XRP leads in new ETF applications ahead of SEC’s deadlines

XRP could be the most likely candidate for the next spot crypto ETF approval, claims Kaiko research.

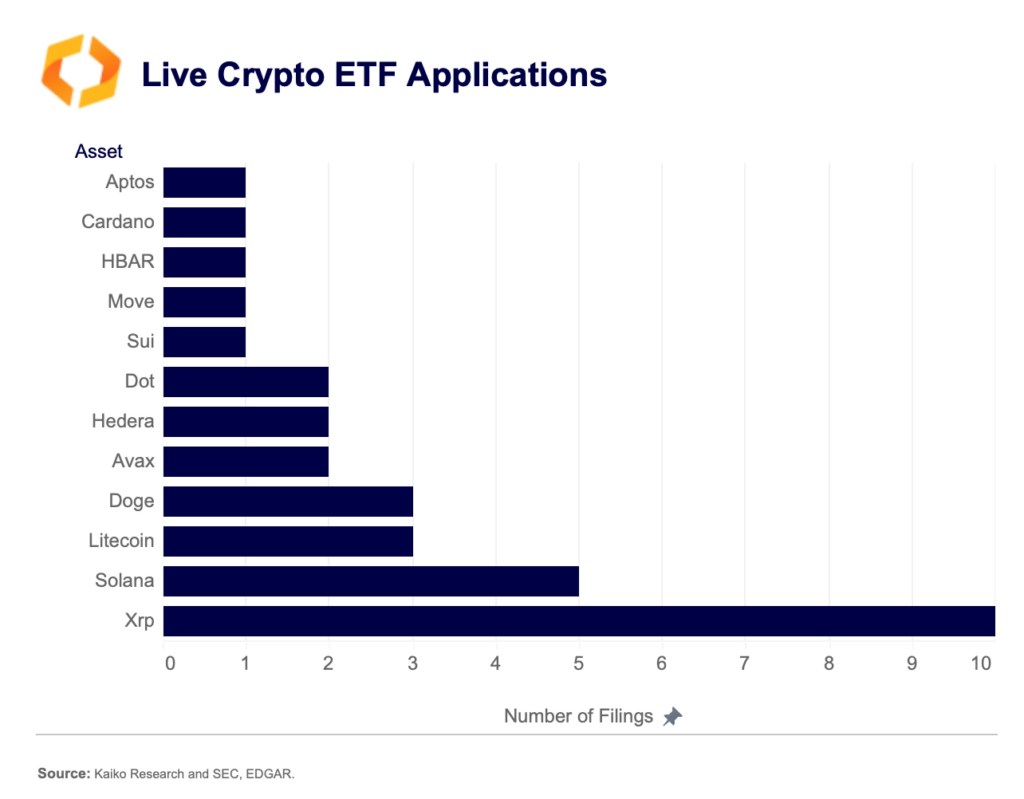

XRP is emerging as possibly the most likely candidate among potential altcoin Exchange Traded Funds. According to a recent report by Kaiko, XRP (XRP) is leading all other tokens by the number of ETF filings, which stand at 10. Solana (SOL) is in second place, with filings by five ETF issuers.

XRP’s liquidity makes it a key candidate for ETF approval

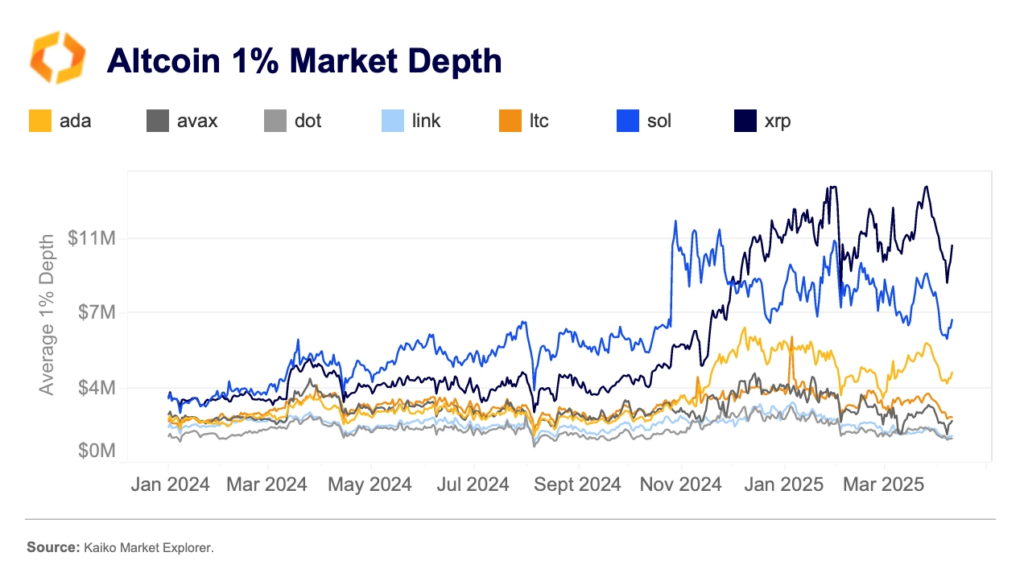

According to Kaiko, both XRP and Solana are likely candidates for approval. This is because both assets have a highly liquid spot market, which the U.S. Securities and Exchange Commission will take into account when processing applications. XRP and Solana have the highest 1% market depth, which is a measure of near-the-price liquidity.

XRP and SOL stand out as two of the most popular assets for ETF applications and are also among the most liquid. A highly liquid spot market is important for creating efficient structured products, and the former SEC leadership was highly sensitive to this.

Specifically, XRP’s market depth took off near the end of 2024, which was also when XRP overtook Solana by market cap. Still, neither token has an active futures market, which Kaiko points out was a key element in the SEC’s decision to list Bitcoin’s ETF product.

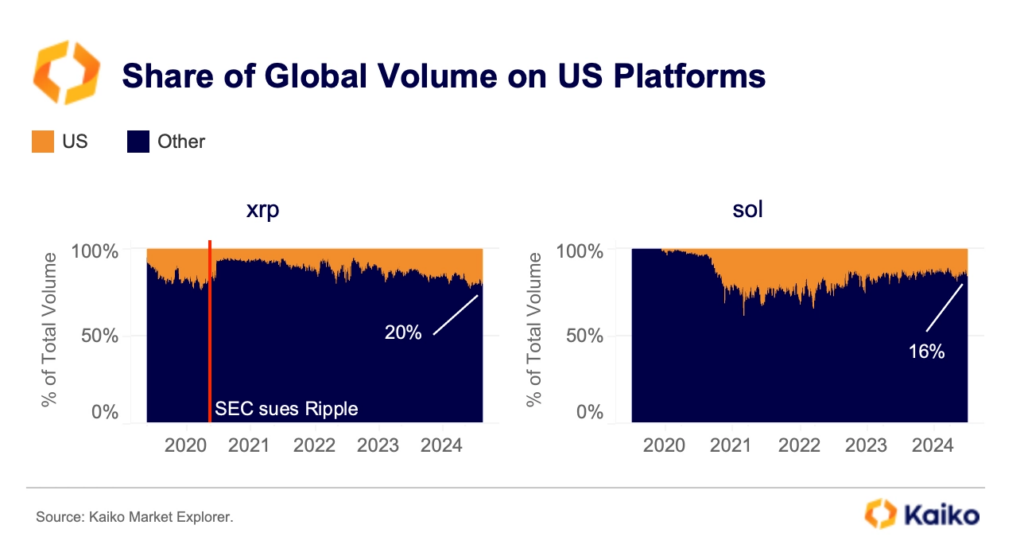

What’s more, its trading volume is mostly concentrated outside the U.S., which is another concern for the SEC. However, the domestic share in trading volume has significantly improved for XRP since its delisting from U.S. exchanges in 2021.

In contrast, for Solana, the share of domestic volume has consistently declined, down from a 30–25% range to 16%. This improvement in domestic trading volume also puts XRP ahead when it comes to ETF issuance.