Why Crypto Has always Needed a Bitcoin Bank

The political aspects of the pioneer cryptocurrency bitcoin also came with a bag of aesthetic values. Anarchist literature, Occupy Wall Street sentiments, and the tearing down of the big banks propelled Satoshi Nakamoto’s innovation back in 2009.

Now, many of the catchphrases of this seemingly bygone era are still in circulation. But, as many ICOs have propped up their very own money-printing presses, can spectators continue to describe the sector as anti-finance?

Money Is Money, Digital or Not

The rise of the ICO and the subsequent hiring of marketers, developers, and community managers meant that these projects also had a payroll. To fulfill these obligations, some startups offered payment in the business’ native token, much like providing employees shares in a nascent startup during the dot-com boom.

Of course, some agreed, others denied, and a handful of different arrangements were made to align incentives. More importantly, this usually worked fine for all parties involved. These costs could be converted and covered smoothly as the funds changing hands weren’t astronomical.

Plus, it provided a convenient entry into the world of speculation and current on- and off-ramps for traditional marketers, for instance, moving into this exciting space.

Things are much different, however, when dealing with the sums typically raked in by a successful ICO. Twenty, thirty, and forty million dollar offerings have since become the norm and also the main attractor to lancing such a variety of fundraising mechanism.

But what happens when that multi-million dollar sum in December 2017 turns into something far less inspiring in seven months later? Employees will likely still be paid their salaries, but company roadmaps may be put on hold until the next bull run.

Spent the morning with an ICO (not to be named) they raised $30m usd with a solid roadmap, they raised when ETH was $1200. They panicked and sold their remaining ETH last night – they have $4m left.

— Ran NeuNer (@cryptomanran) August 8, 2018

Quickly, a tricky paradox arrives when working in a tokenized economy. The fast-moving volatility is both attractive and hype-driven but can sting on the way down for startups looking to hang around five years down the line. Just embracing the massive spikes in value has been one smooth response, while others have resorted to a quick liquidation post-funding rounds.

Still, there is another option: A crypto bank.

How to Sell Banking to People who Hate Banks

The rise of banking infrastructure, at least to the extent that we can imagine banking, seemed like a natural step in the finance-frenzy surrounding digital currencies. As mentioned above, the advantages of having a secure place to store value following an ICO is more than convenient.

After that services like lending, earning interest, and providing liquidity also become necessary. The only problem is trying to convince folks that the bitcoin-bank-in-your-pocket ethos is no longer valid. As such, a productive group of banks meant to serve these purposes has emerged. Challenger banks like N26 and Fidor in Germany are one faction of this business sector, but other startups like Celsius, Blockfi, NEXO, ETHLend, and SALT have all taken up arms to fill this niche.

Even before these crypto banks, BTCJam and Bitcointalk provided valuable lending opportunities for participants. In recounting the history of credit and Crypto, aaiono explained in a Medium post the services offered by the first p2p lending platform that used bitcoin exclusively:

“Without FICO, banks, or even institutional money to fund loans, BTCjam developed a product that was servicing US$1million in loans per month by June 2014, operating 100+ countries, with an investor platform average of 13% ROI, and a robust community.”

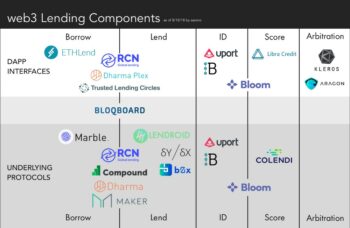

What emerges, according to aaiono, is a novel network only possible in a web3 marketplace. It is a massive process to move from identifying qualified borrowers, securing funds, providing interest on secured funds, and establishing a debt marketplace.

At the time of BTCJam, the infrastructure wasn’t nearly robust enough to handle such an operation. It wasn’t until the advent of the myriad dApps and variant protocols (made possible by technologies like Ethereum and 0x), individual firms can focus on one aspect of a much larger process.

(Source: Medium)

Quickly, we begin to see the power of interconnected dApps and an entirely different type of business model emerging. The only component missing is the wave of users.

How to Buy Your mom a House with Ether

Crypto-centric loan services like Celsius and ETHLend have also incorporated a native token to better facilitate operations. In the case of the former, they use the CEL token to provide five percent interest on holdings kept with Celsius, borrowing at nine percent, and even shorting the crypto market at large. All of these payouts are made in CEL thus increasing demand and adding a viable utility for the digital currency. Herein lies the companies primary ambition to bring “crypto to the people.”

(Source: Celsius)

Of course, primary clients for these kinds of services are those running a blockchain startup following a successful ICO.

In the case of Celsius, they raised $50 million in March 2018 to tackle the monstrous task of bringing 100 million people on board the crypto bandwagon. This will be achieved in three ways according to their white paper:

- Crypto collateral

- Accumulating interest

- Shorting crypto markets

In the first, companies post-ICO needs to safely distribute the amount earned in the offering throughout the many arms of the business. But, what’s rarely talked about is the one-off purchases like cars and homes in which a private individual might need an extra hand to purchase expensive assets. This is even more of a problem when attempting to gather a loan on your digital currencies.

“I wanted to buy a house for my mom, but all I had was this stockpile of ether lying around,” Keith Baumwald CMO/CPO of Celsius told BTCManager in an interview, adding, “If I went to the bank looking for a loan using some digital currency, they would’ve laughed in my face.”

This issue is mitigated via the CEL token with which holders can receive U.S. dollar loans against their holdings. Interest on this loan can also be paid at a discount if borrowers decide to pay the interest in CEL.

Baumwald also explained that the vast majority of the crypto community is holding their ether and bitcoin under the digital equivalent of their mattress. “Why not earn interest on that money as you would with $250,000 in fiat?” he said.

Members of the bank who decide to move their holdings over to Celsius will immediately begin earning up to a competitive five percent interest rate in CEL. The final feature of this nascent financial machine is the ability to short specific features of the market.

As legacy institutions, family and hedge funds dance around the subject of entering the crypto market, Celsius allows naysayers to bet against a particular token’s success. And all the better.

People looking to short are required to pay 50 percent in cash deposits and will need to pay interest when hedging their bets. “These funds are then recycled back through our community, and the flywheel keeps spinning,” Baumwald explained.

Final Points

Understanding a bit of the history behind how crypto loans have functioned in the past is critical for how they will operate in the future. More to that, an alternative business opportunity also reveals itself via the utility of user-facing dApps. This applies to any marketplace, in fact, not just the lending space.

While the CEL token may never moon, it provides a compelling use case for how a digital currency can work. Holders of the token are incentivized to use CEL in a variety of different ways, but Celsius has architected a system that provides benefit for an entire community within each opportunity.

Indeed it’s no Coinbase, but projects like these give us a better glimpse into what a next-generation financial network will look like.