Why is crypto down today? Potential opportunity zone surfaces

The global cryptocurrency market witnessed a notable decline while data from Santiment shows that the majority of the tokens are in the opportunity zone.

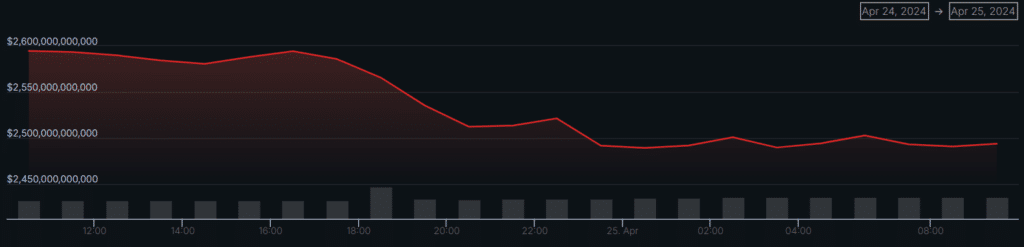

According to data from CoinGecko, the global crypto market cap plunged by 4.1% in the past 24 hours and is currently hovering at $2.49 trillion. The total daily trading volume, however, increased by 16%, reaching $99.1 billion.

The increased trading volume usually brings higher volatility to the market.

Moreover, the leading cryptocurrencies, Bitcoin (BTC) and Ethereum (ETH), dropped by 3.5% and 2.6%, respectively.

BTC is trading at $64,250 and ETH is hovering around $3,150 at the time of writing.

It’s important to note that the Bitcoin ETFs registered an outflow of $120.6 million over the past day, per data from Farside Investors. The BlackRock IBIT Bitcoin ETF recorded a zero inflow day for the first time since ETFs launched in the U.S.

Furthermore, the Grayscale Bitcoin Trust (GBTC) saw a net outflow of $130.4 million on April 24. This movement, again, might be one of the main reasons behind the market-wide bearish sentiment.

On the other hand, data from Santiment shows that more than 85% of the assets listed on the platform are roaming in the opportunity zone.

The market value to realized value (MVRV) ratio of the assets over one-month, three-month and six-month cycles has triggered a buy signal, the market intelligence platform shared in an X post.

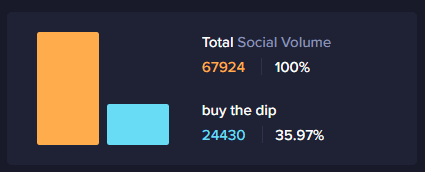

However, “there is growing fear seeping in from the crowd after all of these market cap dips,“ while Santiment adds that “buy the dip” have skyrocketed on social media platforms — dominating 35.97% of the total crypto conversations.

Most of the social activity comes from Reddit and X while Telegram and Bitcointalk have a smaller share, per Santiment.