Aggressive Fed action could rock BTC market

Fed Chair Jerome Powell has signaled that the U.S. central bank’s hawkish stance on rates will continue unabated. Tight rates may hit crypto prices, including bitcoin.

Same policy going forward

In his bi-annual testimony before the US Senate Committee on Banking, Housing, and Urban Affairs on March 7, Federal Reserve Chairman Jerome Powell indicated that regulators would continue their aggressive oversight of the volatile digital asset market.

The sector has been battered by bankruptcies and scandals, notably the collapse of FTX late last year, which has caused it to come under increased scrutiny from officials.

According to Powell, crypto serves as a parallel financial system, so it’s only right that it falls under similar regulations as the traditional financial sector.

More rate hikes incoming

Furthermore, the Fed Chair expects further interest rate hikes to help push inflation back to the 2% target.

Powell said the bank would closely watch economic statistics, especially during the March 10 employment report. Per the Fed Chair, the bank is prepared to speed up its rate hikes to clamp down on inflation.

Bitcoin market may feel the impact of Fed’s aggressive stance

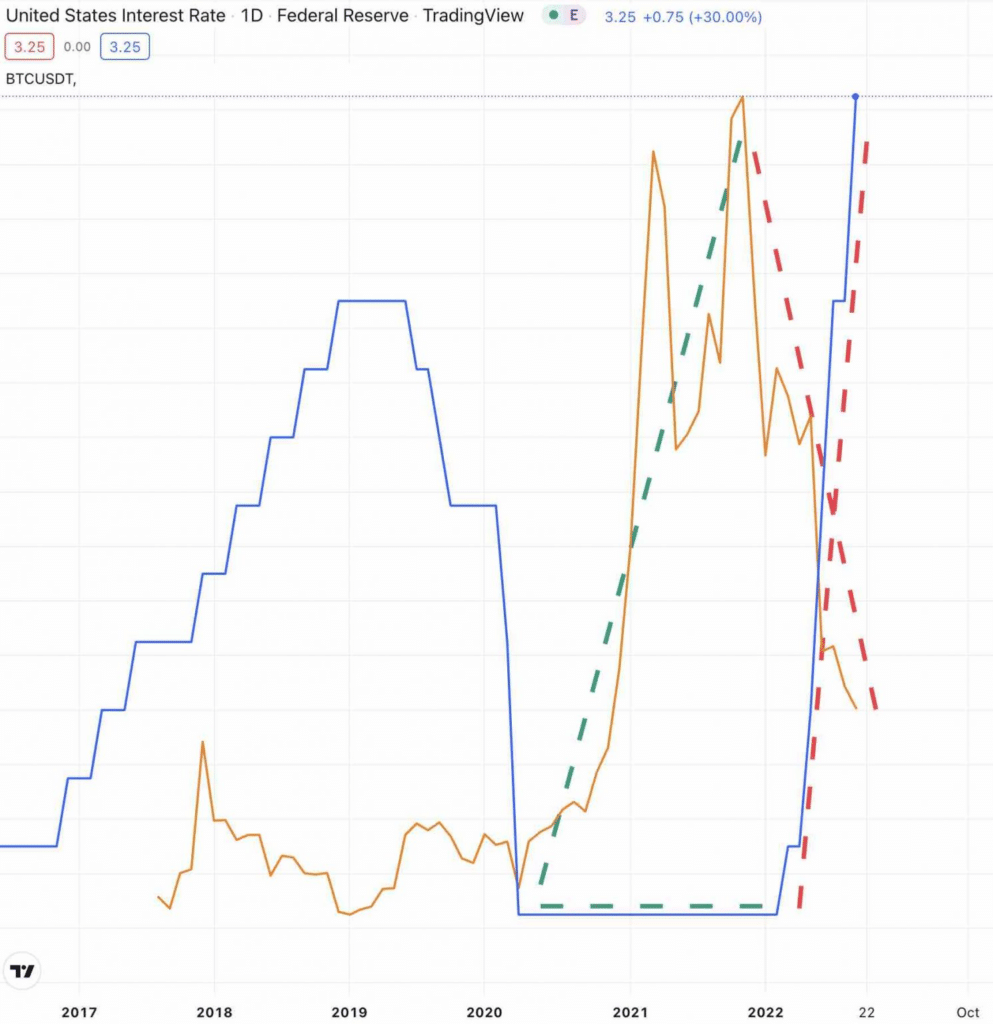

Historically, when the Fed hiked interest rates, a knock-on effect lowered the price of cryptocurrencies. The factors that drove that spillover were a slowing economy, decreased corporate investment and activity, and an unfavorable macroeconomic environment for crypto.

For instance, the price trend of U.S. interest rates overlaid on the bitcoin price shown above. The blue line shows interest rates, and when they declined in 2020 and stayed close to 0% until 2022, the price of bitcoin skyrocketed.

When interest rates sharply increased in 2022, they intersected with BTC’s subsequent decline, suggesting a correlation between macroeconomic factors like interest rates and the dip in the price of BTC and other cryptocurrencies.

Last year, the Fed raised interest rates seven times, with hikes ranging from +25 bps to +75 bps. These hikes shook the traditional stock and crypto markets, leading to sharp price declines. Bitcoin’s price fell from $30,000 to $20,000 from July through September 2022.

Until the beginning of 2023, BTC’s price had been severely restrained by the Fed’s rate increases, remaining below $20,000. Market observers disagree on whether the Fed will act aggressively or passively to contain inflation and whether this has already been factored into current BTC prices.