YieldMax files for ETF focused on MicroStrategy derivatives

YieldMax, a firm specializing in exchange-traded funds (ETFs), has filed to launch a novel yield-bearing ETF based on shares of Michael Saylor’s Bitcoin (BTC) holding company, MicroStrategy.

According to a Dec. 7 filing with the U. S. Securities and Exchange Commission (SEC), the proposed ETF, named Option Income Strategy ETF, is scheduled for a 2024 release and will trade under the ticker MSTY.

This ETF employs a “synthetic covered call” strategy, which involves a combination of buying call options and selling put options to generate income. This income is then planned to be distributed monthly to MSTY ETF holders.

Interestingly, the ETF will not hold any spot MicroStrategy shares but will solely focus on trading MSTR derivatives. To mitigate risks, the fund will cap its monthly gains from call options at 15%.

This strategy means that the monthly yields from the ETF are not directly tied to the performance of MicroStrategy’s stock. Therefore, investors could still receive yields even if MicroStrategy’s shares experience a downturn.

This aspect has sparked discussions among investors and analysts, with some questioning the benefits of investing in the ETF over directly purchasing company stock or options.

Yield-bearing ETFs like the one proposed by YieldMax are generally aimed at conservative investors seeking modestly higher returns from the more volatile segments of the stock market. The gain limits set by the fund managers position these ETFs as a cautious yet potentially more rewarding method for generating passive income from significant stock price fluctuations.

MicroStrategy’s stock has seen considerable growth in 2023, with a more than 290% increase since the start of the year, according to Yahoo Finance data. This surge in value coincides with the company’s aggressive Bitcoin acquisition strategy.

On Nov. 30, Michael Saylor announced the purchase of an additional 16,130 BTC for approximately $593.3 million, averaging $36,785 per Bitcoin.

As of Nov. 29, MicroStrategy’s Bitcoin holdings total around 174,530 BTC, valued at approximately $7.6 billion.

Saylor has expressed his view of Bitcoin as a more reliable store of value than gold. He sees potential for its blockchain technology in various applications, including smart contracts, decentralized finance (DeFi), and voting systems. His vision also includes BTC at the core of a new, more transparent, secure, and efficient financial system.

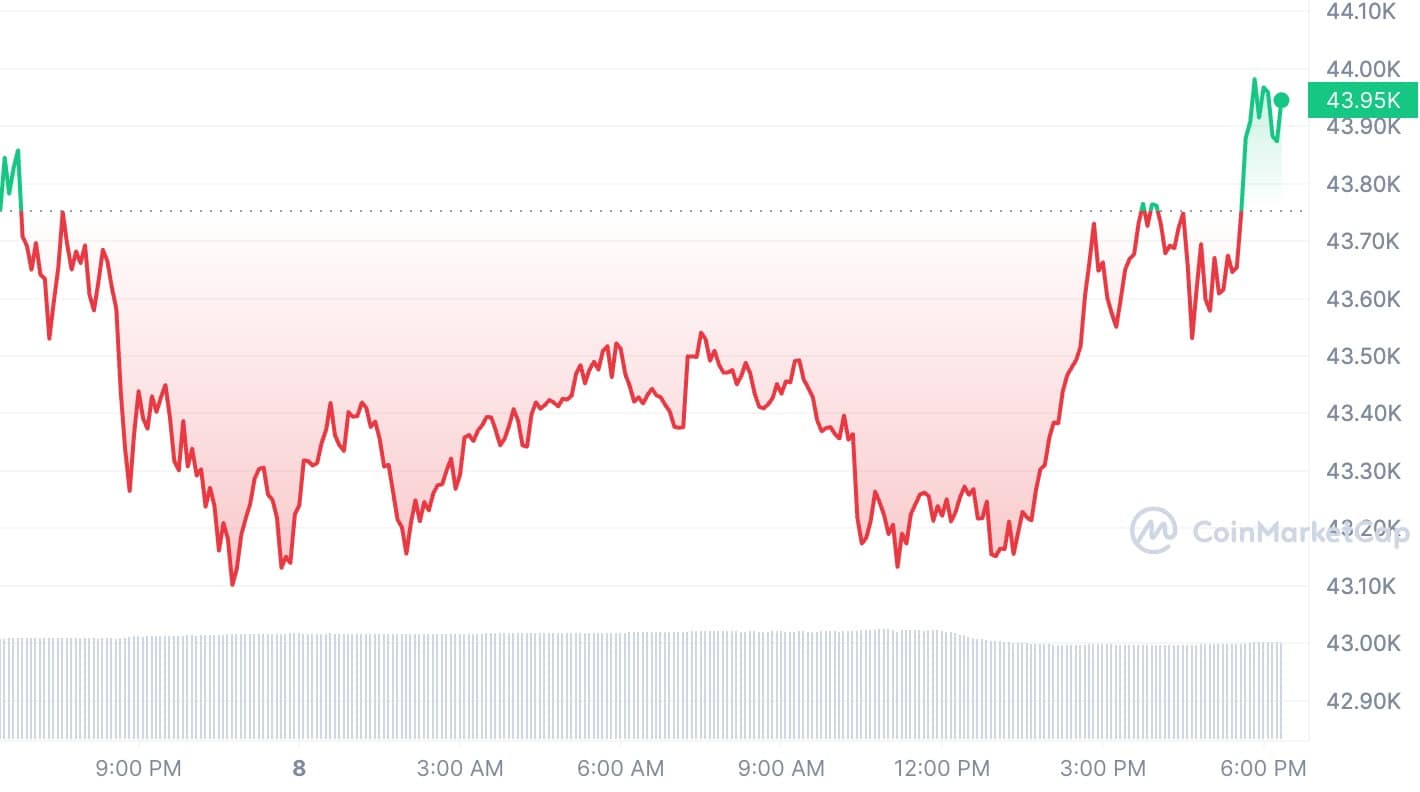

At the time of writing, Bitcoin is trading at around $43,865, marking a rise of over 14% in the last seven days, as per CoinMarketCap data.