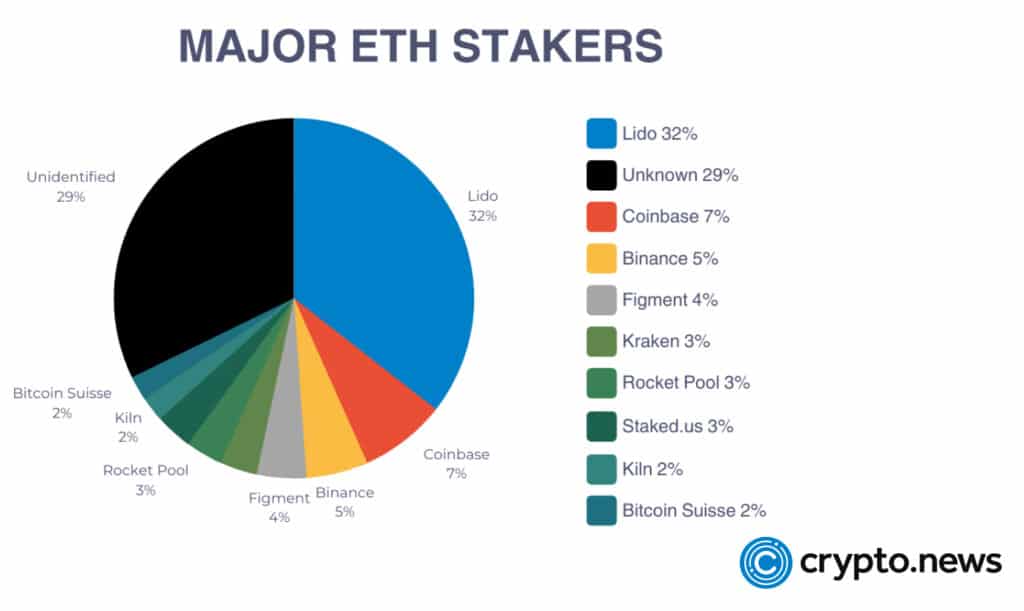

Staking is the foundation of becoming a validator in a PoS blockchain network. The minimum amount that has to be staked for one to become a validator on the Ethereum blockchain is 32 ETH. Blocks are usually validated by more than one validator, and it’s finalized and closed when a particular number of validators certify that the block is accurate.

While the blockchain algorithm selects validators at random, validators with large amounts of staked tokens have a higher probability of being chosen than validators with a lower amount. Validators earn transaction fees as a reward for accurately validating transactions and adding blocks to the blockchain. The reward is usually in proportion to the size of the stake.

Two commonly used methods for randomly selecting validators employed by PoS networks are Randomized Block Selection and Coin Age Selection. In Randomized Block Selection, validators are selected by checking for users with a combination of the lowest hash value and the highest stakes. In the Coin Age Selection method, validators are selected based on how long they have staked their tokens. Most PoS tokens usually combine the two aforementioned methods.

To prevent validators from engaging in duplicitous activities such as verifying fraudulent or inaccurate transactions, they are punished by “slashing,” where the validators lose some of their staked tokens. In slushing, the staked tokens are “burned” – a process that involves sending them to an unusable wallet address where they cannot be accessed by anyone and removed from circulation forever.

Proof-of-stake benefits and drawbacks

Proof-of-stake has its fair share of benefits and drawbacks, as discussed below:

Pros of PoS

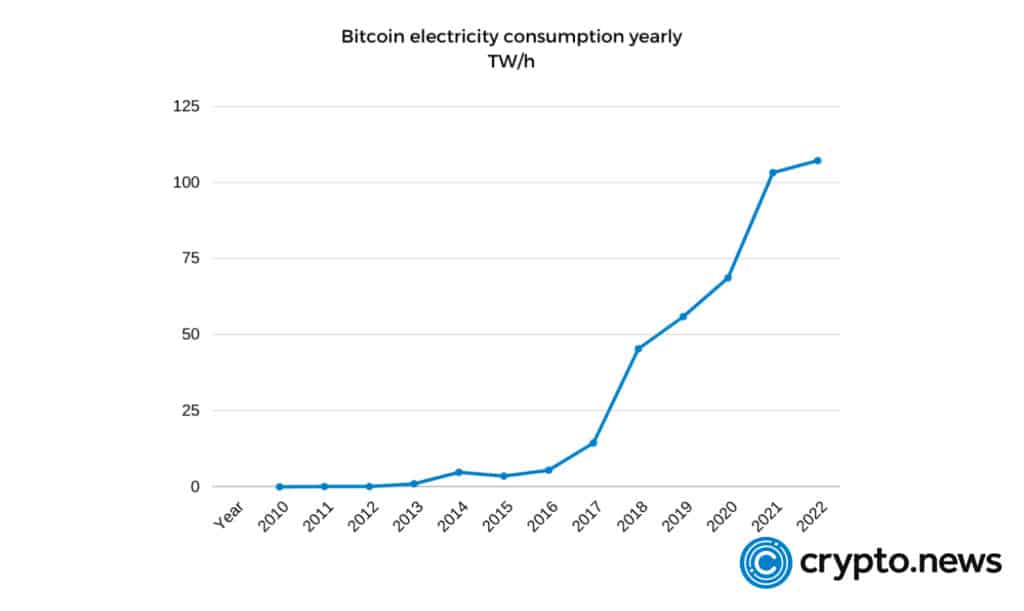

PoW blockchain networks such as Bitcoin require significant computational power and energy consumption. This has raised environmental concerns in recent years. PoS, with its lower energy requirements, offers a potentially more sustainable alternative.

The extensive energy use needed to mine PoW cryptocurrencies can affect both the profitability and geographical distribution of mining. PoW mining tends to be profitable in regions with lower energy costs, which inadvertently leads to a sort of centralization of crypto mining in areas with abundant, low-cost electricity.

In contrast, PoS’s minimal energy consumption democratizes crypto mining. Its nodes are widely distributed, contributing to a more secure and robust blockchain system. In PoS, you don’t need to buy expensive mining equipment or spend a lot on electricity, which can vary in cost depending on location. Instead, you only need to stake a certain amount of coins to become a validator.

Another advantage of PoS networks is their scalability. Unlike PoW networks, PoS blockchains can potentially handle a higher volume of simultaneous transactions without compromising on decentralization and security.

Some benefits of proof-of-stake include the following:

- Open to everyone thanks to lower barriers to entry and reduced hardware requirements.

- Reduced centralization risk considering that staking is more decentralized with numerous nodes securing the network.

- Harsh economic penalties for engaging in fraudulent activities on the network make it more secure.

- Greater crypto-economic security compared to proof-of-work consensus.

- In case of a 51% attack, the network can undergo a social recovery.

Cons of PoS

One of the big disadvantages of proof-of-stake consensus is its susceptibility to security attacks that compromise the overall security of the blockchain network. In PoS, if someone controls 51% of the circulating tokens, they could manipulate transaction validation. This scenario is less complex than executing a 51% attack on a PoW network, which requires control over 51% of the network’s computational power.

PoS is also a fairly new consensus mechanism, therefore, has not been extensively vetted as PoW, which has secured billion-dollar blockchains for over ten years. Some of the drawbacks of PoS networks include:

- Validators holding a substantial amount of cryptocurrency are more likely to be chosen to forge new blocks and earn rewards. This system may concentrate power among a few leading validators. It could risk the network’s security and decentralization and perpetuate wealth disparity.

- The network’s safety in PoS hinges on the amount of cryptocurrency that validators possess. If many validators were to conspire, the network could be more susceptible to attacks.

- Nothing-at-stake issue: A theoretical weakness in PoS networks is the “nothing-at-stake” problem, where validators have little to lose by producing multiple versions of the blockchain. This situation could compromise network consensus and security if one version becomes the “accepted” version.

Proof-of-work vs. proof-of-stake

PoW and PoS share common grounds, but they diverge significantly in their operations. In PoS, participants, also called validators, lock up a certain quantity of their tokens in the network. This act, known as “staking,” gives them a chance to be chosen to validate new blocks and earn rewards. This selection process is partially random, with the validators’ stake and a particular value, known as the hash value, influencing their chances.

On the other hand, in PoW networks, validators, commonly known as miners, compete to solve complex mathematical problems to earn the right to validate transactions. Unlike in PoS, where validators earn transaction fees and not newly created tokens, miners in PoW networks receive block rewards in the form of newly minted coins.

In general, all tokens in PoS networks are introduced during the network’s launch, so no new coins are created as rewards. Conversely, PoW networks generate new coins as rewards for miners. The table below illustrates the key differences between the proof-of-stake and proof-of-work consensus mechanisms.

| Proof-of-Stake | Proof-of-Work |

| Block creators are called validators | Block creators are called miners |

| Staking is necessary for a network participant to become a validator | One needs sophisticated mining equipment and a constant supply of energy to become a miner |

| Energy efficient | Highly energy intensive |

| Better scalability capabilities | Limited in terms of scalability |

| Vulnerable to security attacks such as 51% attacks-network is secured by the value of tokens | Network is secured by computing power |

| Validators receive transactions fees as rewards | Miners receive block rewards |

Notable proof-of-stake cryptocurrencies

PoS is increasingly becoming common in the crypto space. Some of the most popular coins using proof-of-stake include:

- Cardano (ADA)

- Solana (SOL)

- Polygon (MATIC)

- Toncoin (TON)

- Algorand (ALGO)

The bottom line

Proof-of-stake (PoS) is a consensus mechanism used by blockchain networks to validate crypto transactions. It was first suggested in a 2011 forum post to rectify the perceived flaws of Bitcoin’s proof-of-work (PoW) notably excessive energy consumption, which is detrimental to the environment. Peercoin became the first digital currency to use PoS in 2012. The consensus mechanism has immensely grown since its launch to harbor some of the largest and fastest-growing cryptocurrencies.

Whether PoS is better than PoW is a subject still under intense debate among crypto enthusiasts. However, its lower energy demands and greater accessibility for anyone to participate in the network as validators make it an ideal cryptocurrency to spur blockchain technology growth.

What is proof-of-work?

Proof-of-work is the process of using computing power to authenticate transactions on distributed ledgers like Bitcoin and Ethereum. The process is called “Proof-of-work” because it requires participants to solve complex mathematical equations, similar to what miners do mining gold. This consensus algorithm prevents malicious actors from tampering with transaction records and ensures security against 51% of attacks.

What is crypto staking?

Staking is a feature of some cryptocurrencies that enables users to earn rewards for holding cryptocurrency wallets. These rewards vary among projects, ranging from a fixed amount per wallet to a percentage based on the total number of coins. The concept was first introduced the concept in 2014 by Ethereum, offering daily rewards.

What is proof-of-stake?

Proof-of-stake (PoS) is a consensus algorithm used in blockchain networks. Instead of miners competing to solve complex equations as in proof-of-work, in a PoS blockchain network, nodes stake a certain number of tokens to gain the chance to create the next block of transactions. The more tokens staked, the higher the chance of being chosen to validate a new block of transactions. Validators earn rewards, usually transaction fees, for their work. PoS is viewed as less energy-consuming than PoW, making it an environmentally friendly alternative.

Is Bitcoin a proof-of-stake?

No, Bitcoin is not a proof-of-stake (PoS) cryptocurrency. Bitcoin uses a consensus algorithm called proof-of-work (PoW), where miners solve complex mathematical problems to validate transactions and create new blocks. PoS is a different method used by other major cryptocurrencies like Ethereum, Cardano, and Solana. These PoS cryptocurrencies choose validators based on the amount of cryptocurrency they are willing to stake rather than using computational power as Bitcoin does.