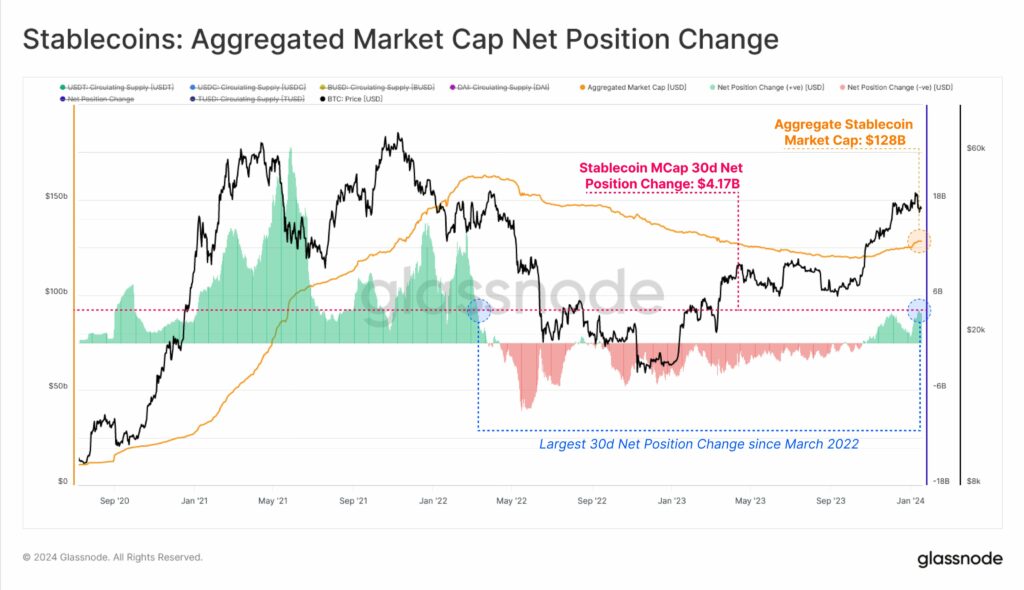

Aggregate stablecoin supply sees largest increase since October

Glassnode data recorded a $4.1 billion monthly increase in the aggregate stablecoin supply, a 21-month high for fiat-pegged cryptocurrencies following bullish momentum.

Since October last year, stablecoin supply has shot up steadily with Bitcoin’s price uptick. This ascent has impacted the aggregated stablecoin market cap, which stood above $128 billion as of Jan. 18. The increase marks the largest inflow since March 2022.

Tether’s USDT dominated the scene with nearly 73% in market share. The market’s second-largest stablecoin, Circle USD Coin (USDC), followed with a 19% share.

Binance USD (BUSD) issued by Paxos, which the Securities and Exchange Commission alleges is a security, came third. MakerDAO’s DAI and TUSD were also factored into Glassnode’s report.

The collective stablecoin pool is an essential piece in cryptocurrency transactions via centralized venues like Coinbase and decentralized exchanges like Uniswap. Stablecoin supply and market cap progression are sometimes used to gauge market sentiment, with increments typically associated with bullish market outlooks.

Stablecoin illicit transactions are up

A Chainalysis report on Crypto Crime Trends noted a shift in criminal activity associated with stablecoins alongside increased transactions and supply.

The research found that stablecoins accounted for roughly 60% of illicit transactions over two years. Chainalysis stressed that findings were published on initial estimates, and the trend did not apply to all criminal operations.

This isn’t the case for all forms of cryptocurrency-based crime. Sanctions-related volume and scam inflows are primarily driving the trend, whereas stablecoins are rarely used for ransomware and darknet markets.

Chainalysis Crypto Crime Trends report

Issuers like Tether can freeze accounts and work closer with law enforcement instead of more decentralized protocols. USDT’s operator deactivated more than 30 addresses linked to suspicious transactions in Israel and Ukraine.

The report states that Bitcoin’s (BTC) high liquidity made it the preferred crypto choice for bad actors despite a 30% drop in BTC-based illicit finance since 2021.