A Week of Satoshi Pt. 3: Big Bitcoin Moments (2008 – 2013)

The Cambrian explosion of cryptocurrencies has behaved much in the same way as in biology. What wasn’t weeded out by a stronger species, didn’t navigate its way through a myriad of natural challenges and establish itself as antifragile, placed itself in league with other battle-tested, long-haul species. Bitcoin is no different, and it’s ten-year history, of which this article embarks upon, is a testament to its colloquial title as the Honey Badger.

Publishing the White Paper and Open-Source Software

On October 31, 2018, Nakamoto published a neat, nine-page document that outlined how the anonymous computer scientist had solved the double-spending problem, omitted a mint, made participants anonymous, and introduced the Proof of Work (PoW) consensus mechanism.

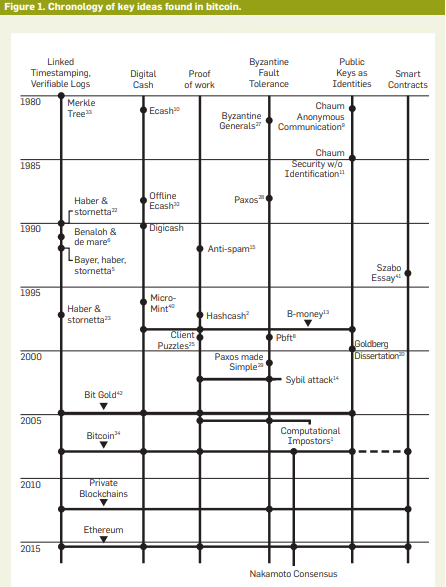

Commentators on the document have described it as elegant, simple, and astounding (assuming the reader is also aware of the 30 years of computer science needed to create the technology).

But determining what happened once this idea was set loose on the world is a story unto itself. It was pulled apart and tinkered with first by crypto anarchists and computer engineers. Soon, for better or for worse, the virus spread into the world of finance of which was the creator’s primary target.

Long before this, though, the technology attracted open source software developers, especially those looking to rail against corporate mechanisms. As such, the Bitcoin project was first uploaded to the open source website called SourceForge on December 9, 2008, three months after publishing the white paper. It wasn’t until January the following year that the 0.1 client was released.

The rough code implied even greater speculation about Nakamoto’s identity as reports described the documentation to be far too complete to be written by only one person. In any case, the idea more so than it’s creator caught the attention of a tight-knit group composed of Hal Finney, Nick Szabo, Wei Dai, and Gavin Andresen. It was Finney who eventually made up the first bitcoin transaction after downloading the 0.1 client.

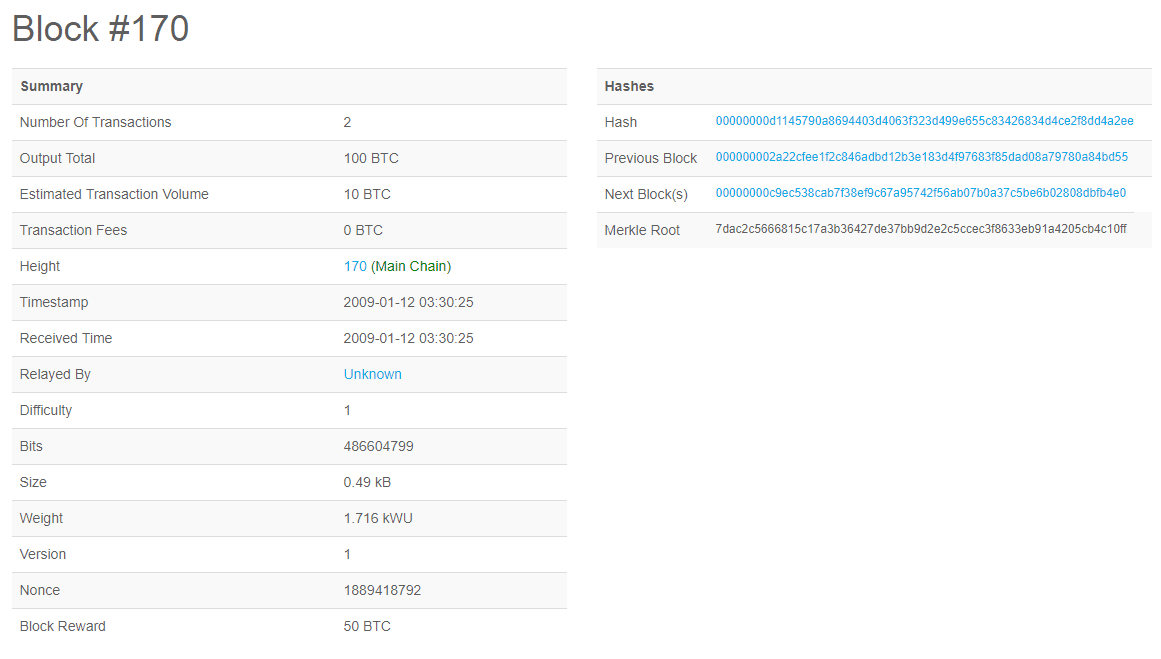

Nakamoto shared ten of his 50 bitcoins that he mined in the genesis block with Finney for participating in the network. Bitcoin’s blockchain shows this historic moment took place on January 12, 2009.

From here on out, as the technology proved more and more reliable from a technical standpoint, it soon began merging with the financial infrastructure. The first to join the experiment was the New Liberty Standard stock exchange who listed the cryptocurrency at roughly $0.0007 on October 5, 2009. In the “Getting Started” tab, the site outlines how early users could make new coins “in exchange for your computer working to validate bitcoin transactions.” As another piece of history, the site explained that “it will take a few hours to generate your first pack of 50 bitcoins.”

From there, the discussions opened into an exclusive IRC channel (something similar to the first Bitcoin forum for newcomers), an updated version of the Bitcoin client is launched, followed by the launch of the first official cryptocurrency exchange Bitcoin Market in February 2010.

Domino’s Pizzas and the Rise of Mt. Gox

The mysterious ways in which a technology can reach the meatspace of the real world are one of its greatest tests. This fact is especially true for testing a money who’s worth is predominantly determined by the community who believes in its value. For Bitcoin, this cooperative agreement was achieved in the exchange of the history’s most famous purchase. On May 22, 2010, Laszlo Hanyecz bought a Papa John’s pizza for 10,000 bitcoins, which at the time was worth approximately ~$25.

The programmer passed the 10K BTC to another programmer named jercos, who then bought the pizza, returned it to Hanyecz, and made history. Much later, Hanyecz made a similar order in February 208, but this time used Bitcoin’s Lightning Network to make the purchase. As a celebration of this event, May 22 has also unofficially been dubbed Bitcoin Pizza Day.

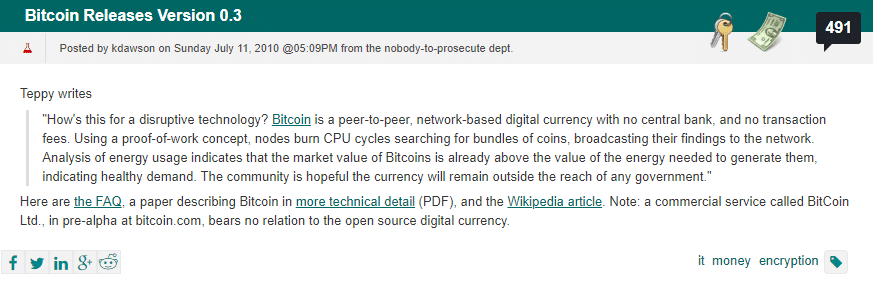

The event as mentioned above continued to attract the attention of users the world over. The third iteration of the Bitcoin client gets a mention on Slashdot.org and a massive spike in price from $0.008 per BTC to $0.08 in ten days also turns many heads.

Even back then imitators were beginning to see the value in hopping on the Bitcoin bandwagon.

From there, the inherent payments utility of the coin could be determined, and following the launch of Mt. Gox in July 2011, the speculative aspect, for which it would become famous, finally emerged. The history of the Japanese exchange began in 2007 when the founder Jed McCaleb, who also helped found RippleLabs before moving onto Stellar Lumens, attempted to create an online platform for buying and selling Magic the Gathering playing cards. Per time constraints, McCaleb eventually had to sell the domain name stating:

“To really make [Mt. Gox] what it has the potential to be would require more time than I have right now. So I’ve decided to pass the torch to someone better able to take the site to the next level. [Mark Karpelès] has already contributed a lot to the bitcoin community and in many ways, he will be better at running the site than I was. He has much more experience with web programming, system administration and integrating with banks and other payment processors than I do.”

Simultaneous to the rise of the exchange under Karpelès, OTC channels in IRC opened up to help facilitate trades between enthusiasts. This channel offered users the opportunity to short the cryptocurrency for the first time as well as eventually facilitating the largest transaction in Bitcoin’s history. Three accounts moved four BTC to 100 trillion Zimbabwe dollars on January 27, 2011, and observers witnessed yet another powerful use case: Inflation-resistant money.

Reaching Dollar Parity and Becoming the Dark Web Currency

After three years of hovering in the range of a few cents, a significant milestone in Bitcoin’s history occurred in February 2011. At that time, the currency was worth $1 for every BTC unit for the first time and is said to have reached “dollar parity.”

With this increase, Bitcoin moved from a subject of fascination for computer geeks and cyber nerds to the attention of business folks and financial experts. After all, the value rise was phenomenal. The currency grew to $1 from being priced at five cents in September 2010, a 20-fold increase over just five months.

In the first three months of 2011, a myriad of milestones were achieved globally for Bitcoin, including 25 percent of all bitcoins mined, Czech mining operator Slushpool reaching 10,000 MH/s, and an Australian man attempting to sell his 1984 Celica Supra for 3,000 BTC in the world’s first automobile-for-bitcoin transaction.

The 1984 Toyota Celica Supra.

Bitcoin began receiving mainstream press from outlets like The Economist and TIME Magazine after reaching dollar parity in May 2011. This event was quickly followed by it achieving parity with both the Euro and British Pound. The hype swiftly ensured an increase in prices until June 2011, after which Bitcoin crashed down to $10 from $31 in what is now referred to as its first “bubble.”

The rise of the dark web marketplace Silk Road was comparable to bitcoin’s price increase in early-2011. Online drug cartels, illegal goods dealers, retailers, and even beauty product manufacturers turned to bitcoin for conducting business globally. This switch proved to be a quality alternative as it mitigated the high-fees and rigid KYC issues associated with traditional banks.

In many ways, notably its pseudo-anonymous features, bitcoin suited illegal businesses and became a “favorite” of the underworld. The tradeoff? Bad press and perception of use as an illicit tool financing for the years to come.

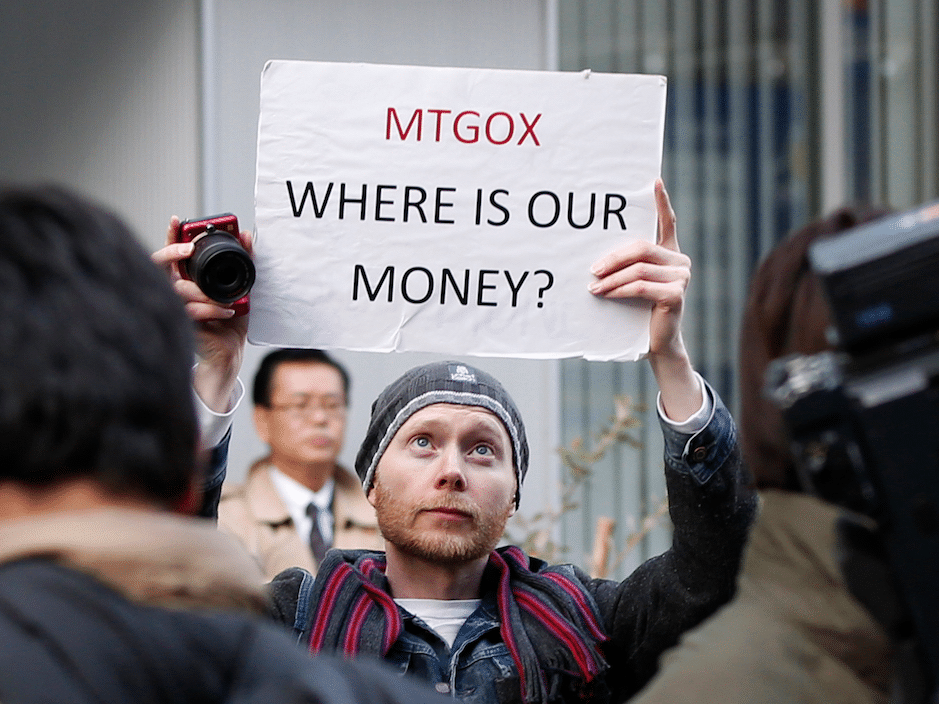

In June 2011, the then world’s largest Bitcoin exchange Mt.Gox dealt with a security breach compromising thousands of user accounts. Currency prices quickly fell by 23 percent after the news, while the attack became the first of several such security breaches that the infamous exchange faced throughout its existence.

A man demands lost funds after one of the Mt.Gox hacks.

Despite the negative outlook, Bitcoin became an entity that the public knew about, at least in major economies, and interest in the concept of cryptocurrencies and blockchain technology grew. The year also saw the arrival of alternative currencies, or “altcoins” as now popularly known, such as Litecoin and Namecoin.

Most early altcoins were an improvement on Bitcoin’s speed, protocol, and scalability. However, while altcoins shifted to serve other purposes in the years to come, the pioneer cryptocurrency maintained its position as the largest currency by market cap. Even Litecoin, which was the second-largest cryptocurrency in its early years, has slipped to the seventh position after newer coins like XRP, ETH, and XEM rose the ranks.

Towards the end of 2011, a world record transaction of the largest Bitcoin fees was conducted at block 157,235, with 171 BTC in fees paid at the time. At current prices, this figure is worth over $1 million.

Smooth Sailing, Scams, and Security Breaches

The year 2012 started with none of the choppy volatility or sensationalist media mentions that Bitcoin was becoming known for. In the first four months, the currency crossed the $100 mark for the first time in April 2011, despite an unfortunate hack of security firm Linode in March 2011 which saw 46,000 bitcoin leave the website hosting company.

To date, the instance remains the largest theft of bitcoins by the number of coins stolen. In the same month, Tradehill, the world’s second largest Bitcoin exchange at the time, shut down after regulatory pressure and the loss of $100,000 to a customer lawsuit.

In May 2011, Bitcoin Magazine, the first publication dedicated to Bitcoin and cryptocurrencies was launched, with a print edition launched shortly after. The magazine was co-founded by 17-year-old Vitalik Buterin, who later co-founded the Ethereum protocol in 2015.

Interestingly, while the publication sought to educate the public on the benefits of using Bitcoin, a leaked FBI report on May 9, 2011, brought attention to the currency as an illegal facilitator of payments for terrorists, weapons, and narcotics.

In July 2012, cryptocurrency exchange Coinbase was launched in San Francisco by Brian Armstrong. The exchange focused primarily on creating a standardized, credible, and accessible platform for the trading of bitcoin, and has developed over the years as a crypto-finance business worth over $8 billion as of October 31, 2018.

Founder Brian Armstrong (pictured right) at Coinbase Offices.

The month also saw venture capitalist Adam Draper launch the Boost VC, a Bitcoin startup incubator that has since invested in 65 cryptocurrency startups, including Abra, 0x Protocol, Ledger, and cryptocurrencies ether, Dencentraland (MANA), and Zcash (ZEC). Another noteworthy event was of the largest-ever recorded Bitcoin block, observed at height 181919 and a mammoth 1,322 transactions.

October 2012 saw the creation of KnCMiner, a Swedish company that aimed to mass-manufacture Bitcoin mining hardware. Meanwhile, London hosted the first major Bitcoin conference on October 15, followed by the formation of the Bitcoin Foundation on October 27. Popular publishing platform WordPress.org introduced bitcoin as a payment method on November 15, 2012.

In December 2012, Bitcoin Central became the first cryptocurrency business to be classified as a licensed bank within the European regulatory framework. The last notable development that year become Bitcoin’s first “halving” day, which saw block reward reduce from 50 BTC to 25 BTC on December 28.

Adoption Rising, China’s First FUD, and the Demise of Silk Road

Payments processor BitPay started the year on a positive note, reporting 10,000 bitcoin transactions on its payments network with no case of fraud reported. The currency’s price saw its share of ups and down as volatility began to play culprit, yet crossed the $1,000 mark for the first time in April 2013.

A strange anomaly occurred in March 2011 when the Bitcoin protocol split into two independent chains for over six hours. Both chains registered transactions until core developers requested all exchanges to halt their services temporarily. A sharp sell-off was observed after panicked investors voiced concerns of fraud. However, operations soon resumed to normal after the protocol was downgraded to version 0.7.

In April 2013, Mt.Gox and Bitinstant experienced significant processing delays after insufficient network capacity, which caused prices to plunge from $266 to $76 within three hours. A similar period later, the price hovered to $160 and continued to increase after news of dating application OkCupid and food ordering service Foodler announced support for bitcoin.

On May 15, 2013, Mt. Gox accounts were seized by U.S. authorities seized accounts after the firm’s legal status suddenly came to light. Feds noted the Bitcoin exchange was not registered as a certified money transmitter with the Financial Crimes Enforcement Network (FinCen). Meanwhile, competitor BitInstant revealed it processed approximately 30 percent of the world’s Bitcoin transactions, facilitating 30,000 transfers in April 2013 alone.

A rather opposing development took place in July 2013. M-Pesa, a global mobile payments system aimed at the underprivileged, began linking bitcoin payments in Kenya, a popular market. During the same time, Thailand’s Foreign Exchange administration banned bitcoin trading in the country citing its illegal status as a financial mechanism.

October 2013 saw one of the most controversial events with the high-profile arrest of Ross Ulbricht, the alleged owner of Silk Road. The U.S. Federal Bureau of Investigation seized 26,000 BTC from the site’s cold wallet and sentenced Ulbricht to lifetime imprisonment. Meanwhile, a Canadian company called Robocoin launched the world’s first Bitcoin ATM and Chinese internet giant Baidu announced support for bitcoin payments.