15th anniversary of Bitcoin white paper: From concept to multi-billion-dollar market

Explore the transformative 15-year journey of Bitcoin, from its humble beginnings in a nine-page whitepaper to its current state as a billion-dollar asset class, as we delve into key milestones, technological advancements, and what the future holds.

Although Bitcoin’s official birthday is often celebrated on Jan. 3, when the token was first launched, it was actually 15 years ago today that Bitcoin’s journey started from a nine-page white paper. By all means, 2008 was not a year to remember for most individuals. A historic recession, crippling natural disasters, war, and so much more. As some would argue, the only positive to come from the year of the “great depression” was Bitcoin. Of course, nobody had realized its revolutionary potential just yet.

Satoshi Nakamoto’s Bitcoin white paper laid the foundation for a financial transformation that significantly changed the face of digital finances today. From trading at less than a dollar to reaching nearly $70,000 in value, Bitcoin has seen a series of rollercoaster events in the past 15 years. It has created a trillion-dollar industry within a decade and also sparked significant controversies. So, as we celebrate the 15th anniversary of Bitcoin’s white paper, let’s dive a bit deeper into its history, key milestones, current state, and potential future.

The Genesis: Satoshi Nakamoto and the Bitcoin white paper

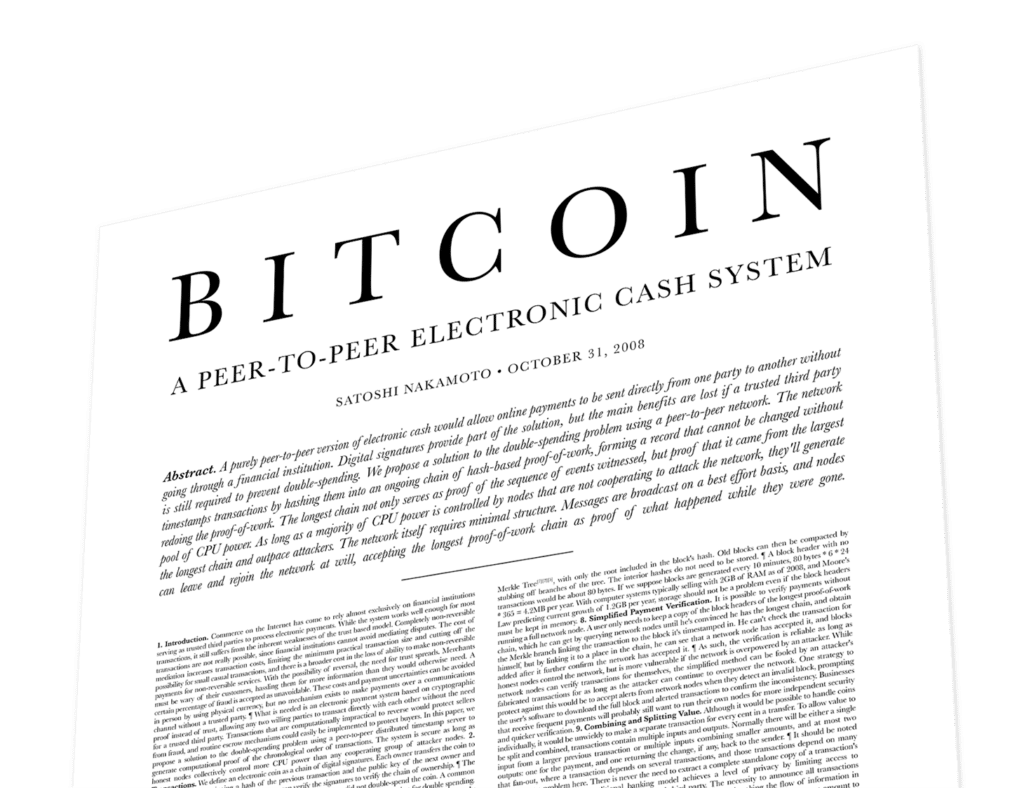

In the midst of 2008, as traditional financial institutes were collapsing and pleading for government bailouts, a document surfaced on a modest cryptography mailing list. Released on the cypherpunk mailing list, an online community dedicated to advancing privacy through cryptography, Nakamoto’s paper was titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”

This manifesto detailed how a decentralized, peer-to-peer system could facilitate digital transactions without relying on trust or a central authority like banks. It introduced concepts like proof-of-work and the blockchain to ensure security and integrity within this decentralized network. The white paper proposed that transactions could be verified by network nodes through cryptography and recorded on a public ledger accessible to anyone but alterable by none—a blockchain.

“The first time I heard about Bitcoin was when I was playing World of Warcraft back in 2012/2013. I started to do some serious research on the white paper of Bitcoin and by reading more about it on the Bitcointalk forum. From that time, I was fascinated by Bitcoin and the technology behind it: blockchain.”

– Sunny Lu, CEO at Vechain

Nakamoto’s vision was not merely a theoretical construct; the white paper included proof-of-concept code snippets, showcasing the practicality of this approach. Most importantly, the white paper addressed the double-spending problem that had plagued digital currencies. By creating a time-stamped, immutable record of all transactions, Bitcoin would make double-spending virtually impossible.

Evolution of the blockchain: from concept to reality

Nakamoto’s Bitcoin white paper and the release of the Bitcoin software gave life to the blockchain, which in turn created the concept of decentralized finance (defi). The first block, known as the “Genesis Block,” was mined on January 3, 2009. Embedded in its code was a headline from The Times: “Chancellor on brink of second bailout for banks.” It was, to some extent, a political statement reflecting Bitcoin’s counter-establishment ethos.

Early miners were able to earn 50 Bitcoins for every block they mined, a reward that has since been halved multiple times, in keeping with Bitcoin’s deflationary model. This process, known as “halving,” occurs approximately every four years, and it ensures that only 21 million Bitcoins will ever exist, making the token a deflationary asset by design.

As more blocks were added to this immutable chain, it became evident that Nakamoto had solved one of computing’s most significant issues: achieving consensus across a distributed network without central authority. From here, blockchain technology would take off across industries, becoming a model framework for fast, secure, and transparent transactions.

“I think the early years of democratizing and spreading the ideas of decentralization was Bitcoin’s finest hour. The deficiencies that have become more apparent in recent years and actually work against the vision. But the jury is still out on BTC’s long-term relevance”

– Lars Seier Christensen, Co-Founder and Chairman of Concordium

The events that defined Bitcoin’s journey

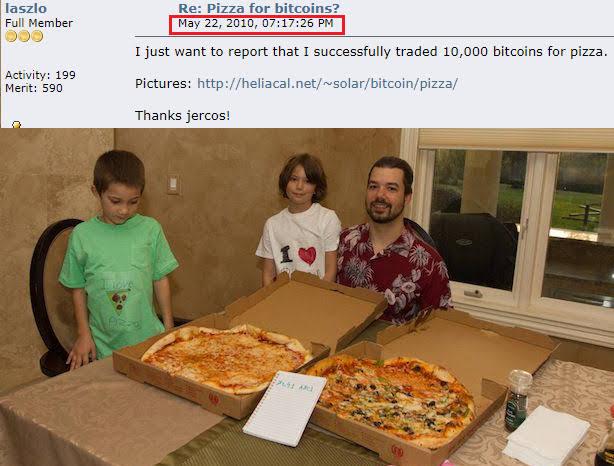

Let’s wind the clock back to May 22, 2010, affectionately known in crypto circles as “Bitcoin Pizza Day.” On this day, a programmer named Laszlo Hanyecz made history by buying two pizzas for 10,000 Bitcoins. It was the first documented case of Bitcoin being used to buy tangible goods, signaling the digital currency’s potential as a medium of exchange.

Then came the rise and fall of Mt. Gox, one of the first major Bitcoin exchanges. At its peak, it handled around 70% of all Bitcoin transactions. However, a significant hacking incident in 2014 led to the loss of 850,000 Bitcoins and, eventually, the exchange’s bankruptcy. It served as a hard lesson on the importance of security in the crypto space.

But Bitcoin rebounded. In 2017, it achieved parity with gold, trading at around $1,268 per Bitcoin. This milestone was symbolic, establishing Bitcoin as an asset class. The same year saw the divisive hard fork that led to the creation of Bitcoin Cash, underscoring the community-driven nature of this decentralized system.

Fast forward to 2020, when the COVID-19 pandemic pushed global economies into chaos. Bitcoin emerged as a “digital gold,” with major corporations like Tesla and MicroStrategy adopting it as a reserve asset. This move toward institutional acceptance underscored Bitcoin’s evolving role from a rebel currency to a legitimate store of value.

Just a year later, El Salvador made headlines in 2021 by becoming the first country to make Bitcoin legal tender, a controversial yet groundbreaking move. The same year, Bitcoin reached its all-time high, recording a value of over $69,000 per token.

Then, in 2022, another crypto winter hit the industry, as Bitcoin lost more than 60% of its value. The crash was driven by several factors, including macroeconomic uncertainty, interest rate hikes by the U.S. Federal Reserve, and rising inflation, which collectively dampened the initial high optimism in the crypto market.

Regulatory scrutiny also intensified, with the SEC taking actions against crypto firms, further shaking investor trust. Additionally, the crypto market faced internal crises, such as the fall of cryptocurrency exchange FTX and the collapse of stablecoins like Terra and Luna. These events not only led to massive sell-offs but also exposed systemic vulnerabilities in the crypto sector, including poor risk management and fraudulent activities. Overall, the market’s high correlation with tech indices like Nasdaq, which itself saw significant declines, further exacerbated the downturn.

However, as the market is recovering from the setback in 2022, Bitcoin has finally started to regain momentum, reaching a value of $35,000 last week, its highest in a year.

Bitcoin and its network today

As we sit in 2023, Bitcoin’s state is a testament to both its resilience and its continuing evolution. With a market capitalization of more than $670 billion, it’s hard to overlook its presence as a dominant force in the global financial landscape. But it’s not just the token’s monetary value that captures attention; it’s the robustness of the Bitcoin network itself.

The network now boasts over 10,000 nodes, making it one of the most decentralized and secure systems in existence. With advances in layer-2 solutions like the Lightning Network, transaction speeds have accelerated, and fees have dropped, making microtransactions more feasible. This enhanced scalability shows Bitcoin’s capability to adapt and meet the changing demands of its growing user base.

The technology’s underlying proof-of-work consensus mechanism has prompted a renewed focus on renewable energy solutions for mining. Environmental concerns, which are often a significant point of contention for Bitcoin critics, are being systematically addressed through sustainable mining solutions, although there’s still work to be done.

Bitcoin is also seeing wider adoption across various sectors. Several major brands, like PayPal, Microsoft, AT&T, and Starbucks, have already integrated Bitcoin payment gateways. A recent study by Deloitt also suggests that 75% of retailers have plans to start accepting Bitcoin payments over the next two years.

Yet, challenges remain. Regulatory scrutiny is intensifying, with countries like China implementing strict crypto bans. Asset volatility and security concerns persist, indicating that while Bitcoin has matured, it’s not entirely foolproof.

The future outlook for Bitcoin

Looking ahead to 2024, several key developments hint at Bitcoin’s future trajectory. First and foremost, the crypto community is eagerly awaiting the upcoming Bitcoin halving in 2024. Currently, miners are rewarded 6.25 Bitcoins for each block mined. Post-halving, this reward will be slashed to 3.125 Bitcoins per block. This deflationary measure is baked into Bitcoin’s code to limit supply and, historically, has been a precursor to significant price rallies.

The upcoming halving could have a broader impact on Bitcoin’s market dynamics and investor sentiment. Let’s take a look at some of the trends in Bitcoin price behavior around the past three halving events:

First halving (2012)

- Pre-halving: Bitcoin saw a steady increase in price months before the November 2012 halving, moving from around $5 to approximately $12.

- Post-halving: After the block reward dropped from 50 BTC to 25 BTC, the price eventually rose to roughly $266 in April 2013.

Second halving (2016)

- Pre-halving: The price surged from around $430 in January 2016 to nearly $760 by the time of the halving in July 2016.

- Post-halving: After the block reward was halved from 25 BTC to 12.5 BTC, Bitcoin experienced a bull run that took its price to around $20,000 by December 2017.

Third halving (2020)

- Pre-halving: Bitcoin started the year at around $7,200 and climbed to approximately $9,000 by the time of the halving in May.

- Post-halving: After the block reward was cut to 6.25 BTC, Bitcoin witnessed a significant increase, reaching all-time highs of around $64,000 in April 2021.

On the technological front, the activation of the Taproot update on November 14, 2021, marked a significant moment for the network. This protocol improved Bitcoin’s scalability and privacy, streamlining complex transactions and making them cheaper and quicker. The update opened doors to future innovations and discussions about how Bitcoin could evolve into a widely adopted global currency.

Financial instruments tied to Bitcoin are also evolving. After Grayscale’s historic victory against the SEC over exchange-traded funds (ETF), it could be only a matter of time before the leading cryptocurrency makes its way into the stock market.

The SEC is currently reviewing multiple filings for Bitcoin ETFs, with firms like BlackRock, Bitwise, WisdomTree, Fidelity, and Invesco all in the running. If approved, these ETFs could act as a catalyst, providing a more convenient route for institutional capital to flow into the Bitcoin ecosystem.

The future, while promising, will not be without its challenges. Regulatory hurdles, security concerns, and market volatility remain potent factors that could shape Bitcoin’s path forward. However, if the past 15 years are any indication, Bitcoin has proven its resilience, innovation, and adaptability, making it a compelling narrative that’s far from over.