XRP price at risk as investors react to US government affiliation

XRP price has stalled at the $0.59 range since retreating from the $0.62 area on Jan. 11 amid concerns about Ripple’s affiliation with the U.S. Government.

A job posting on the Ripple website has sparked negative sentiment across the XRP community this week. The revelation came as the applicants discovered a line citing that the company was “a federal contractor or subcontractor” to the United States government.

Federal contractors refer to businesses or organizations currently in a contractual agreement with any department or agency of the United States Government.

Ripple is not alien to working with governments, having entered into several CBDC and settlement partnerships with multiple countries in recent years. However, XRP’s long-drawn-out SEC lawsuit over the last two years has fractured the community’s relationship with U.S. regulators.

Hence, this statement, affirming Ripple’s affiliation with the U.S. government, has triggered negative sentiment within the community.

XRP social sentiment slides to a two-year low

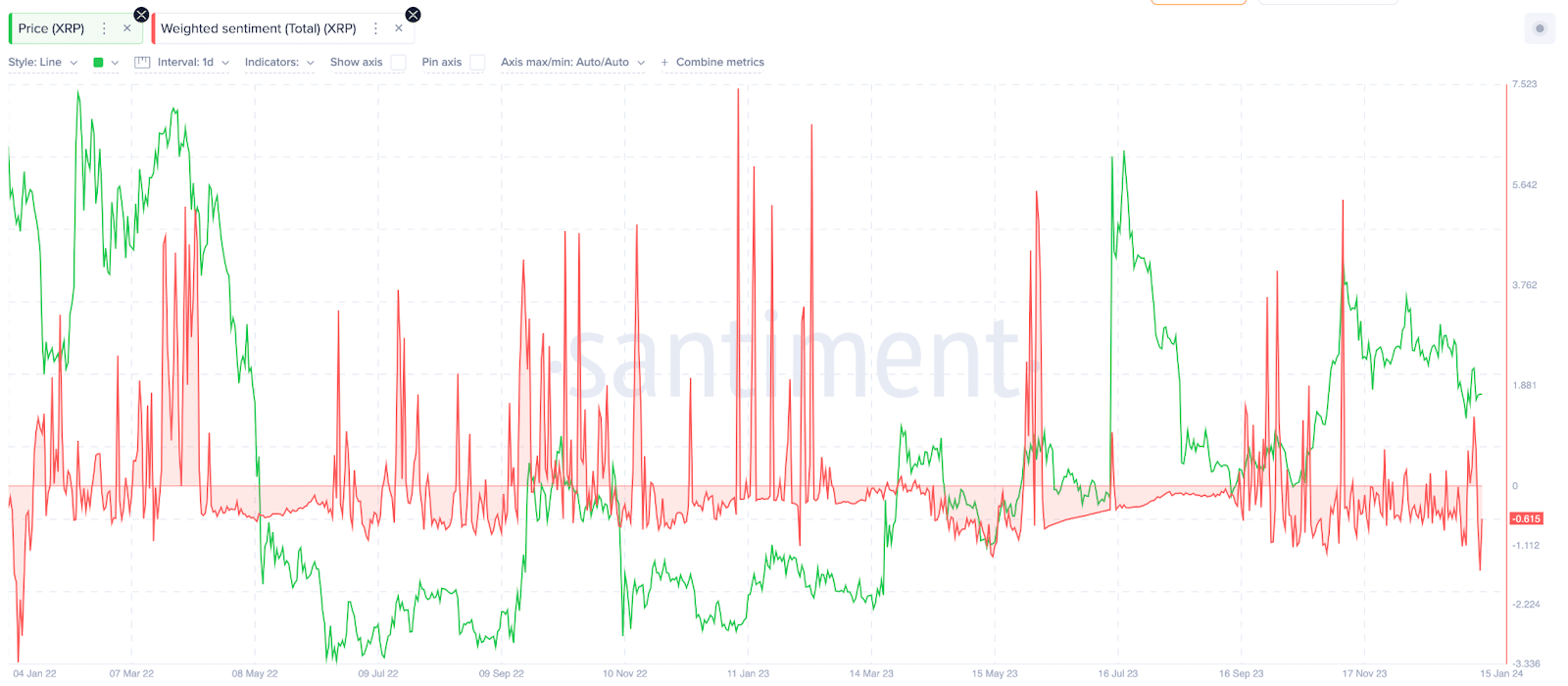

XRP price has stalled at the $0.59 area since discussions surrounding Ripple’s affiliation with the US government spread across the community. But looking beyond the price charts, on-chain data trends reveal that the overall sentiment within the XRP ecosystem has flipped negative.

Santiment’s weighted sentiment metric measures the number of negative comments a project receives against the negatives.

The XRP weighted sentiment slid into negative values, reaching a two-year low of 1.58% on Jan. 14.

Negative values of weighted sentiment indicate that most discussions surrounding the asset at that period are dominantly negative. The timing means that XRP’s current negative sentiment cycle could be attributed to investors stating their concerns about Ripple’s affiliation with the U.S. government.

If this devolves into a larger scale of market fear, uncertainty, and doubt (FUD), XRP price runs the risk of a major bearish downtrend.

XRP traders have closed futures contracts worth $242 million

The decline in XRP open interest relative to spot prices in the last two weeks is another critical market indicator highlighting the growing bearish pressure.

As illustrated below, XRP open interest has declined 32% from $755 million to $513 million, shedding $242 million in value between Jan. 3 and Jan. 16.

Comparatively, XRP spot prices have only declined 8% from $0.62 to a local bottom of $0.58.

Open interest quantifies the total capital invested in active futures contracts for a specific crypto asset. Singularly, a decline in open interest is considered a significant bearish signal. It indicates disinterest among market participants as capital flows out of the markets.

The current market dynamics illustrate that XRP derivatives markets have shrunk significantly faster than prices in the last two weeks. This could mean that the XRP price is significantly overvalued in the spot markets.

XRP price forecast: will it revisit $0.50?

From an on-chain perspective, the decline in open interest validates that dominant negative sentiment within the XRP ecosystem. Combining these factors could see XRP price retreat closer to the $0.50 area in the short term.

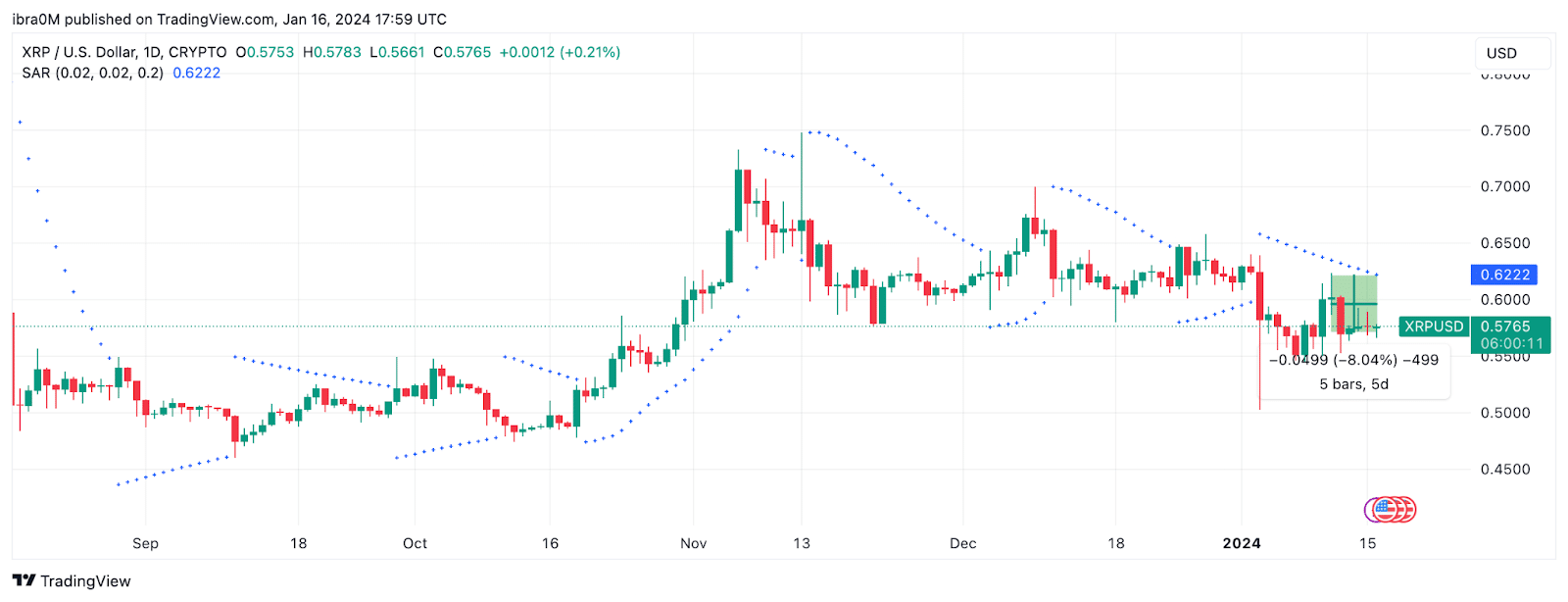

The Parabolic SAR technical indicator also affirms this XRP price forecast. When it points below an asset’s current price, it suggests a dominant bearish momentum.

XRP Parabolic SAR indicator dots point toward $0.62 at the time of writing on Jan. 16, which is well above the current price of $0.57. This alignment is a strong indication that the bears are in firm control.

However, the bulls must clear the initial psychological support level around $0.55 to validate this thesis. If they break down that buy wall, the XRP price could slide toward $0.50.

Conversely, the bulls could invalidate that prediction if they successfully force a rebound above $0.60.