XRP price analysis: Can this $760M signal turn the tide?

Ripple’s price stumbled 8% to a weekly low of $0.53 on Feb. 22 but curtailed selling pressure among traders signals widespread intent to hold out for a rebound phase.

The price of Ripple (XRP) soared to a February 2024 peak of $0.58 on Feb. 15, riding on bullish headwinds spread across the layer-1 crypto sector.

As XRP price retreated below $0.55 this week, investors have increasingly refrained from selling rather than entering a large-scale sell-off.

XRP bulls refrain from selling amid 8% retracement

XRP’s price joined other top-ranked layer-1 coins at the forefront of the crypto market rally last week. Increased demand and positive sentiment surrounding layer-1 altcoins and a timely $120 million inflow from crypto whales were major rally drivers.

While XRP price lagged behind rival layer-1 coins like Avalanche (AVAX), Solana (SOL), and Ethereum (ETH), all of which scored double-digit gains, XRP’s 7.4% uptick was enough to propel it to a new monthly peak of $0.58 on Feb. 15.

After another brazen attempt at flipping $0.58 territory on Feb. 19, XRP price entered a sharp 8% pullback to a local low of $0.53 at press time on Feb. 22. On-chain data trends show that most current XRP holders have maintained a bullish outlook amid the price downtrend.

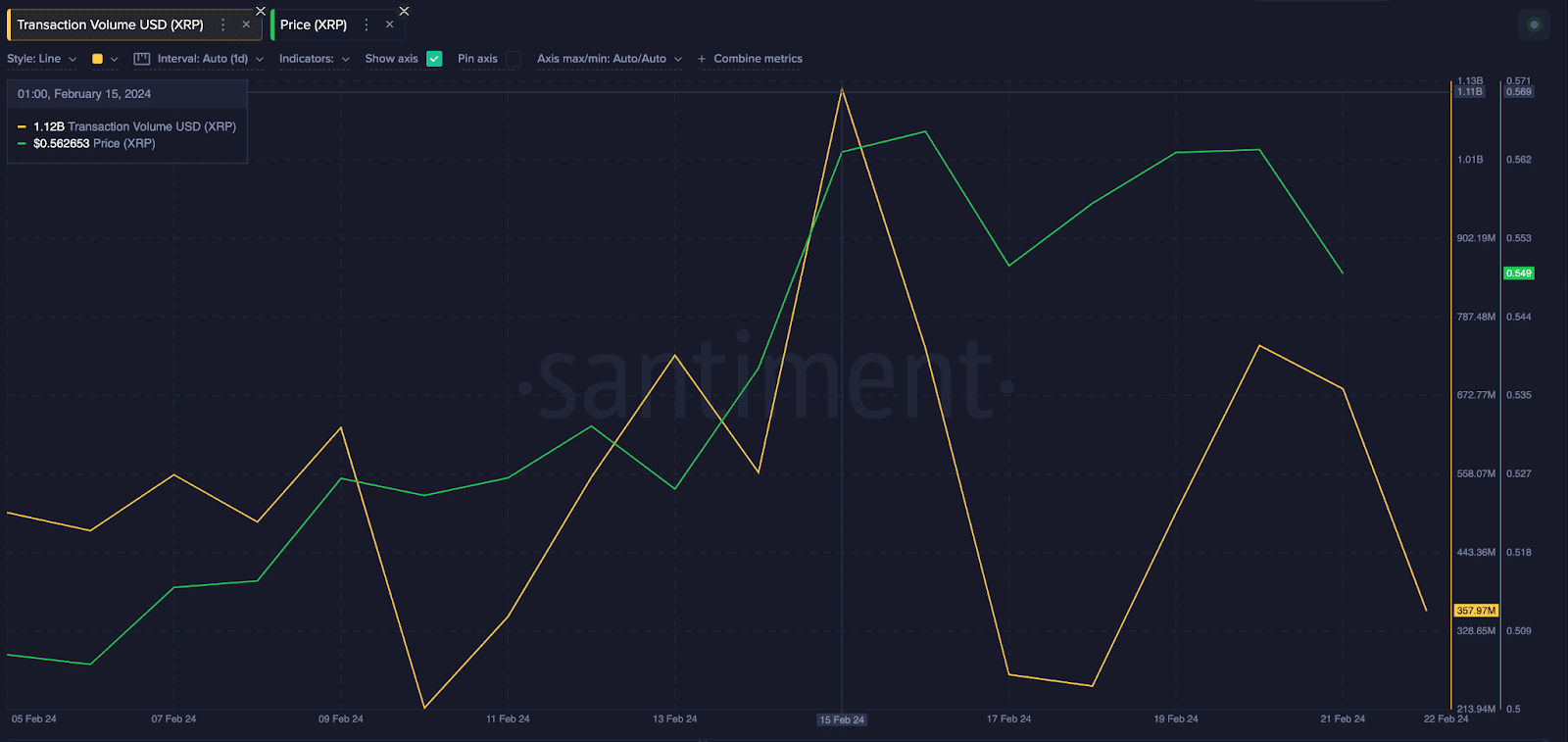

The Santiment chart shows that XRP trading volume rose to $1.1 billion at the peak of last week’s rally of Feb. 15. As prices began to slide, XRP traders have increasingly dialed down their trading activity.

The chart above shows that XRP trading volume is down by $760 million compared to last week’s peak. At the time of writing on Feb. 22, only $357.9 million worth of trades were recorded in the last 24 hours.

XRP trading volume dropped 73.2% between Feb. 15 and Feb. 22. However, XRP price declined by only 8% during that period.

When trading volume declines faster compared to the pace of price decline, savvy investors see it as a sign of strong underlying confidence. It suggests that investors expect the current pullback to transition swiftly into a rebound phase.

Additionally, key fundamental factors, such as the overall altcoin market cap growth this week, with BTC and ETH both trading at historic peaks, also further reinforce the optimistic outlook for an imminent XRP price rebound.

XRP price forecast: Bulls to defend $0.50 fiercely

The curtailed selling pressure observed in the markets this week puts XRP in a prime position to avoid a further downswing below $0.50. However, the upper Bollinger band indicator shows that in the case of an early rebound, the bulls face initial resistance at the previous peak, around $0.58.

If the bullish scenario is as predicted, XRP price could enter a major breakout towards $0.60.

Conversely, the bears could invalidate this optimistic price forecast if they force a reversal below the critical $0.50 area. As depicted by the lower Bollinger band indicator, the buy wall at $0.49 could offer considerable support in the short term.