1INCH plunges 34% days after Ripple-SEC ruling

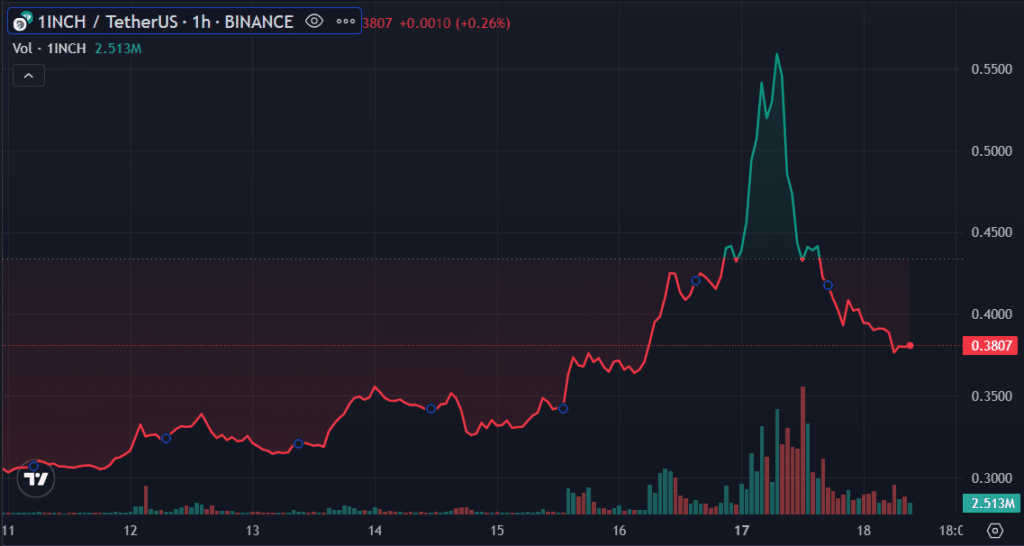

1inch Network’s native token, 1INCH, is down 34% in the past 24 hours, making it the biggest loser among the top 100 assets ranked by market capitalization.

Consequently, market participants appear to be selling due to the decline, heaping more pressure as the token crashed below multiple support levels to around the $0.37 zone.

1INCH is correcting less than a week after a market-wide rally sparked by Judge Analisa Torres’ ruling in the Ripple vs. United States Securities and Exchange Commission (SEC) legal battle. The market interpreted the order positively, lifting Bitcoin and altcoins, including 1INCH.

Before then, 1INCH had been consolidating between $0.30 and $0.34 for two weeks before its upsurge on July 13. The rally brought it to a high of $0.5935 by July 17, marking an 89% increase in four days.

Within this timeframe, 1INCH experienced a significant increase in trade volume due to a surge in investor interest in capitalizing on the rally. Notably, the token became the second-most traded asset on Upbit, South Korea’s largest exchange, on July 17.

According to trackers, on July 17, 1INCH’s 24-hour trade volume stood at $112.5 million. However, the market-wide run saw the upward momentum fall.

Bears forced 1INCH lower to $0.4029, a 6.16% correction from $0.5935 posted on July 17. These losses spilled over, triggering even more losses on July 18.