XRP open interest crosses $1b as traders target $0.75 price rally

Ripple’s price broke above $0.66 on March 25, up 17% within the weekly timeframe: recent derivative market trends suggest traders are pining for more upside.

Ripple (XRP) has been on an upward trajectory over the past week, mirroring the broader mega-cap crypto market trend.

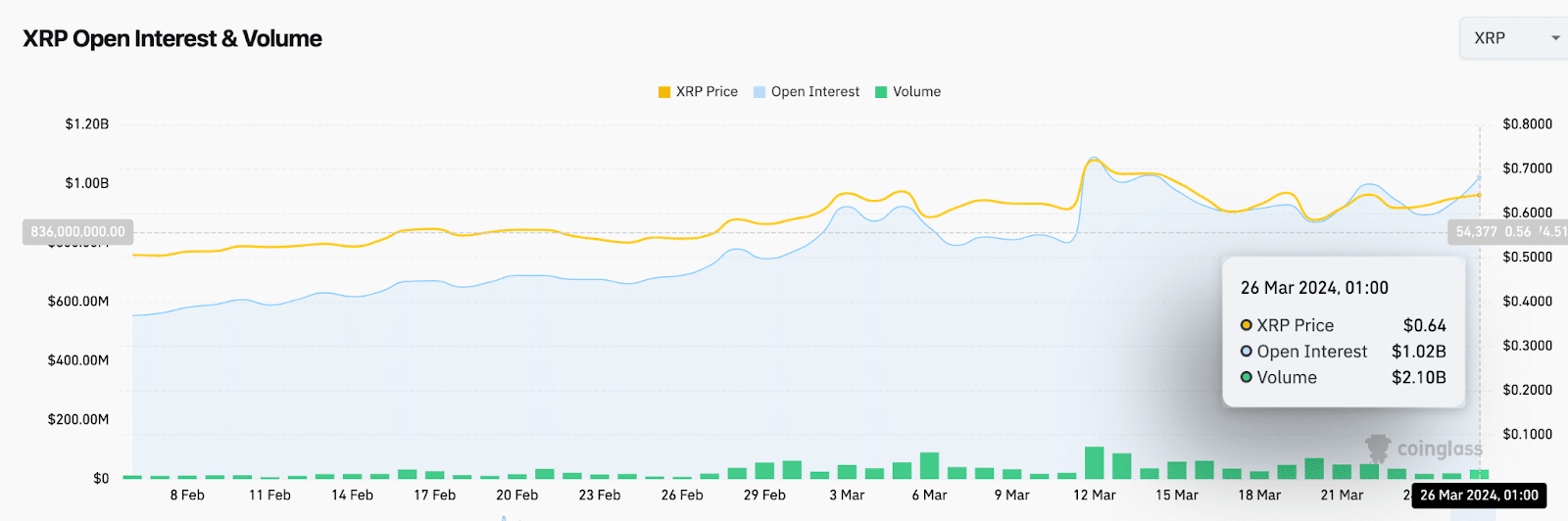

XRP open interest crosses $1 billion for first time in two weeks

On March 11, bulls staged a surprise breakout as XRP price surged 18.5% within a frenetic 24-hour time frame to reach the 2024 peak of $0.74. However, the rapid profit-taking wave that followed triggered a correction below $0.60 within a week.

After a week of consolidation, recent trends in the derivatives markets show that bullish XRP traders are bracing up for another significant price bounce.

CoinGlass’s open interest chart presents the real-time value of total active futures contracts for a specific cryptocurrency. It is a proxy for measuring the underlying asset’s market depth, liquidity, and overall investor interest.

XRP’s open interest reached $1.02 billion on March 26, its highest since March 14. It also marks a net capital inflow of $150 million since the recent significant market dip recorded on March 20.

An increase in open interest during a price recovery phase suggests that most traders are betting on the current price uptrend to continue, hence the rapid capital inflows.

XRP spot prices increased 19.4% between March 20 and March 26, while open interest has only jumped by 15%. This rare market alignment suggests that the current rally is more deeply rooted in organic spot demand than speculative trading in the futures market.

Bulls raise leverage 100% to capitalize on the rally

XRP price outpacing open interest growth suggests stronger fundamental factors driving the ongoing rally, such as increased adoption and positive ecosystem developments, like the new automated market maker (AMM) functionality on the Ripple-backed blockchain network.

On March 22, Ripple Chief Technology Officer David Schwartz took to X to praise the long-anticipated launch of automated market maker (AMM) functionality, hailing it as a significant evolution of the platform’s native decentralized exchange.

Getting in on the act, bullish speculative traders in the derivatives markets have increased their appetites for high-risk leveraged positions this week.

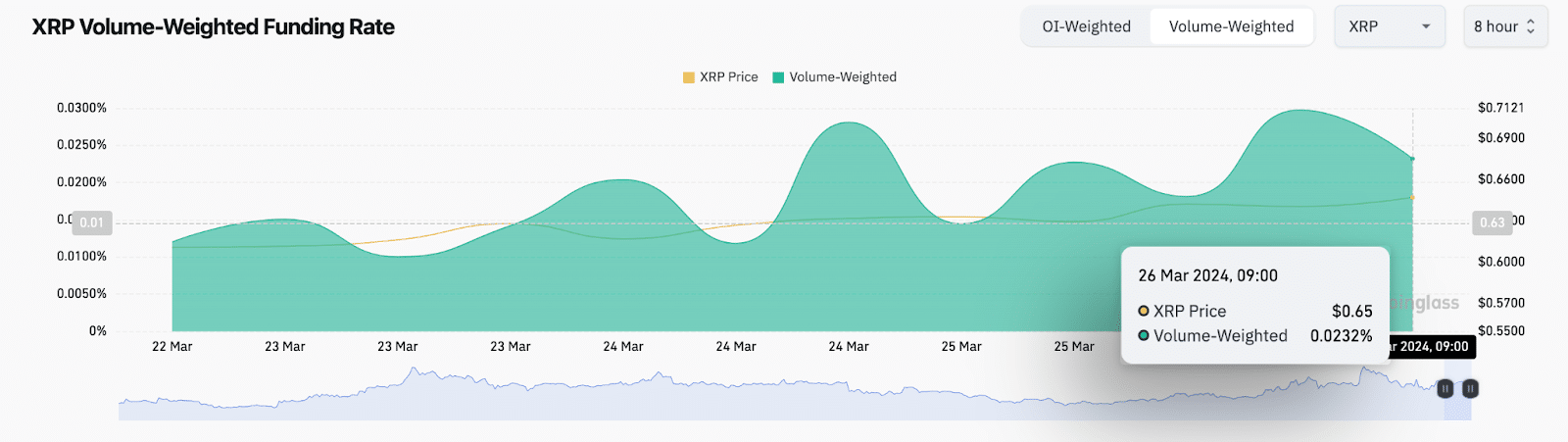

CoinGlass’s funding rate metric represents the aggregate percentage of fees paid between long traders and short position holders in the derivatives markets.

XRP Funding rate has increased from 0.01% to 0.02% between March 23 and March 26, showing that bullish traders have more than doubled their leveraged positions in the last 72 hours.

Typically, an increase in funding rate signals widespread risk-taking, expecting more upside. This means that long traders pay higher fees to short traders to keep their perpetual future positions open, anticipating booking larger profits when spot prices increase.

When short traders witness a rapid increase in leverage and aggressive risk-taking among long traders, they often make covering spot purchases to hedge their bets and mitigate potential losses if the rally breaches their margin-call price.

The short traders’ hedging purchases could add to the growing market demand and further accelerate the price rally in the days ahead.

XRP price forecast: Next target, $0.75?

Drawing insights from the 100% jump in bullish traders’ leverage activity, organic growth in spot demand and potential hedging strategies from short traders, XRP price looks set for another leg up above $0.75.

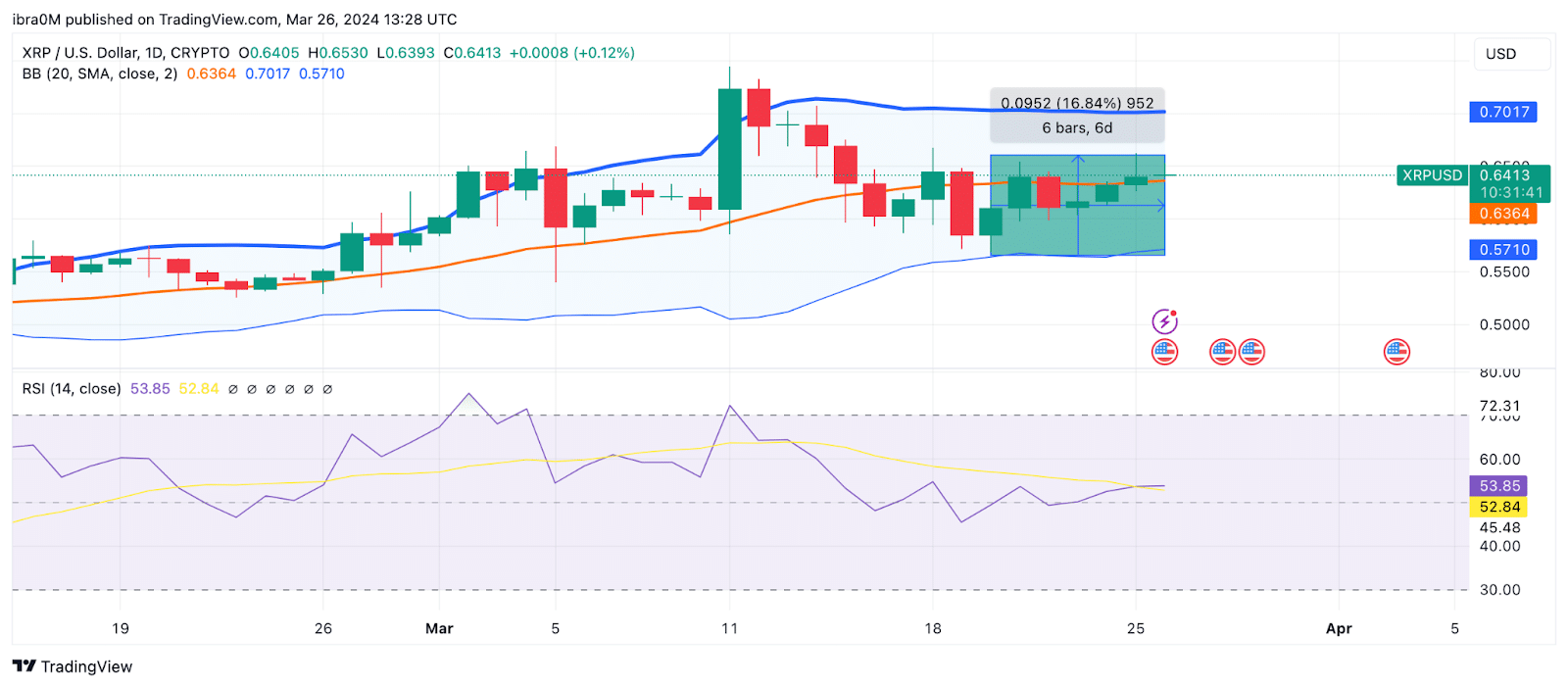

The relative strength index (RSI) technical indicator current trend 53.2 also affirms this bullish XRP price forecast. It shows that after 17% price gains in the past week, there’s still significant room for growth before XRP markets approach overbought territories.

Hence, if XRP can break above the next significant resistance at the $0.70 depicted by the upper Bollinger band, a major breakout toward $0.75 could be on the cards.

However, in a bearish market downturn, the $0.57 support level depicted by the lower limit of the Bollinger band indicators will be one to watch. A major downswing below that range could see the bears regain control of the market momentum.