Zilliqa (ZIL): Permissionless Blockchain for Higher Scalability

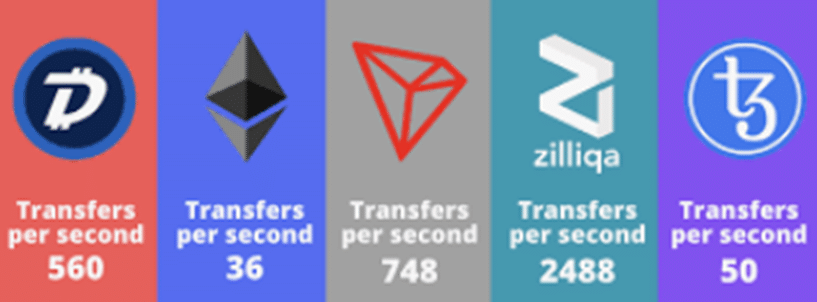

Zilliqa (ZIL), permissionless blockchain able to demonstrate productivity of about thousands transactions per second, may effectively resolve the existing scalability challenges and extend the applications of sharding as a second-layer solution.

What Is ZIL?

Zilliqa (ZIL) creates a platform for many dApps as well as offers staking and yield farming opportunities to its users globally. The token ZIL is used for enabling transactions and implementing smart contracts’ functionality. Zilliqa’s innovations refer to relying on sharding-based blockchain solutions for maximizing the network’s efficiency and flexibility. Moreover, the growing number of shards also contributes to the proportional increase in the network’s productivity per second. Moreover, all records are immediately added to Zilliqa’s blockchain, ensuring that no additional time is required for processing such extra requests. On this basis, Zilliqa has almost unlimited opportunities for serving the growing number of clients with minimum fees and processing time. The platform also tries to challenge such traditional payment systems as VISA and MasterCard.

ZIL’s current price equals $0.2128 with the circulating supply of 12.59 billion tokens. Its maximum supply equals 21 billion tokens, implying that it can still be increased by about 40%. Zilliqa’s total market capitalization equals $2.68 billion, making it the 51st largest cryptocurrency in the market. ZIL reached the highest price in April-May of 2021 at the level of about $0.24, although its recent price movements allow approaching these maximum levels, confirming the investors’ growing interest in its sharding innovations. Moreover, such layer-2 solutions may become even more applicable in the proof-of-stake segment, thus contributing to the successful evolution of Ethereum 2.0 and other major altcoins. The competitive positions of VISA and MasterCard can also weaken in the near future, thus creating additional opportunities for such innovative solutions as Zilliqa.

Reasonability of Investing in ZIL

The demand for ZIL will mostly depend on the combination of the following major factors: the rates of the proof-of-stake segment’s growth; comparative positions of sharding in regards to alternative blockchain solutions; the spread of yield farming; and Zilliqa’s integration with other blockchain platforms. Overall, there is a high likelihood that this project will continue to develop rapidly, contributing to the development of new dApps and blockchain solutions. For this reason, many strategic investors may be interested in opening long positions, thus expecting ZIL’s appreciation in the following months. Technical analysis may be used for predicting potential price movements of the analyzed token in the short term.

There are two major support levels that prevent the token’s price from depreciation. The first one is at the level of $0.040, and it reflects the local bottom within the past several months. The second one is at the price of $0.14 that demonstrates the major support in case the ZIL price experiences a correction in the following days. In addition, there is a resistance level of about $0.24 that reflects the historical maximum reached last year. At the moment, ZIL possesses the required potential for successfully overcoming this critical level and exceeding historical maximums.