XRP price outlook: Ripple’s underperformance explained

Ripple (XRP) price has underperformed the broader crypto market this year. It has crashed by over 20% in 2024 while Bitcoin has soared by almost 50%. XRP has lagged behind other top ten cryptocurrencies like Toncoin, Ethereum, and Binance Coin.

XRP has risen by just 1.6% in the past 12 months while Bitcoin has surged by over 100%. Its underperformance versus meme coins like Floki, Pepe, Book of Meme, and Brett has been a source of frustration for longer-term investors.

Ripple’s performance has lagged the market despite even as the developers made several initiatives to boost its value. For example, the recently launched the XRPL EVM sidechain is capable of handling over 1,000 transactions per second. In a statement last week, the developers noted that they will use Axelar as the bridge protocol for the platform.

The challenge for Ripple is that the EVM space has become highly saturated and competitive. As a result, many major networks that have moved to the space like IOTA and EOS have found it hard to compete.

Ripple is also planning to launch its stablecoin, which will be pegged to the US dollar. Again, the stablecoin industry is highly competitive and having a brand name does not guarantee success. For example, PayPal’s PYUSD has a market cap of $414 million, making it much smaller than USD Coin and Tether.

The XRP price has underperformed because of the weak traction among traders and users. Most crypto traders are focusing on meme coins like Pepe, Book of Meme, and Brett.

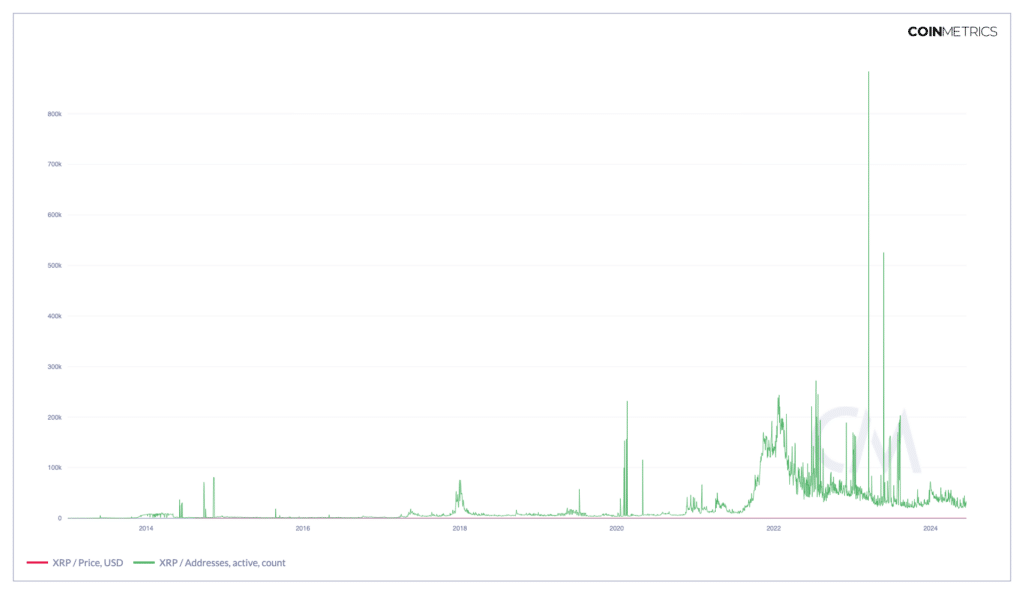

At the same time, on-chain metrics show that the number of active accounts and transactions has dropped sharply this year.

Ripple’s active addresses

Additionally, Ripple has not signed up many financial services companies to use its platform after its victory against the SEC last year. Analysts question whether there is strong demand for Ripple’s On Demand Liquidity (ODL) solution at a time when banks like JPMorgan and ANZ are testing their tokenization products.

In summary, Ripple’s XRP has underperformed because of weak demand among traders and institutions. There are also questions about whether its growth initiatives like EVM and stablecoins will become successful.

XRP price forecast

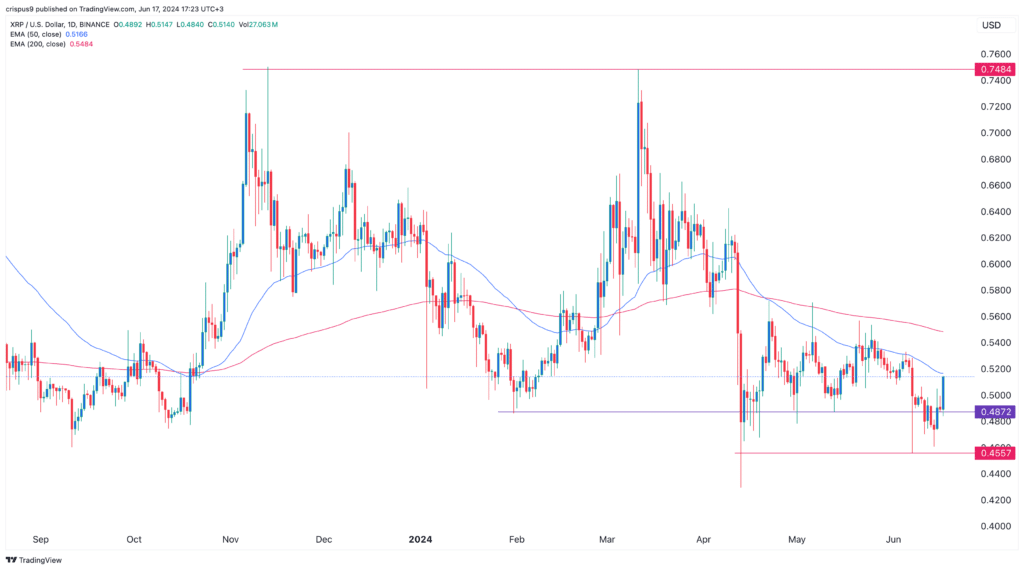

The other reason why XRP token tumbled is that it formed a double-top pattern at $0.7484, its highest point on November 13th and March 13th. In price action analysis, a double-top is one of the most bearish signs in the market. The token has now moved slightly above its neckline at $0.4872.

Ripple also formed a death cross on April 14th as the 200-day and 50-day Exponential Moving Averages (EMA) crossed each other.

Therefore, while the XRP has rebounded in the past two days, its outlook remains bearish, with the initial target to watch being at $0.4872. A drop below that level will point to more downside as sellers target the next support at $0.4557.